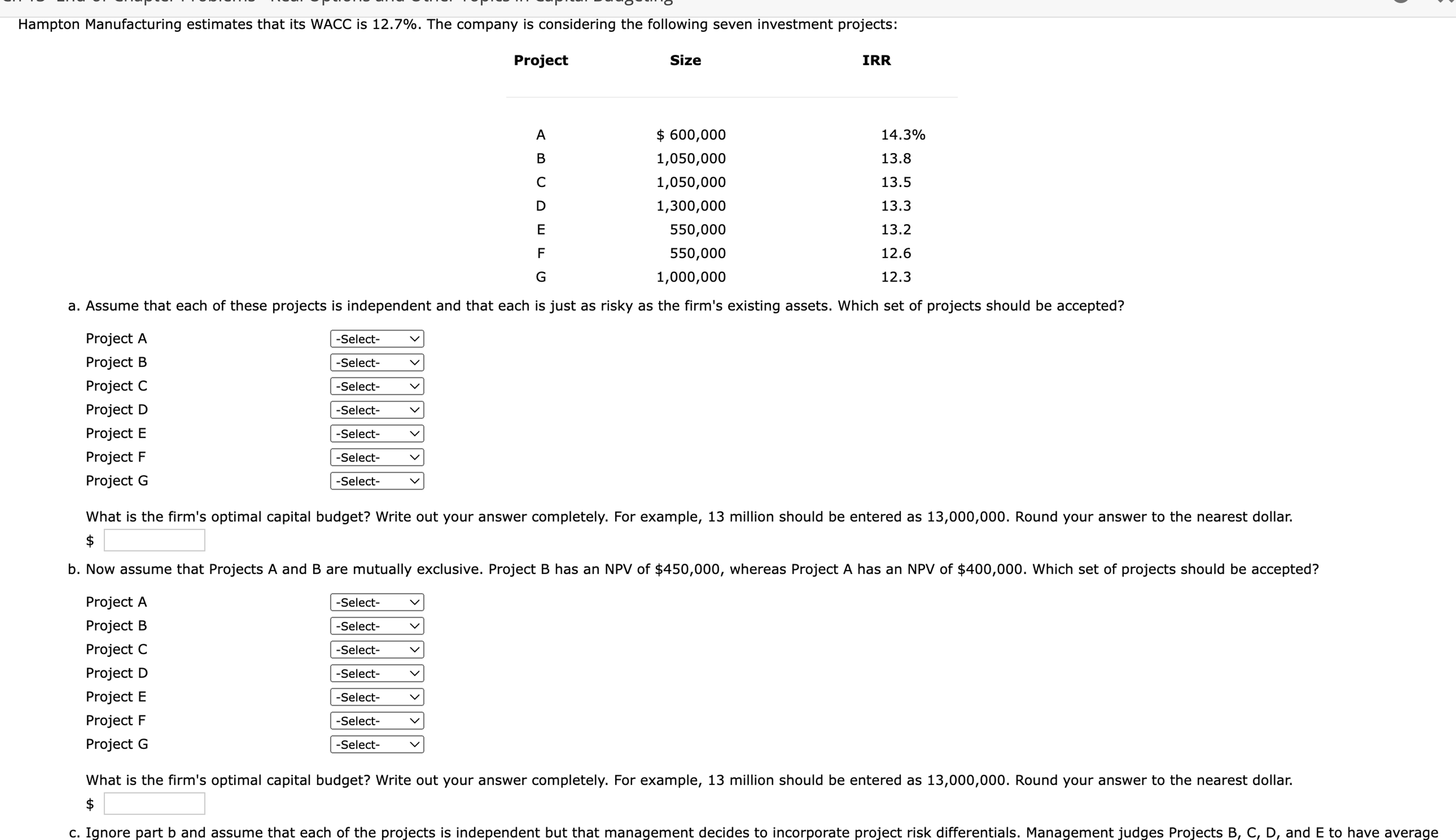

Question: Hampton Manufacturing estimates that its WACC is 1 2 . 7 % . The company is considering the following seven investment projects: a . Assume

Hampton Manufacturing estimates that its WACC is The company is considering the following seven investment projects:

a Assume that each of these projects is independent and that each is just as risky as the firm's existing assets. Which set of projects should be accepted?

What is the firm's optimal capital budget? Write out your answer completely. For example, million should be entered as Round your answer to the nearest dollar.

$

b Now assume that Projects A and B are mutually exclusive. Project B has an NPV of $ whereas Project A has an NPV of $ Which set of projects should be accepted?

Project A

Project B

Project C

Project D

Project E

Project

Project G

Select

What is the firm's optimal capital budget? Write out your answer completely. For example, million should be entered as Round your answer to the nearest dollar.

$

c Ignore part b and assume that each of the projects is independent but that management decides to incorporate project risk differentials. Management judges Projects and to have average

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock