Question: Hand write the calculations showing all equations and steps involved 4. The managers of Grand Bank asks for a performance/risk analysis, and asks you to

Hand write the calculations showing all equations and steps involved

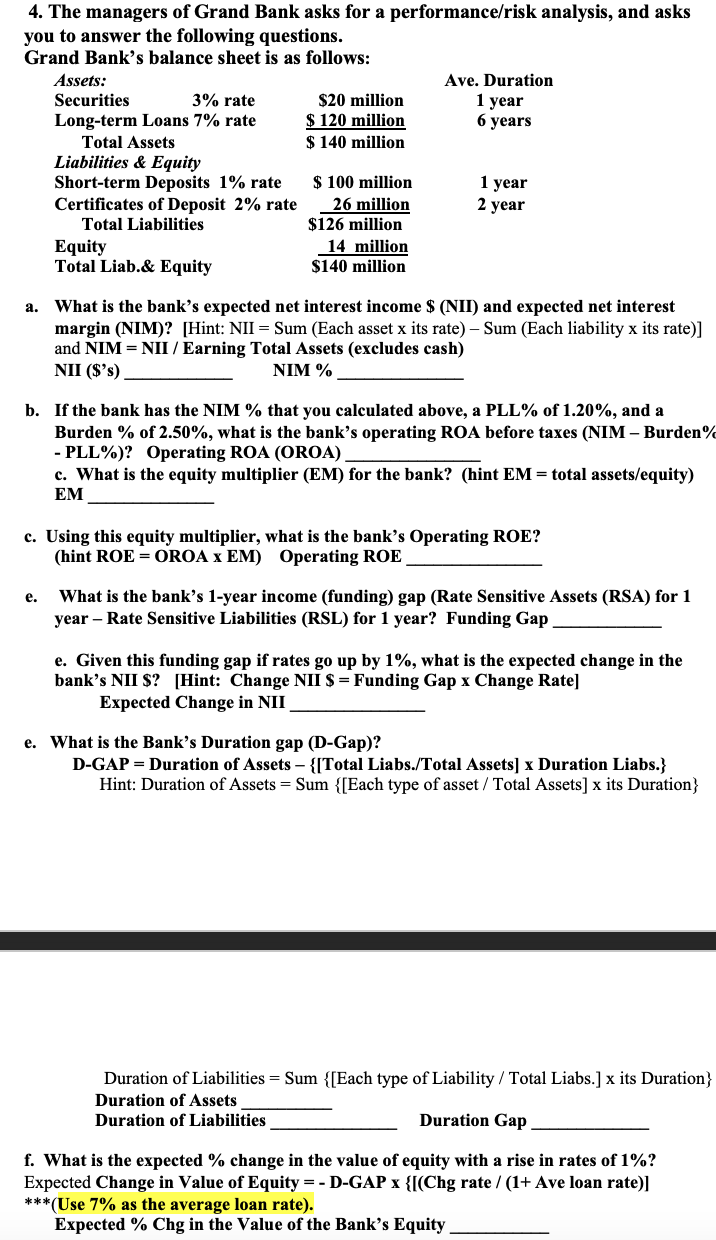

4. The managers of Grand Bank asks for a performance/risk analysis, and asks you to answer the following questions. Grand Bank's balance sheet is as follows: Assets: Ave. Duration Securities 3% rate $20 million 1 year Long-term Loans 7% rate $ 120 million 6 years Total Assets $ 140 million Liabilities & Equity Short-term Deposits 1% rate $ 100 million 1 year Certificates of Deposit 2% rate 26 million 2 year Total Liabilities $126 million Equity 14 million Total Liab.& Equity $140 million a. What is the bank's expected net interest income $ (NII) and expected net interest margin (NIM)? [Hint: NII = Sum (Each asset x its rate) - Sum (Each liability x its rate)] and NIM = NII / Earning Total Assets (excludes cash) NII ($'s) NIM % b. If the bank has the NIM % that you calculated above, a PLL% of 1.20%, and a Burden % of 2.50%, what is the bank's operating ROA before taxes (NIM - Burden% - PLL%)? Operating ROA (OROA). c. What is the equity multiplier (EM) for the bank? (hint EM = total assets/equity) EM c. Using this equity multiplier, what is the bank's Operating ROE? (hint ROE = OROA X EM) Operating ROE e. What is the bank's 1-year income (funding) gap (Rate Sensitive Assets (RSA) for 1 year - Rate Sensitive Liabilities (RSL) for 1 year? Funding Gap e. Given this funding gap if rates go up by 1%, what is the expected change in the bank's NII $? [Hint: Change NII $ = Funding Gap x Change Rate) Expected Change in NII e. What is the Bank's Duration gap (D-Gap)? D-GAP = Duration of Assets {[Total Liabs./Total Assets] x Duration Liabs.} Hint: Duration of Assets = Sum {[Each type of asset / Total Assets) x its Duration Duration of Liabilities = Sum {[Each type of Liability / Total Liabs.] x its Duration Duration of Assets Duration of Liabilities Duration Gap f. What is the expected % change in the value of equity with a rise in rates of 1%? Expected Change in Value of Equity = - D-GAP x {[(Chg rate / (1+ Ave loan rate) ***(Use 7% as the average loan rate). Expected % Chg in the Value of the Bank's Equity 4. The managers of Grand Bank asks for a performance/risk analysis, and asks you to answer the following questions. Grand Bank's balance sheet is as follows: Assets: Ave. Duration Securities 3% rate $20 million 1 year Long-term Loans 7% rate $ 120 million 6 years Total Assets $ 140 million Liabilities & Equity Short-term Deposits 1% rate $ 100 million 1 year Certificates of Deposit 2% rate 26 million 2 year Total Liabilities $126 million Equity 14 million Total Liab.& Equity $140 million a. What is the bank's expected net interest income $ (NII) and expected net interest margin (NIM)? [Hint: NII = Sum (Each asset x its rate) - Sum (Each liability x its rate)] and NIM = NII / Earning Total Assets (excludes cash) NII ($'s) NIM % b. If the bank has the NIM % that you calculated above, a PLL% of 1.20%, and a Burden % of 2.50%, what is the bank's operating ROA before taxes (NIM - Burden% - PLL%)? Operating ROA (OROA). c. What is the equity multiplier (EM) for the bank? (hint EM = total assets/equity) EM c. Using this equity multiplier, what is the bank's Operating ROE? (hint ROE = OROA X EM) Operating ROE e. What is the bank's 1-year income (funding) gap (Rate Sensitive Assets (RSA) for 1 year - Rate Sensitive Liabilities (RSL) for 1 year? Funding Gap e. Given this funding gap if rates go up by 1%, what is the expected change in the bank's NII $? [Hint: Change NII $ = Funding Gap x Change Rate) Expected Change in NII e. What is the Bank's Duration gap (D-Gap)? D-GAP = Duration of Assets {[Total Liabs./Total Assets] x Duration Liabs.} Hint: Duration of Assets = Sum {[Each type of asset / Total Assets) x its Duration Duration of Liabilities = Sum {[Each type of Liability / Total Liabs.] x its Duration Duration of Assets Duration of Liabilities Duration Gap f. What is the expected % change in the value of equity with a rise in rates of 1%? Expected Change in Value of Equity = - D-GAP x {[(Chg rate / (1+ Ave loan rate) ***(Use 7% as the average loan rate). Expected % Chg in the Value of the Bank's Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts