Question: Harris Banks Chief Economist is forecasting a substantial decrease in money market interest rates over the next 4 weeks. Assuming the Chief Economist is correct

Harris Banks Chief Economist is forecasting a substantial decrease in money market interest rates over the next 4 weeks. Assuming the Chief Economist is correct in her forecast, what would you recommend to Harris Banks funds management department regarding how and where to raise the money needed? Explain why you make this recommendation. (

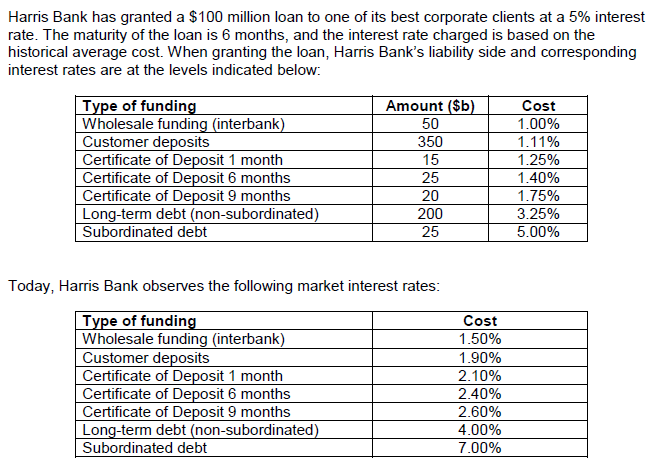

Harris Bank has granted a $100 million loan to one of its best corporate clients at a 5% interest rate. The maturity of the loan is 6 months, and the interest rate charged is based on the historical average cost. When granting the loan, Harris Bank's liability side and corresponding interest rates are at the levels indicated below: Type of funding Wholesale funding (interbank) Customer deposits Certificate of Deposit 1 month Certificate of Deposit 6 months Certificate of Deposit 9 months Long-term debt (non-subordinated) Subordinated debt Amount ($b) 50 350 15 25 20 200 25 Cost 1.00% 1.11% 1.25% 1.40% 1.75% 3.25% 5.00% Today, Harris Bank observes the following market interest rates: Type of funding Wholesale funding (interbank) Customer deposits Certificate of Deposit 1 month Certificate of Deposit 6 months Certificate of Deposit 9 months Long-term debt (non-subordinated) Subordinated debt Cost 1.50% 1.90% 2.10% 2.40% 2.60% 4.00% 7.00% Harris Bank has granted a $100 million loan to one of its best corporate clients at a 5% interest rate. The maturity of the loan is 6 months, and the interest rate charged is based on the historical average cost. When granting the loan, Harris Bank's liability side and corresponding interest rates are at the levels indicated below: Type of funding Wholesale funding (interbank) Customer deposits Certificate of Deposit 1 month Certificate of Deposit 6 months Certificate of Deposit 9 months Long-term debt (non-subordinated) Subordinated debt Amount ($b) 50 350 15 25 20 200 25 Cost 1.00% 1.11% 1.25% 1.40% 1.75% 3.25% 5.00% Today, Harris Bank observes the following market interest rates: Type of funding Wholesale funding (interbank) Customer deposits Certificate of Deposit 1 month Certificate of Deposit 6 months Certificate of Deposit 9 months Long-term debt (non-subordinated) Subordinated debt Cost 1.50% 1.90% 2.10% 2.40% 2.60% 4.00% 7.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts