Question: Harrison, a facilities manager, would like to purchase a new commercial water filtration system for a building he manages. He estimates this would cost

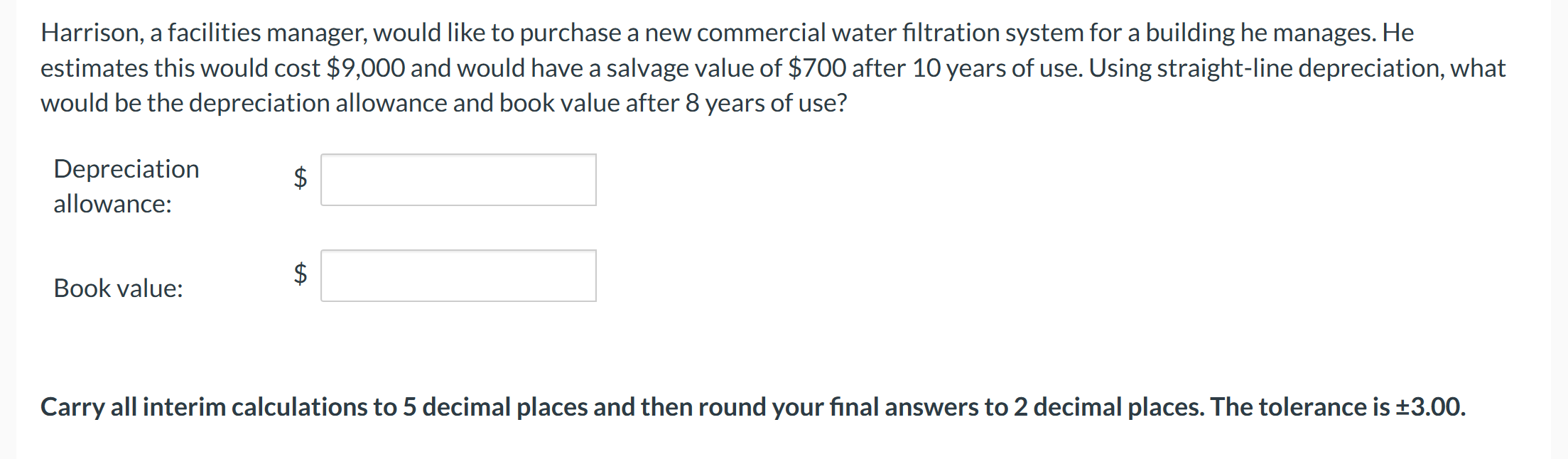

Harrison, a facilities manager, would like to purchase a new commercial water filtration system for a building he manages. He estimates this would cost $9,000 and would have a salvage value of $700 after 10 years of use. Using straight-line depreciation, what would be the depreciation allowance and book value after 8 years of use? Depreciation allowance: Book value: Carry all interim calculations to 5 decimal places and then round your final answers to 2 decimal places. The tolerance is 3.00.

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

To calculate the depreciation allowance and book value after 8 years of use we can use the straightl... View full answer

Get step-by-step solutions from verified subject matter experts