Question: Supose that a 2 year put on the S&P 500 of strike price 20 costs 10 dollars while a 2 year call of strike

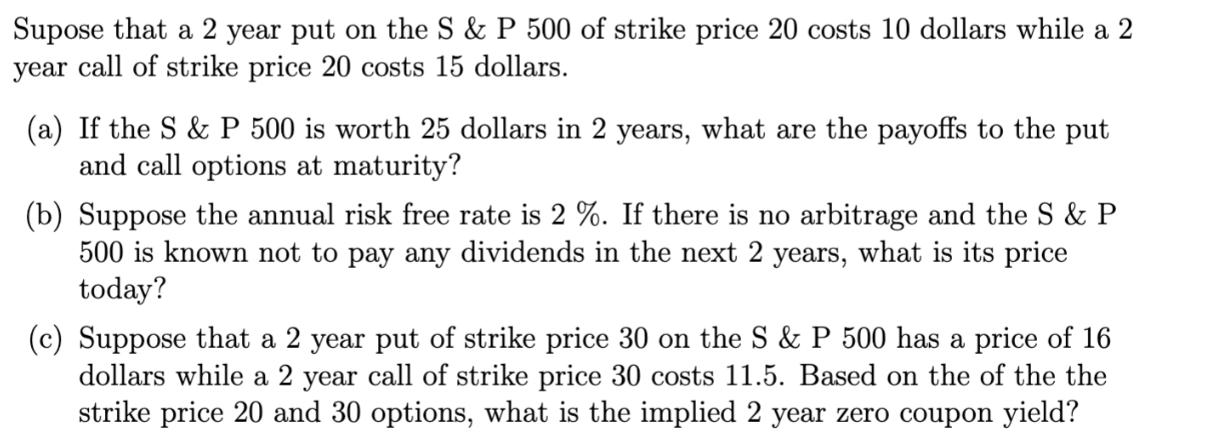

Supose that a 2 year put on the S&P 500 of strike price 20 costs 10 dollars while a 2 year call of strike price 20 costs 15 dollars. (a) If the S&P 500 is worth 25 dollars in 2 years, what are the payoffs to the put and call options at maturity? (b) Suppose the annual risk free rate is 2 %. If there is no arbitrage and the S & P 500 is known not to pay any dividends in the next 2 years, what is its price today? (c) Suppose that a 2 year put of strike price 30 on the S&P 500 has a price of 16 dollars while a 2 year call of strike price 30 costs 11.5. Based on the of the the strike price 20 and 30 options, what is the implied 2 year zero coupon yield?

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Question a Payoffs at Maturity Let the SP 500 index value in 2 years be 25 Given Put Option Strike 2... View full answer

Get step-by-step solutions from verified subject matter experts