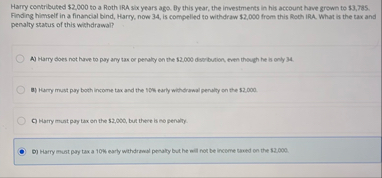

Question: Harry contributed $ 2 , 0 0 0 to a Roth IRA six years ago. By this year, the investments in his account have grown

Harry contributed $ to a Roth IRA six years ago. By this year, the investments in his account have grown to $ Finding himself in a financlal bind, Marry, now Is competled to withdraw from this floth the what it the tax and penalty status of this withdrawal?

A Harry does not have to pay any tas of perally on the distribution, even though he is only

Hurry must pay both income tax and the early withdrawal penalty on the $

O Marry must pay tax on the $ but there is no penaly.

D Harry must pay tax a W early withdrawal penally but he will not be income tasud on the

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock