Question: Has a full information what is the problem? Kendra, Cogley, and Mei share income and loss in a 3:2:1 ratio (in ratio form: Kendra, 3/6;

Has a full information what is the problem?

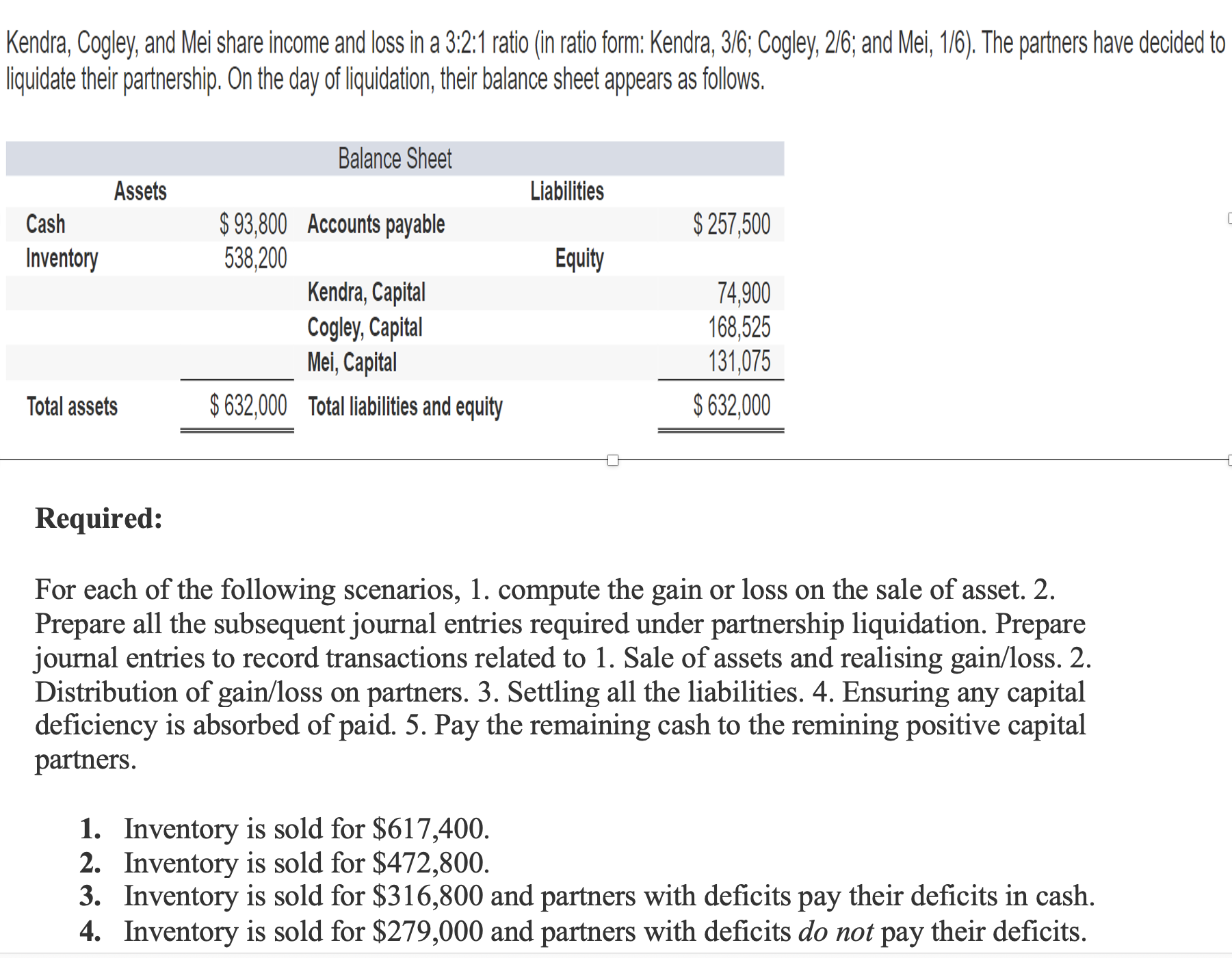

Kendra, Cogley, and Mei share income and loss in a 3:2:1 ratio (in ratio form: Kendra, 3/6; Cogley, 216; and Mei, 1/6). The partners have decided to liquidate their partnership. On the day of liquidation, their balance sheet appears as follows. Required: For each of the following scenarios, 1. compute the gain or loss on the sale of asset. 2. Prepare all the subsequent journal entries required under partnership liquidation. Prepare journal entries to record transactions related to 1. Sale of assets and realising gain/loss. 2 . Distribution of gain/loss on partners. 3. Settling all the liabilities. 4. Ensuring any capital deficiency is absorbed of paid. 5. Pay the remaining cash to the remining positive capital partners. 1. Inventory is sold for $617,400. 2. Inventory is sold for $472,800. 3. Inventory is sold for $316,800 and partners with deficits pay their deficits in cash. 4. Inventory is sold for $279,000 and partners with deficits do not pay their deficits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts