Question: hat functions d ho are Coca-Ca hat functions de MINI-CASE Allocation of joint costs LO5 Clark Kent Inc. buys crypton for $0.80 a gallon. At

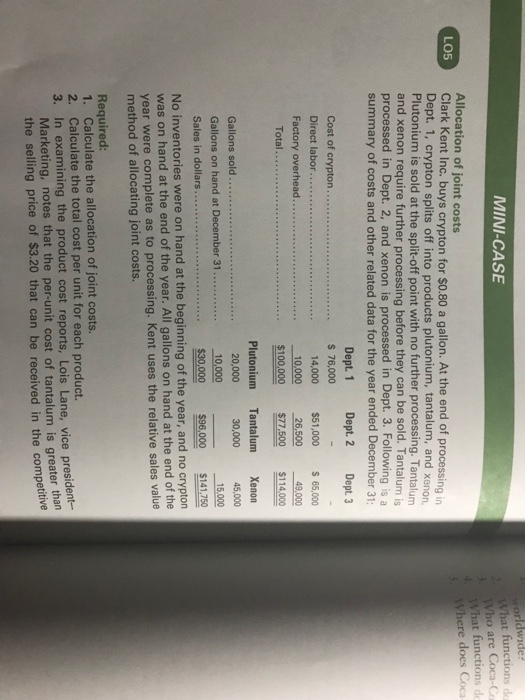

hat functions d ho are Coca-Ca hat functions de MINI-CASE Allocation of joint costs LO5 Clark Kent Inc. buys crypton for $0.80 a gallon. At the end of processing in Dept. 1, crypton splits off into products plutonium, tantalum, and xenon. Plutonium is sold at the split-off point with no further processing. Tantalum and xenon require further processing before they can be sold. Tantalum is processed in Dept. 2, and xenon is processed in Dept. 3. Following is a summary of costs and other related data for the year ended December 31 Dept. 1 . 76,000 Dept. 2 Dept. 3 Cost of crypton. 14,000 $51,000 65,000 10,000 26,500 49,000 $114,000 Factory overhead. 100,000 Plutonium Tantalum Xenon 45,000 15,000 Gallons sold 20,000 30,000 $30,000 96,000 $141.259 o crypton Sales in dollars. No inventories were on hand at the beginning of the year, and n was on hand at the end of the year. All gallons on hand at the end of the year were complete as to processing. Kent uses the relative sales value method of allocating joint costs. Required: 1. Calculate the allocation of joint costs. 2. Calculate the total cost per unit for each product. 3. In examining the product cost reports, Lois Lane, vice president Marketing, notes that the per-unit cost of tantalum is greater than the selling price of $3.20 that can be received in the competitive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts