Question: have 1 and a half hour please need it quick 3) a) Garanti Bank this year announced a dividend of 2 TL per share. Analysts

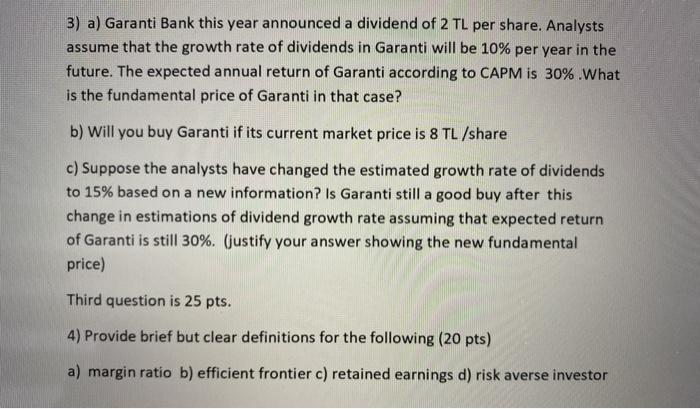

3) a) Garanti Bank this year announced a dividend of 2 TL per share. Analysts assume that the growth rate of dividends in Garanti will be 10% per year in the future. The expected annual return of Garanti according to CAPM is 30% .What is the fundamental price of Garanti in that case? b) Will you buy Garanti if its current market price is 8 TL /share c) Suppose the analysts have changed the estimated growth rate of dividends to 15% based on a new information? Is Garanti still a good buy after this change in estimations of dividend growth rate assuming that expected return of Garanti is still 30%. (justify your answer showing the new fundamental price) Third question is 25 pts. 4) Provide brief but clear definitions for the following (20 pts) a) margin ratio b) efficient frontier c) retained earnings d) risk averse investor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts