Question: Yearly depreciation expense schedules have been computed under three different methods for an asset having a salvage value of $90 at the end of its

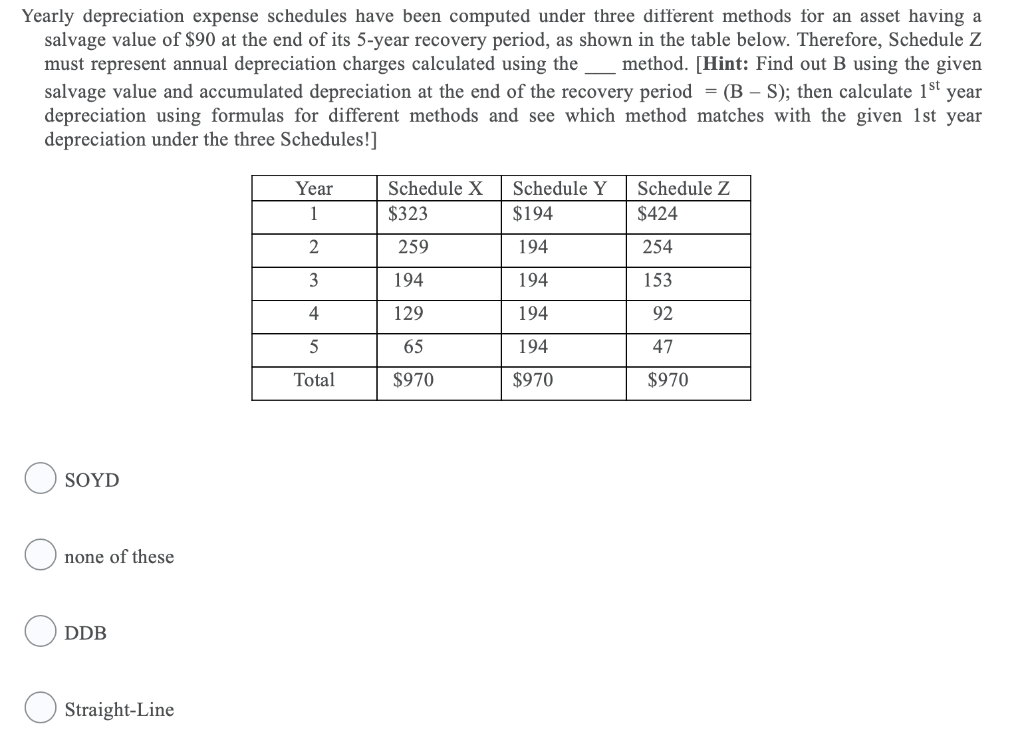

Yearly depreciation expense schedules have been computed under three different methods for an asset having a salvage value of $90 at the end of its 5-year recovery period, as shown in the table below. Therefore, Schedule Z must represent annual depreciation charges calculated using the method. [Hint: Find out B using the given salvage value and accumulated depreciation at the end of the recovery period = (B-S); then calculate 1st year depreciation using formulas for different methods and see which method matches with the given 1st year depreciation under the three Schedules!] Year 1 2 3 4 5 Total Schedule X $323 259 194 129 65 $970 Schedule Y $194 1 94 194 1 94 | 194 $970 Schedule Z $424 254 153 92 47 $970 O SOYD none of these ODDB Straight-Line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts