Question: have done this assignment, i need to submit it in 8 hours, want to double check if I have done it right. 1. You have

have done this assignment, i need to submit it in 8 hours, want to double check if I have done it right.

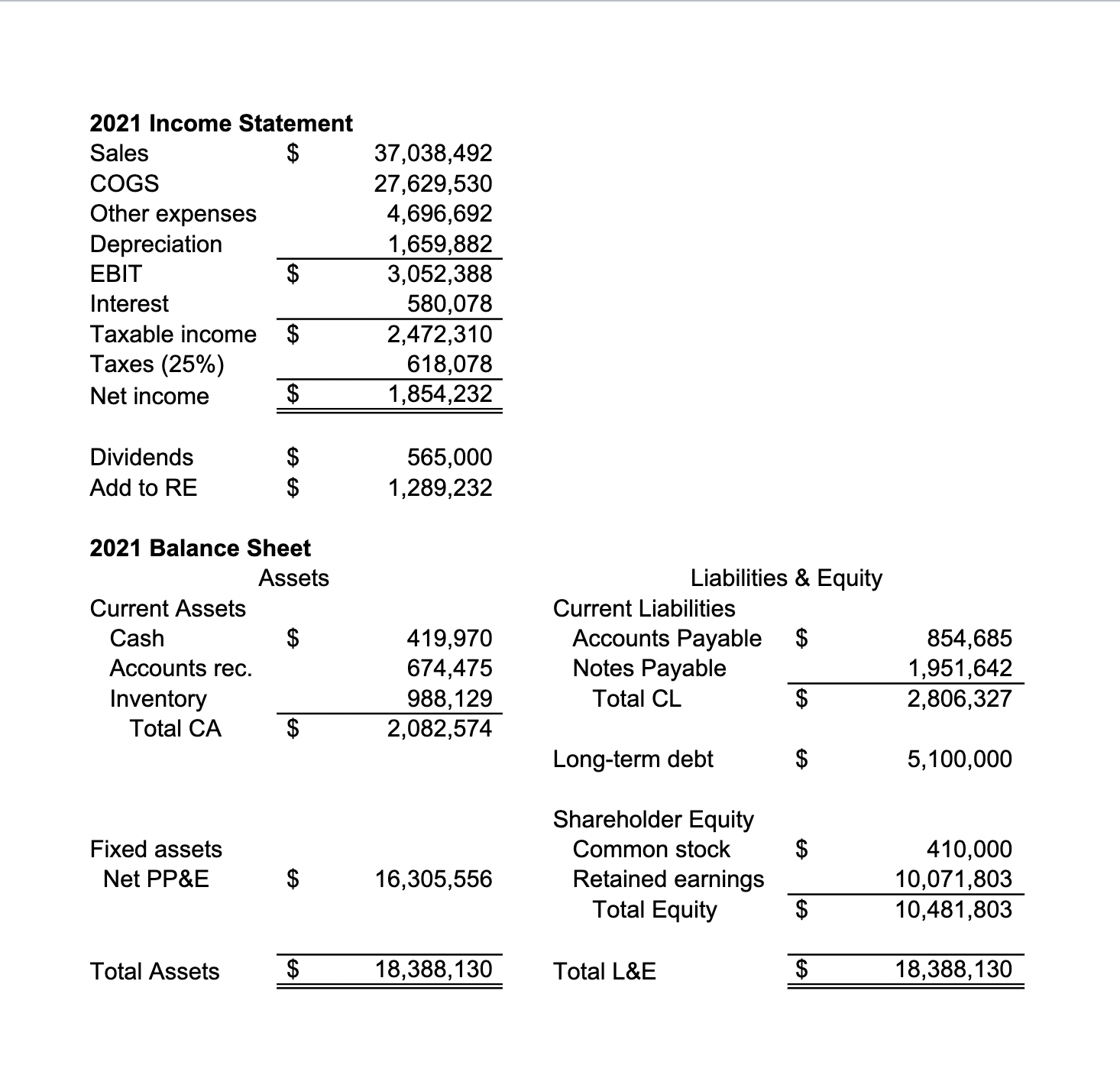

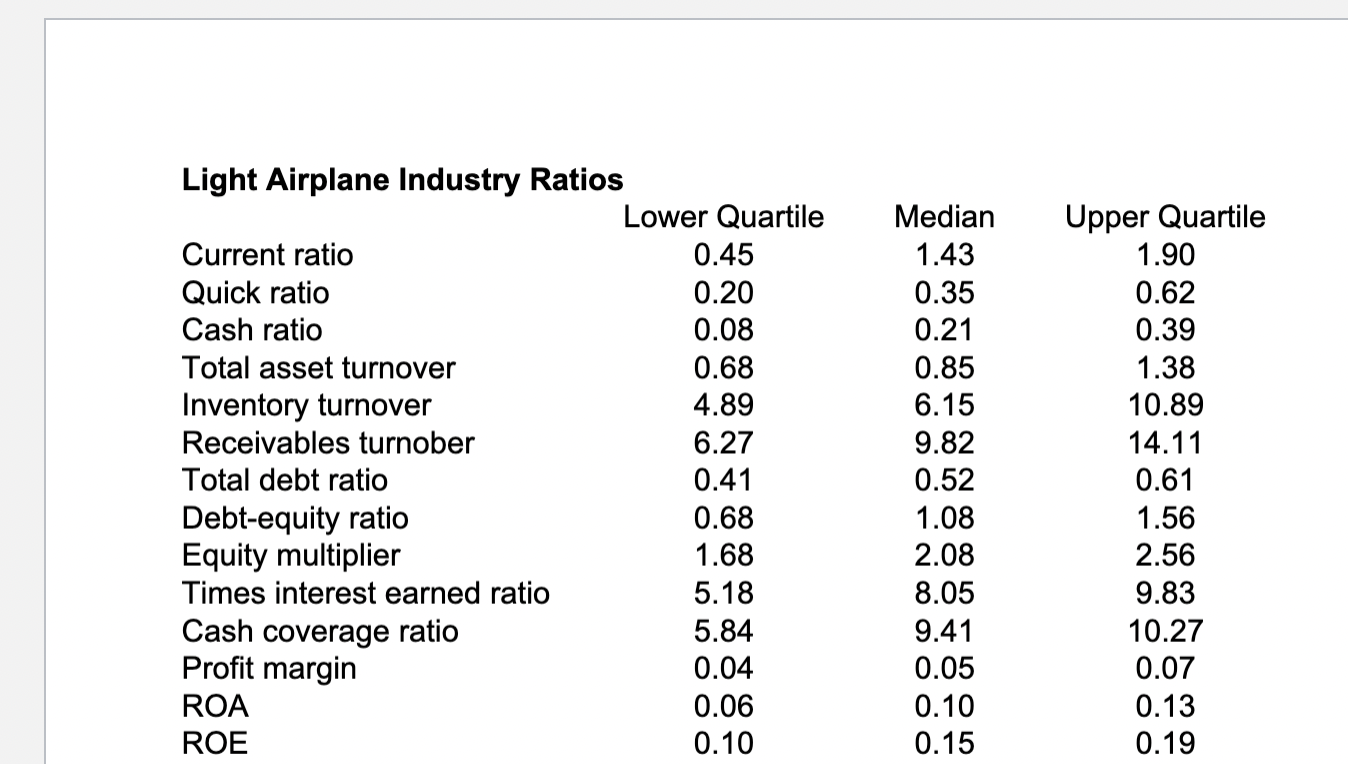

1. You have been asked to calculate two growth rates, the internal growth rate and the sustainable growth rate for the company. You know that the internal growth rate is the rate the company can maintain with internal financing only. A higher growth rate is possible but will need external financing. The sustainable growth rate is the maximum growth rate company can maintain with no external equity financing while keeping the leverage ratio constant. The two rates can be computed as follows:

Internal growth rate = ROA*b / (1-ROA*b) Sustainable growth rate = ROE*b / (1-ROE*b) Where b is plow back ratio, defined as 1 - Dividend Payout Ratio

2. You were told that sales are projected to grow 15% next year. Your boss asked you to check whether a 15% growth rate is possible without changing the debt/equity ratio. If yes, you will need to compute how much external financing is needed (You know that you will need to work out the pro forma financial statements for a 15% sales increase, using the percentage of sales approach). Please make sure you explain your answer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts