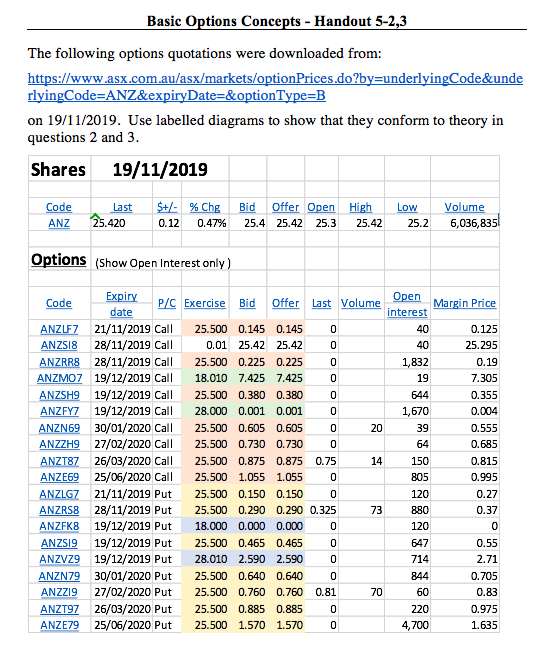

Question: The following options quotations were downloaded from: https://www.asx.com.au/asx/markets/optionPrices.do?by=underlyingCode&underlyingCode=ANZ&expiryDate=&optionType=B on 19/11/2019.Use labelled diagrams to show that they conform to theory in questions 2 and 3. Basic

The following options quotations were downloaded from:

https://www.asx.com.au/asx/markets/optionPrices.do?by=underlyingCode&underlyingCode=ANZ&expiryDate=&optionType=B

on 19/11/2019.Use labelled diagrams to show that they conform to theory in questions 2 and 3.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts