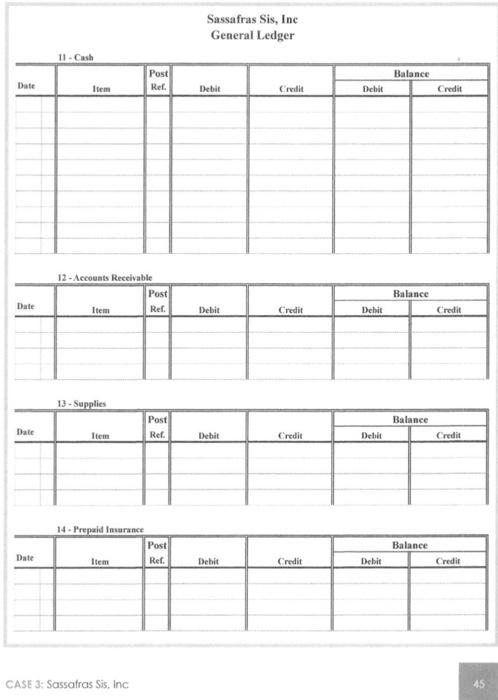

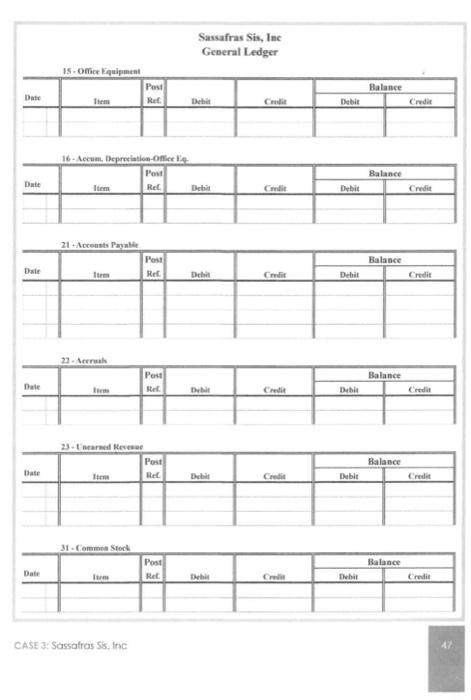

Question: having a hard time please use the amounts in the yellow instead of theose stated with the transactions PART 1- Case Study 3 Instructions: BEFORE

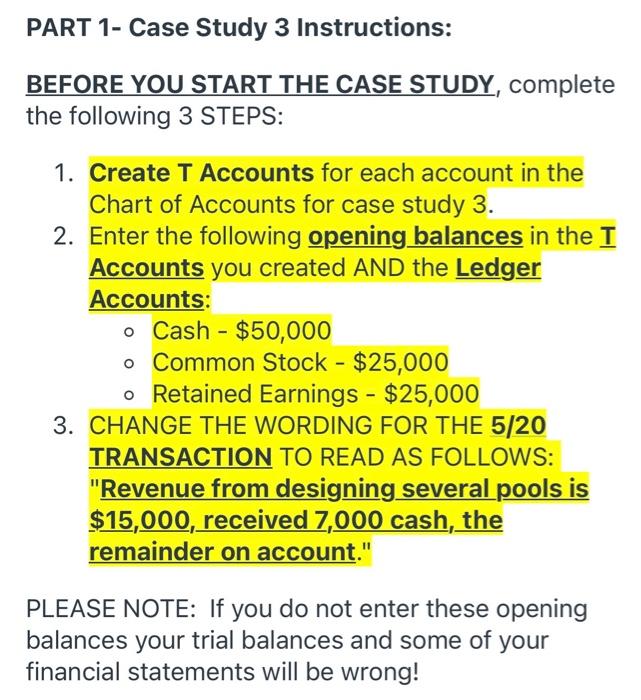

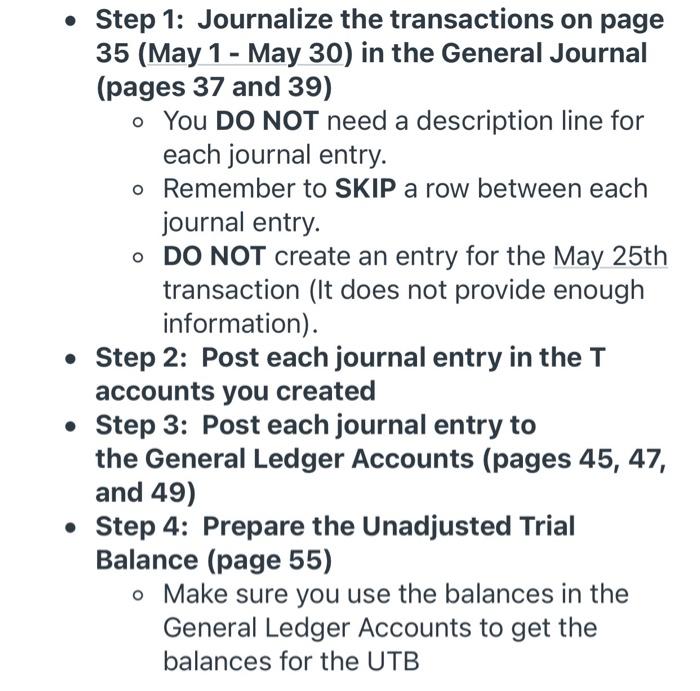

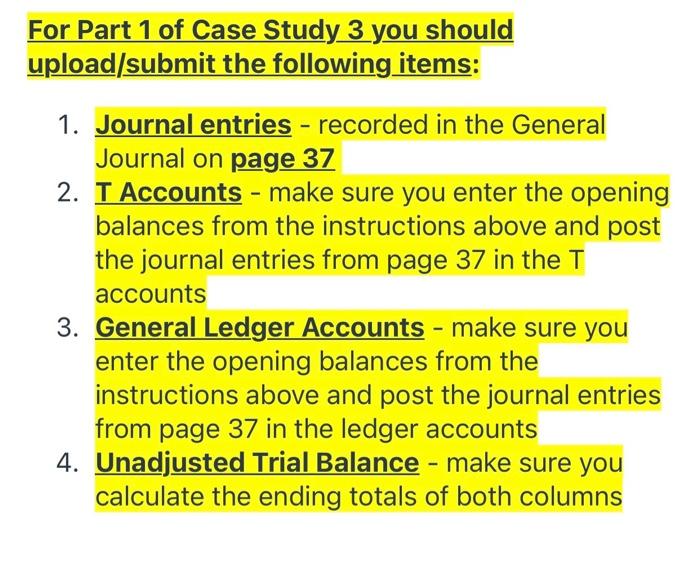

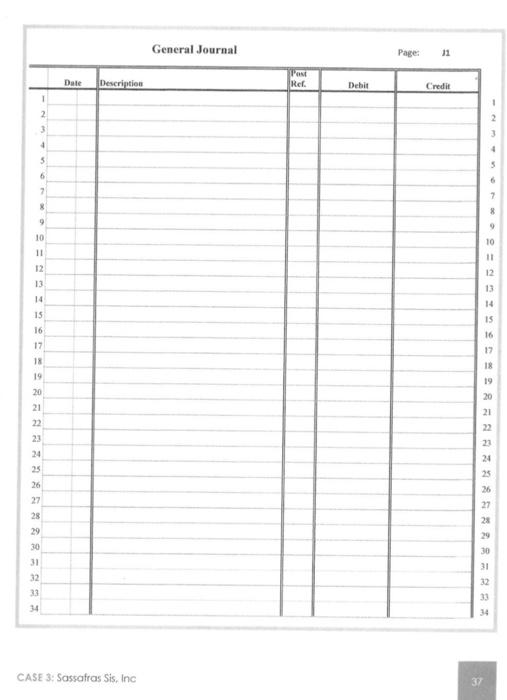

PART 1- Case Study 3 Instructions: BEFORE YOU START THE CASE STUDY, complete the following 3 STEPS: 1. Create T Accounts for each account in the Chart of Accounts for case study 3. 2. Enter the following opening balances in the I Accounts you created AND the Ledger Accounts: o Cash - $50,000 o Common Stock - $25,000 o Retained Earnings - $25,000 3. CHANGE THE WORDING FOR THE 5/20 TRANSACTION TO READ AS FOLLOWS: "Revenue from designing several pools is $15,000, received 7,000 cash, the remainder on account." PLEASE NOTE: If you do not enter these opening balances your trial balances and some of your financial statements will be wrong! Step 1: Journalize the transactions on page 35 (May 1 - May 30) in the General Journal (pages 37 and 39) o You DO NOT need a description line for each journal entry. o Remember to SKIP a row between each journal entry. DO NOT create an entry for the May 25th transaction (It does not provide enough information). Step 2: Post each journal entry in the T accounts you created Step 3: Post each journal entry to the General Ledger Accounts (pages 45, 47, and 49) Step 4: Prepare the Unadjusted Trial Balance (page 55) o Make sure you use the balances in the General Ledger Accounts to get the balances for the UTB For Part 1 of Case Study 3 you should upload/submit the following items: 1. Journal entries - recorded in the General Journal on page 37 2. T Accounts - make sure you enter the opening balances from the instructions above and post the journal entries from page 37 in the T accounts 3. General Ledger Accounts - make sure you enter the opening balances from the instructions above and post the journal entries from page 37 in the ledger accounts 4. Unadjusted Trial Balance - make sure you calculate the ending totals of both columns General Journal Page: 11 Date Description Pa Rer Debit Credit 1 2 3 4 5 6 2 X 9 10 11 10 11 12 13 12 13 14 15 14 16 17 18 19 15 16 12 18 19 20 20 21 21 22 21 24 23 24 23 26 27 25 26 27 29 28 29 30 30 31 31 32 33 34 32 33 CASE 3: Sassafras Sis, Inc 37 Sassafras Sis, Inc General Ledger 11 - Cash Balance Date Post Ref: Item Debit Credit Debit Credit 12 - Accounts Receivable Post Item Rer. Balance Date Debit Credit Debit Credit 13 - Supplies Post Balance Date Item Rel Debit Credit Dehli Credit 14. Prepaid Insurance Post Item Rer Balance Date Debit Credit Debit Credit CASE 3: Sassafras Sis. Inc Sassafras Sis, Inc General Ledger 15 Office Equipment Post sem Ret Date Balance Credit Debit C Debit 16- Accum. Depreciation Offices Post Ret Debit Date Balance Credit Debit 21. Accounts Payable Balance Pest Rek Dell Dehit Credit 22. Ar Balance Date Post RE Debit Credit Deble Credit 23.ned Reve Balance Post Re Date Dahil Credi Debit Credit 31-Comm Stock Balance Date Post Het De C Debit Credit CASE 3: Sassafras Sis, Inc PART 1- Case Study 3 Instructions: BEFORE YOU START THE CASE STUDY, complete the following 3 STEPS: 1. Create T Accounts for each account in the Chart of Accounts for case study 3. 2. Enter the following opening balances in the I Accounts you created AND the Ledger Accounts: o Cash - $50,000 o Common Stock - $25,000 o Retained Earnings - $25,000 3. CHANGE THE WORDING FOR THE 5/20 TRANSACTION TO READ AS FOLLOWS: "Revenue from designing several pools is $15,000, received 7,000 cash, the remainder on account." PLEASE NOTE: If you do not enter these opening balances your trial balances and some of your financial statements will be wrong! Step 1: Journalize the transactions on page 35 (May 1 - May 30) in the General Journal (pages 37 and 39) o You DO NOT need a description line for each journal entry. o Remember to SKIP a row between each journal entry. DO NOT create an entry for the May 25th transaction (It does not provide enough information). Step 2: Post each journal entry in the T accounts you created Step 3: Post each journal entry to the General Ledger Accounts (pages 45, 47, and 49) Step 4: Prepare the Unadjusted Trial Balance (page 55) o Make sure you use the balances in the General Ledger Accounts to get the balances for the UTB For Part 1 of Case Study 3 you should upload/submit the following items: 1. Journal entries - recorded in the General Journal on page 37 2. T Accounts - make sure you enter the opening balances from the instructions above and post the journal entries from page 37 in the T accounts 3. General Ledger Accounts - make sure you enter the opening balances from the instructions above and post the journal entries from page 37 in the ledger accounts 4. Unadjusted Trial Balance - make sure you calculate the ending totals of both columns General Journal Page: 11 Date Description Pa Rer Debit Credit 1 2 3 4 5 6 2 X 9 10 11 10 11 12 13 12 13 14 15 14 16 17 18 19 15 16 12 18 19 20 20 21 21 22 21 24 23 24 23 26 27 25 26 27 29 28 29 30 30 31 31 32 33 34 32 33 CASE 3: Sassafras Sis, Inc 37 Sassafras Sis, Inc General Ledger 11 - Cash Balance Date Post Ref: Item Debit Credit Debit Credit 12 - Accounts Receivable Post Item Rer. Balance Date Debit Credit Debit Credit 13 - Supplies Post Balance Date Item Rel Debit Credit Dehli Credit 14. Prepaid Insurance Post Item Rer Balance Date Debit Credit Debit Credit CASE 3: Sassafras Sis. Inc Sassafras Sis, Inc General Ledger 15 Office Equipment Post sem Ret Date Balance Credit Debit C Debit 16- Accum. Depreciation Offices Post Ret Debit Date Balance Credit Debit 21. Accounts Payable Balance Pest Rek Dell Dehit Credit 22. Ar Balance Date Post RE Debit Credit Deble Credit 23.ned Reve Balance Post Re Date Dahil Credi Debit Credit 31-Comm Stock Balance Date Post Het De C Debit Credit CASE 3: Sassafras Sis, Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts