Question: Having trouble with these problems, could anyone please help? Exercise 7-4 (Algo) Basic Segmented Income Statement (L07-4) Royal Lawncare Company produces and sells two packaged

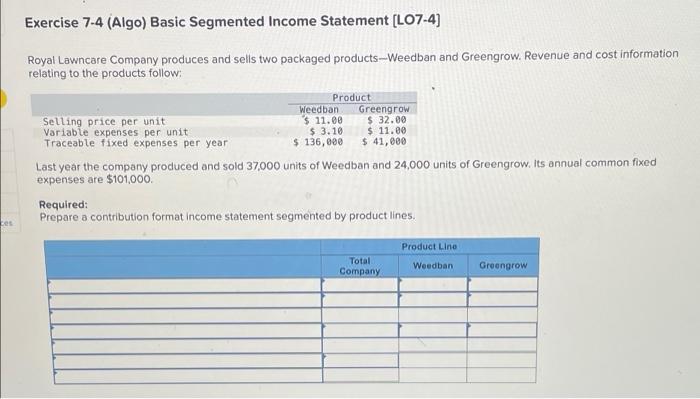

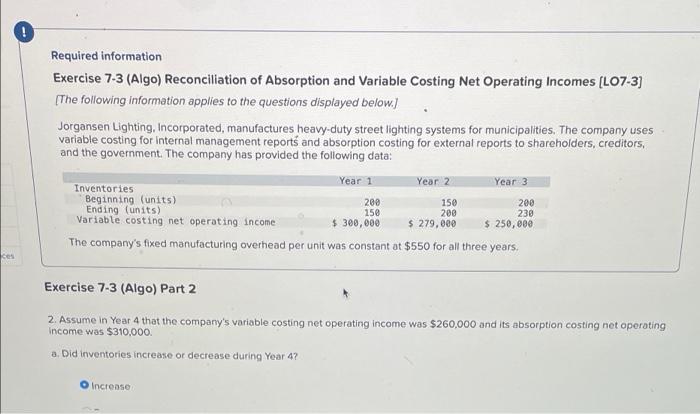

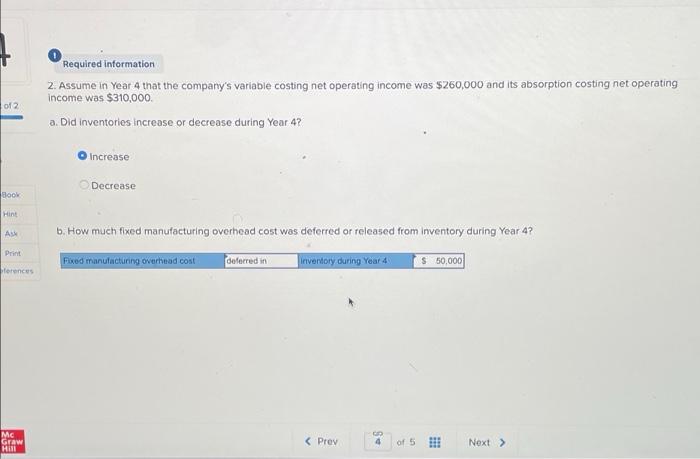

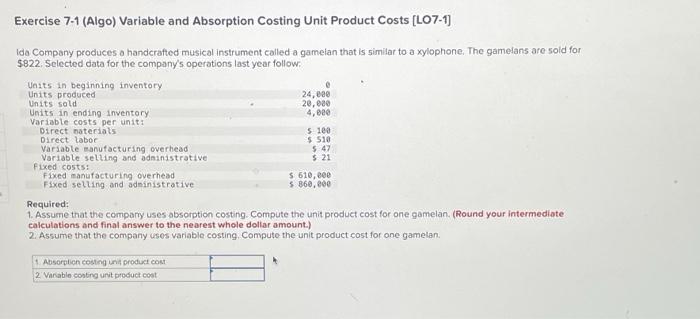

Exercise 7-4 (Algo) Basic Segmented Income Statement (L07-4) Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Weedban Greengrow Selling price per unit $ 11.00 $ 32.00 Variable expenses per unit $ 3.10 $ 11.00 Traceable fixed expenses per year $ 136,000 $ 41,000 Last year the company produced and sold 37,000 units of Weedban and 24,000 units of Greengrow. Its annual common fixed expenses are $101,000. Required: Prepare a contribution format income statement segmented by product lines. Les Product Line Total Company Weedban Greengrow Required information Exercise 7-3 (Algo) Reconciliation of Absorption and Variable Costing Net Operating Incomes (L07-3) [The following information applies to the questions displayed below.) Jorgansen Lighting, Incorporated, manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data: Year 1 Inventories Year 2 Year 3 Beginning (units) Ending (units) Variable costing net operating income $ 300,000 $ 279,000 $ 250,000 The company's fixed manufacturing overhead per unit was constant at $550 for all three years. 200 150 150 200 200 230 ces Exercise 7-3 (Algo) Part 2 2. Assume in Year 4 that the company's variable costing net operating income was $260,000 and its absorption costing net operating Income was $310,000 a. Did inventories increase or decrease during Year 4? Increase Required information 2. Assume in Year 4 that the company's variable costing net operating income was $260,000 and its absorption costing net operating income was $310,000 a. Did inventories increase or decrease during Year 4? of 2 Increase Decrease Book Hint AS b. How much fixed manufacturing overhead was deferred or released from inventory during Year 4? Print erences Fixed manufacturing overhead cost deferred in Inventory during Year 4 $50,000 Mc Graw HINI Exercise 7-1 (Algo) Variable and Absorption Costing Unit Product Costs (L07-13 Ida Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $822. Selected data for the company's operations last year follow. Units in beginning inventory @ Units produced 24,000 Units sald 20,000 Units in ending inventory 4,820 Variable costs per unit: Direct baterials 5 100 Direct labor $ 510 Variable manufacturing overhead Variable selling and administrative $ 21 Fixed costs: Fixed manufacturing overhead $ 510,000 Fixed selling and administrative 5 860,000 Required: 1. Assume that the company uses absorption costing. Compute the unit product cost for one gamelan. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) 2. Assume that the company uses variable costing, Compute the unit product cost for one gamelan. 5.47 1 Absorption costing unit product cost 2 Vacable conting unit product cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts