Question: I will rewrite the answer on a paper please don't use excel 3. The comparative financial statements of True Beauty Pools. Inc.. for 2013, 2012

I will rewrite the answer on a paper please don't use excel

I will rewrite the answer on a paper please don't use excel

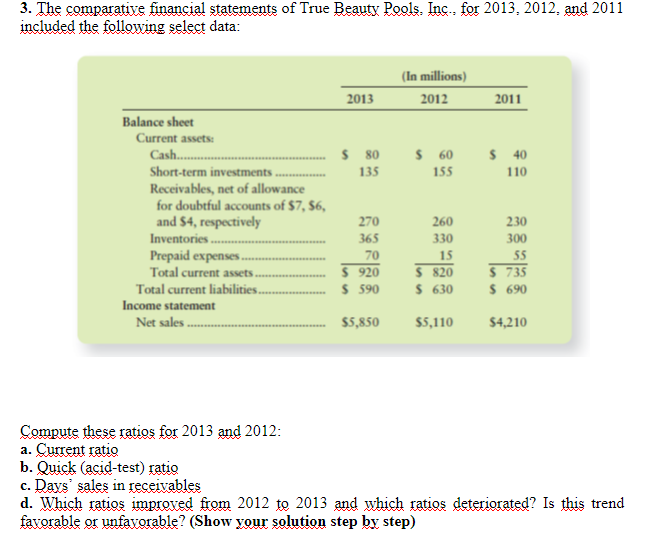

3. The comparative financial statements of True Beauty Pools. Inc.. for 2013, 2012 and 2011 included the following select data: (In millions) 2012 2013 2011 $ 80 $ 60 135 155 $ 40 110 Balance sheet Current assets: Cash........... Short-term investments Receivables, net of allowance for doubtful accounts of $7, 56, and $4, respectively Inventories.... Prepaid expenses. Total current assets Total current liabilities. Income statement Net sales. 270 365 70 $ 920 $ 590 260 330 15 $ 820 $ 630 230 300 55 $ 735 $ 690 $5,850 $5,110 $4,210 Compute these ratios for 2013 and 2012: a. Current ratio b. Quick (acid-test) ratio c. Days sales in receivables d. Which ratios improved from 2012 to 2013 and which ratios deteriorated? Is this trend favorable or unfavorable? (Show your solution step by step)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts