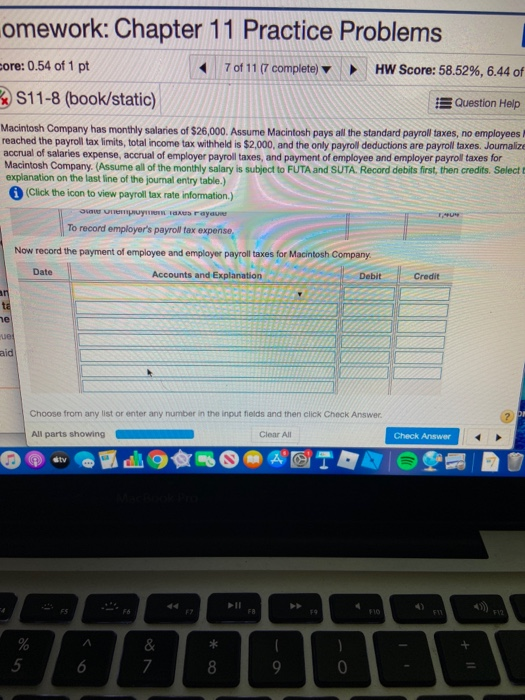

Question: Having trouble with this last question: omework: Chapter 11 Practice Problems eore: 0.54 of 1 pt 7 of 11 (7 complete) HW Score: 58.52%, 6.44

omework: Chapter 11 Practice Problems eore: 0.54 of 1 pt 7 of 11 (7 complete) HW Score: 58.52%, 6.44 of S11-8 (book/static) Question Help Macintosh Company has monthly salaries of $26,000. Assume Macintosh pays all the standard payroll taxes, no employees reached the payroll tax limits, total income tax withheld is $2,000, and the only payroll deductions are payroll taxes. Journalize accrual of salaries expense, accrual of employer payroll taxes, and payment of employee and employer payroll taxes for Macintosh Company. (Assume all of the monthly salary is subject to FUTA and SUTA. Record debits first, then credits. Select explanation on the last line of the journal entry table.) Click the icon to view payroll tax rate information.) To record employer's payroll tax expense, Now record the payment of employee and employer payroll taxes for Macintosh Company Accounts and Explanation Credit Date Debit ar ta he ue aid Choose from any list or enter any number in the input fields and then click Check Answer All parts showing Clear All Check Answer tv .. FB FIL F12 % 5 6 7 8 9 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts