Question: having trouble with this problem. not sure if its correct and cant find the other answers! thanks for your help! Homework #13 4 An insurance

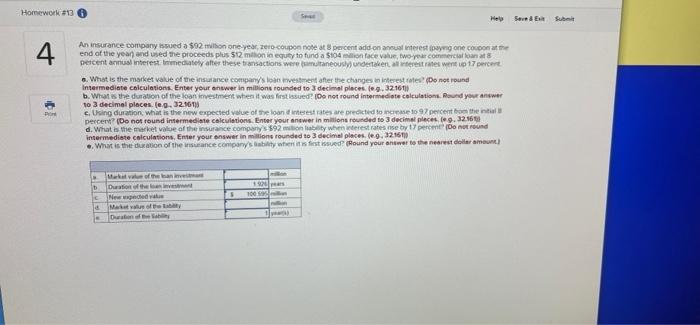

Homework #13 4 An insurance company issued a $92 million one-year, zero-coupon note at 8 percent add-on annual interest (paying one coupon at the end of the year and used the proceeds plus $12 million in equity to fund a $104 million face value, two-year commercial loan at 8 percent annual interest Immediately after these transactions were amultaneously) undertaken, all interest rates went up 17 percent P a. What is the market value of the insurance company's loan investment after the changes in interest rates? (Do not round Intermediate calculations. Enter your answer in millions rounded to 3 decimal places. (eg. 32161) b. What is the duration of the loan investment when it was first issued? (Do not round intermediate calculations. Round your answer to 3 decimal places. (e.g. 32.161)) c. Using duration, what is the new expected value of the loan if interest rates are predicted to increase to 97 percent from the initial percent? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal pieces, (eg. 32.16) d. What is the market value of the insurance company's $92 milion liability when interest rates nse by 17 percent (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places. (e.g. 32.161) What is the duration of the insurance company's ability when it is first issued? (Round your answer to the nearest dollar amount) LAUGH b 10 Help Save & Exit Submit Market value of the ban inves Duration of the love New expected value Market value of the ability Duration of Sability 192 S 100 9 rullen Homework #13 4 An insurance company issued a $92 million one-year, zero-coupon note at 8 percent add-on annual interest (paying one coupon at the end of the year and used the proceeds plus $12 million in equity to fund a $104 million face value, two-year commercial loan at 8 percent annual interest Immediately after these transactions were amultaneously) undertaken, all interest rates went up 17 percent P a. What is the market value of the insurance company's loan investment after the changes in interest rates? (Do not round Intermediate calculations. Enter your answer in millions rounded to 3 decimal places. (eg. 32161) b. What is the duration of the loan investment when it was first issued? (Do not round intermediate calculations. Round your answer to 3 decimal places. (e.g. 32.161)) c. Using duration, what is the new expected value of the loan if interest rates are predicted to increase to 97 percent from the initial percent? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal pieces, (eg. 32.16) d. What is the market value of the insurance company's $92 milion liability when interest rates nse by 17 percent (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places. (e.g. 32.161) What is the duration of the insurance company's ability when it is first issued? (Round your answer to the nearest dollar amount) LAUGH b 10 Help Save & Exit Submit Market value of the ban inves Duration of the love New expected value Market value of the ability Duration of Sability 192 S 100 9 rullen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts