Question: he first problem in this assignment asks for a description of how diversification (adding more assets to a ortfolio) changes the risk of the portfolio,

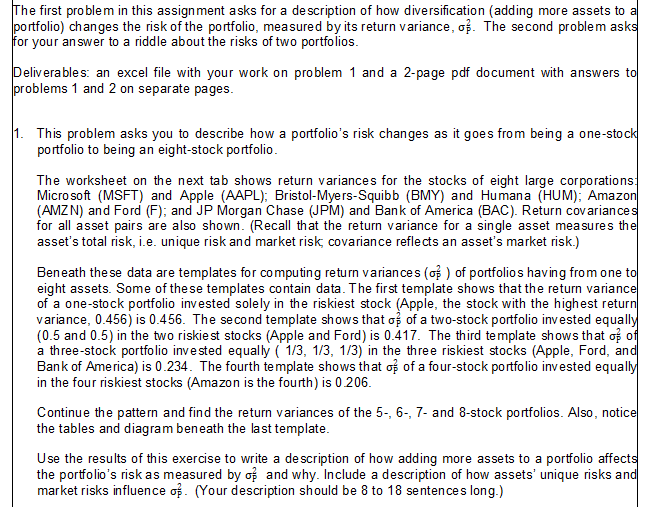

he first problem in this assignment asks for a description of how diversification (adding more assets to a ortfolio) changes the risk of the portfolio, measured by its return variance, P2. The second problem asks or your answer to a riddle about the risks of two portfolios. eliverables: an excel file with your work on problem 1 and a 2-page pdf document with answers to roblems 1 and 2 on separate pages. This problem asks you to describe how a portfolio's risk changes as it goes from being a one-stock portfolio to being an eight-stock portfolio. The worksheet on the next tab shows return variances for the stocks of eight large corporations: Microsoft (MSFT) and Apple (AAPL); Bristol-Myers-Squibb (BMY) and Humana (HUM); Amazon (AMZN) and Ford (F); and JP Morgan Chase (JPM) and Bank of America (BAC). Return covariances for all asset pairs are also shown. (Recall that the return variance for a single asset measures the asset's total risk, i.e. unique risk and market risk, covariance reflects an asset's market risk.) Beneath the data are templates for computing return variances (P2) of portfolios having from one to eight assets. Some of the se templates contain data. The first template shows that the return variance of a one-stock portfolio invested solely in the riskiest stock (Apple, the stock with the highest return variance, 0.456 ) is 0.456 . The second template shows that P2 of a two-stock portfolio invested equally (0.5 and 0.5) in the two riskiest stocks (Apple and Ford) is 0.417 . The third template shows that P2 of a three-stock portfolio invested equally (1/3,1/3,1/3) in the three riskiest stocks (Apple, Ford, and Bank of America) is 0.234 . The fourth template shows that P2 of a four-stock portfolio invested equally in the four riskiest stocks (Amazon is the fourth) is 0.206 . Continue the pattern and find the return variances of the 5-, 6-, 7- and 8-stock portfolios. Also, notice the tables and diagram beneath the last template. Use the results of this exercise to write a description of how adding more assets to a portfolio affects the portfolio's risk as measured by P2 and why. Include a description of how assets' unique risks and market risks influence P2. (Your description should be 8 to 18 sentences long.) he first problem in this assignment asks for a description of how diversification (adding more assets to a ortfolio) changes the risk of the portfolio, measured by its return variance, P2. The second problem asks or your answer to a riddle about the risks of two portfolios. eliverables: an excel file with your work on problem 1 and a 2-page pdf document with answers to roblems 1 and 2 on separate pages. This problem asks you to describe how a portfolio's risk changes as it goes from being a one-stock portfolio to being an eight-stock portfolio. The worksheet on the next tab shows return variances for the stocks of eight large corporations: Microsoft (MSFT) and Apple (AAPL); Bristol-Myers-Squibb (BMY) and Humana (HUM); Amazon (AMZN) and Ford (F); and JP Morgan Chase (JPM) and Bank of America (BAC). Return covariances for all asset pairs are also shown. (Recall that the return variance for a single asset measures the asset's total risk, i.e. unique risk and market risk, covariance reflects an asset's market risk.) Beneath the data are templates for computing return variances (P2) of portfolios having from one to eight assets. Some of the se templates contain data. The first template shows that the return variance of a one-stock portfolio invested solely in the riskiest stock (Apple, the stock with the highest return variance, 0.456 ) is 0.456 . The second template shows that P2 of a two-stock portfolio invested equally (0.5 and 0.5) in the two riskiest stocks (Apple and Ford) is 0.417 . The third template shows that P2 of a three-stock portfolio invested equally (1/3,1/3,1/3) in the three riskiest stocks (Apple, Ford, and Bank of America) is 0.234 . The fourth template shows that P2 of a four-stock portfolio invested equally in the four riskiest stocks (Amazon is the fourth) is 0.206 . Continue the pattern and find the return variances of the 5-, 6-, 7- and 8-stock portfolios. Also, notice the tables and diagram beneath the last template. Use the results of this exercise to write a description of how adding more assets to a portfolio affects the portfolio's risk as measured by P2 and why. Include a description of how assets' unique risks and market risks influence P2. (Your description should be 8 to 18 sentences long.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts