Question: INSTRUCTIONS: Do not round off any intermediate calculations. Final dollar answers should be rounded to two decimal places. Unless otherwise indicated, final interest rate answers

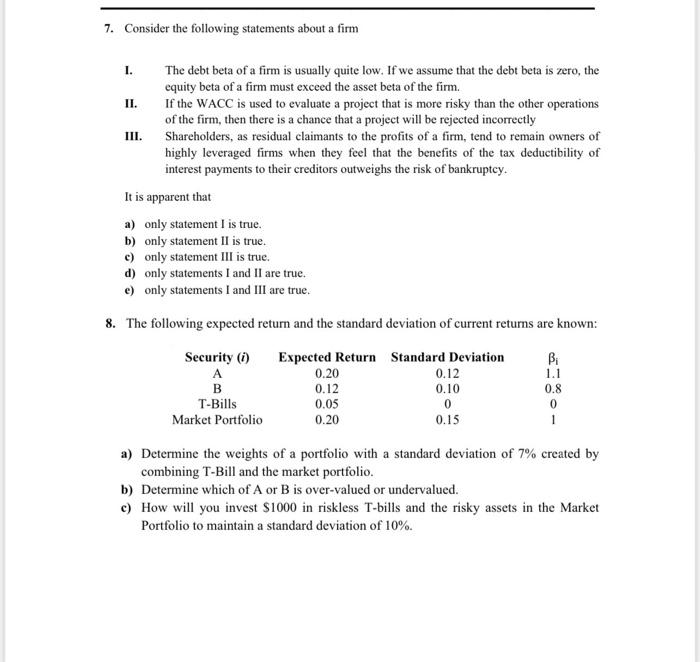

INSTRUCTIONS: Do not round off any intermediate calculations. Final dollar answers should be rounded to two decimal places. Unless otherwise indicated, final interest rate answers should be rounded to 6 decimal places if expressed as a decimal or 4 decimal places if expressed as a percent. You do not need to show "trailing zeros" (i.e., if no non-zero digits remain, 2.5% will do instead of 2.500000%) but make certain there are none. Include a timeline for obtain part-marks in the event that you misinterpret the problem. 7. Consider the following statements about a firm 1. II. The debt beta of a firm is usually quite low. If we assume that the debt beta is zero, the equity beta of a firm must exceed the asset beta of the firm. If the WACC is used to evaluate a project that is more risky than the other operations of the firm, then there is a chance that a project will be rejected incorrectly III. Shareholders, as residual claimants to the profits of a firm, tend to remain owners of highly leveraged firms when they feel that the benefits of the tax deductibility of interest payments to their creditors outweighs the risk of bankruptcy. It is apparent that a) only statement is true. b) only statement II is true. c) only statement III is true, d) only statements I and II are true. e) only statements I and III are true. 8. The following expected return and the standard deviation of current returns are known: Security (0) Expected Return Standard Deviation Bi A 0.20 1.1 B 0.12 0.10 0.8 T-Bills 0.05 0 Market Portfolio 0.20 0.15 1 0.12 0 a) Determine the weights of a portfolio with a standard deviation of 7% created by combining T-Bill and the market portfolio. b) Determine which of A or B is over-valued or undervalued. c) How will you invest $1000 in riskless T-bills and the risky assets in the Market Portfolio to maintain a standard deviation of 10%. INSTRUCTIONS: Do not round off any intermediate calculations. Final dollar answers should be rounded to two decimal places. Unless otherwise indicated, final interest rate answers should be rounded to 6 decimal places if expressed as a decimal or 4 decimal places if expressed as a percent. You do not need to show "trailing zeros" (i.e., if no non-zero digits remain, 2.5% will do instead of 2.500000%) but make certain there are none. Include a timeline for obtain part-marks in the event that you misinterpret the problem. 7. Consider the following statements about a firm 1. II. The debt beta of a firm is usually quite low. If we assume that the debt beta is zero, the equity beta of a firm must exceed the asset beta of the firm. If the WACC is used to evaluate a project that is more risky than the other operations of the firm, then there is a chance that a project will be rejected incorrectly III. Shareholders, as residual claimants to the profits of a firm, tend to remain owners of highly leveraged firms when they feel that the benefits of the tax deductibility of interest payments to their creditors outweighs the risk of bankruptcy. It is apparent that a) only statement is true. b) only statement II is true. c) only statement III is true, d) only statements I and II are true. e) only statements I and III are true. 8. The following expected return and the standard deviation of current returns are known: Security (0) Expected Return Standard Deviation Bi A 0.20 1.1 B 0.12 0.10 0.8 T-Bills 0.05 0 Market Portfolio 0.20 0.15 1 0.12 0 a) Determine the weights of a portfolio with a standard deviation of 7% created by combining T-Bill and the market portfolio. b) Determine which of A or B is over-valued or undervalued. c) How will you invest $1000 in riskless T-bills and the risky assets in the Market Portfolio to maintain a standard deviation of 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts