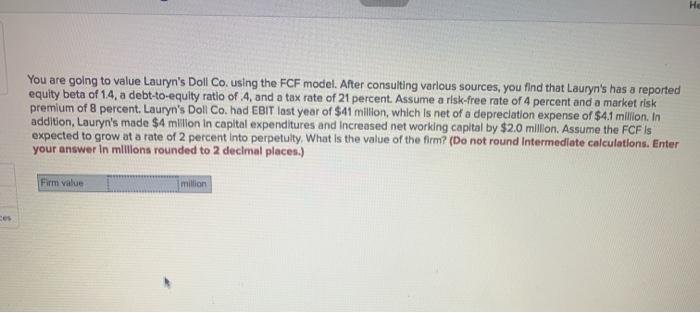

Question: He You are going to value Lauryn's Doll Co, using the FCF model. After consulting various sources, you find that Lauryn's has a reported equity

He You are going to value Lauryn's Doll Co, using the FCF model. After consulting various sources, you find that Lauryn's has a reported equity beta of 14, a debt-to-equlty ratio of 4, and a tax rate of 21 percent. Assume a risk-free rate of 4 percent and a market risk premium of 8 percent. Lauryn's Doll Co. had EBIT last year of $41 million, which is net of a depreciation expense of $4.1 milion. In addition, Lauryn's made $4 million in capital expenditures and increased net working capital by $2,0 million. Assume the FCF is expected to grow at a rate of 2 percent Into perpetulty, What is the value of the firm? (Do not round Intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Firm value million CES

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts