Question: Head Question 1. (25 marks) a) Omar Ali & Co, had equity of $145,000 at the beginning of the year. At the end of the

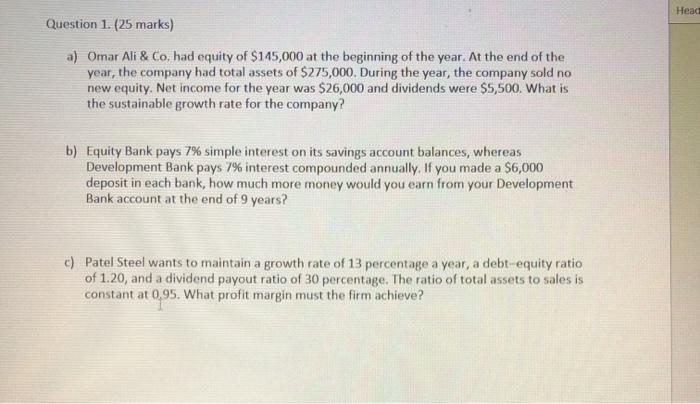

Head Question 1. (25 marks) a) Omar Ali & Co, had equity of $145,000 at the beginning of the year. At the end of the year, the company had total assets of $275,000. During the year, the company sold no new equity. Net income for the year was $26,000 and dividends were $5,500. What is the sustainable growth rate for the company? b) Equity Bank pays 7% simple interest on its savings account balances, whereas Development Bank pays 7% interest compounded annually. If you made a $6,000 deposit in each bank, how much more money would you earn from your Development Bank account at the end of 9 years? c) Patel Steel wants to maintain a growth rate of 13 percentage a year, a debt-equity ratio of 1.20, and a dividend payout ratio of 30 percentage. The ratio of total assets to sales is constant at 0,95. What profit margin must the firm achieve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts