Question: Heavy Metal Ltd has requested your help in preparing their financial statements as they are unsure of the new requirements of NZ IFRS 16 Leases

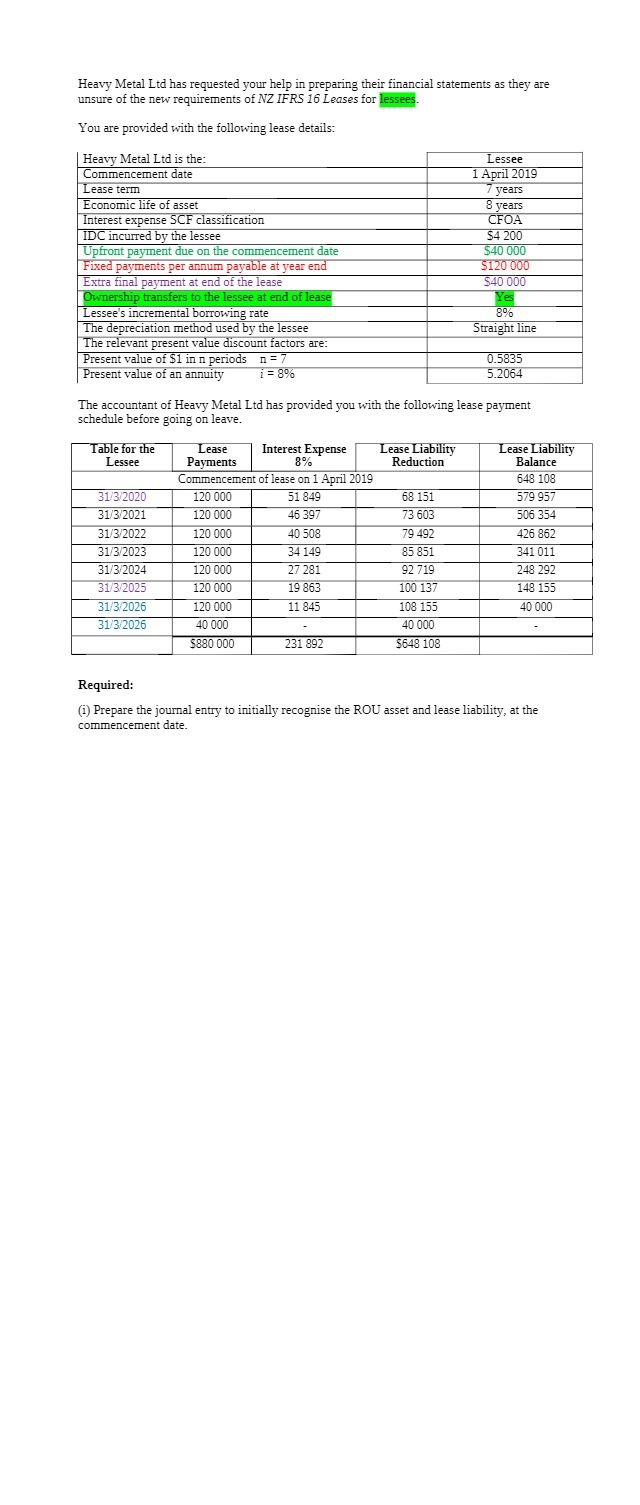

Heavy Metal Ltd has requested your help in preparing their financial statements as they are unsure of the new requirements of NZ IFRS 16 Leases for lessees You are provided with the following lease details: Heavy Metal Ltd is the: Lessee Commencement date April 2019 Lease term 7 years Economic life of asset 8 years Interest expense SCF classification CFOA IDC incurred by the lessee $4 200 Upfront payment due on the commencement date $40 000 Fixed payments per annum payable at year end $120 000 Extra final payment at end of the lease $40 000 Ownership transfers to the lessee at end of lease Yes Lessee's incremental borrowing rate 8% The depreciation method used by the lessee Straight line The relevant present value discount factors are: Present value of $1 in n periods n = 0.5835 Present value of an annuity i = 8% 5.2064 The accountant of Heavy Metal Ltd has provided you with the following lease payment schedule before going on leave. Table for the Lease Interest Expense Lease Liability Lease Liability Lessee Payments 8% Reduction Balance Commencement of lease on 1 April 2019 648 108 31/3/2020 120 000 51 849 68 151 579 957 31/3/2021 120 000 46 397 73 603 506 354 31/3/2022 120 000 40 508 79 49 426 862 31/3/2023 120 000 34 149 85 851 341 011 31/3/2024 120 000 27 281 92 719 248 292 31/3/2025 120 000 19 863 100 137 148 155 31/3/2026 120 000 11 845 108 155 40 000 31/3/2026 40 000 40 00 $880 000 231 892 $648 108 Required: (i) Prepare the journal entry to initially recognise the ROU asset and lease liability, at the commencement date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts