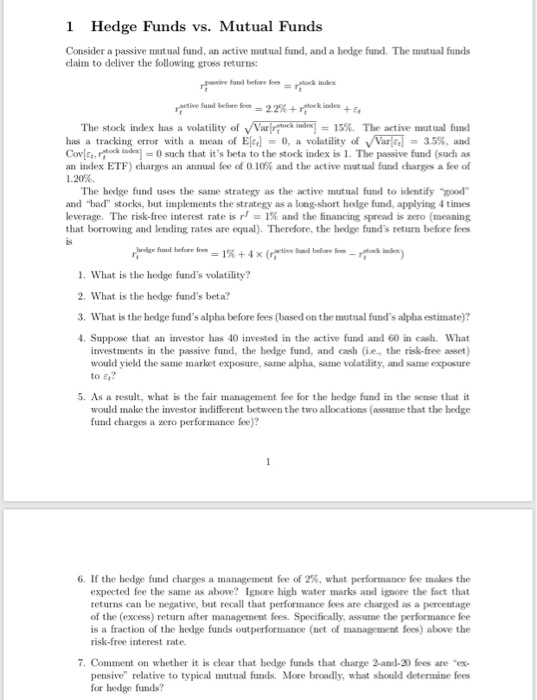

Question: Hedge Funds vs. Mutual Funds 1 Consider a passive mut ual fund, an active mutual fund, and a hedge fund. The mutual funds claim to

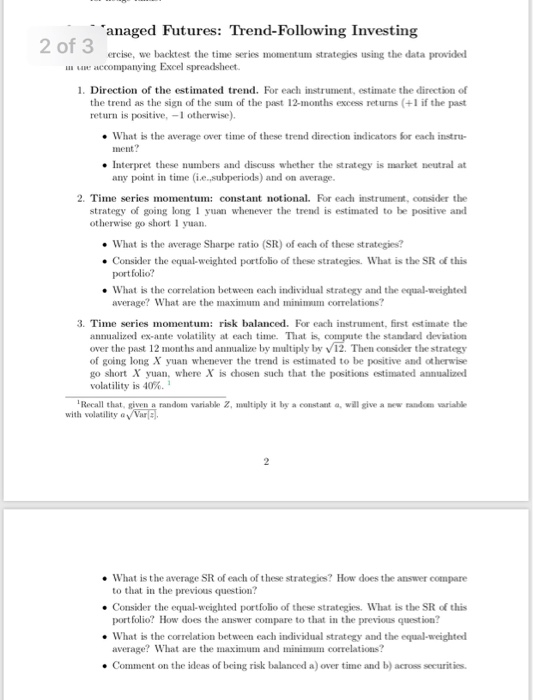

Hedge Funds vs. Mutual Funds 1 Consider a passive mut ual fund, an active mutual fund, and a hedge fund. The mutual funds claim to deliver the following gross returns: rpasive fund before fee radive fund before 22% + ,tock index + e. The stock index has a volatility of vNarianTR-15% The active mutual fund has a tracking error with a mean of Ele1-0, a volatility of VWarlc.]-3.5%, and CovlEtock0 such that it's beta to the stock index is 1. The passive fund (such as an index ETF) charges an annual fee of 0.10% and the active mutual fund charges a foe of 1.20%. The hedge fund uses the same strategy as the active Inutnal fund to identify "goor and bad stocks, but implements the strategy as a long-short hedge fund, applying 4 times leverage. The risk-free interest rate is r/-1% and the financing spread is zero (meaning that borrowing and lending rates are equal). Therefore, the hedge fund's return before fees . What is the hedge fund's volatility? 2. What is the hedge fund's beta? 3. What is the hedge fund's alpha before fees (based on the mutual fund's alpha estimate)? . Suppose that an investor has 40 invested in the active fund and 60 in cash. What investments in the passive fund, the hedge fund, and cash ie, the risk-free asset) would yield the same market exposure, same alpha, same volatility, and same exposure to E? 5. As a result, what is the fair management fee for the hedge fund in the sense that it would make the investor indifferent between the two allocations (assume that the hedge fund charges a zero performance fee)? 6. If the hedge fund charges a managenont fee of 2%, what performance fee makes the expected fee the same as above? Ignore high water marks and ignore the fact that returns can be negative, but recall that performance fees are charged as a percentage of the (excess) return after management fees. Specifically, assume the performance fee is a fraction of the hedge funds outperformance (net of management fees) above the risk-free interest rate. 7. Comment on whether it is clear that bedge funds that charge 2-and-20 fees are "ex- pensive relative to typical mutual funds. More broadly, what should determine fees for hedge funds? anaged Futures: Trend-Following Investing 2 of 3 ercise, we backtest the time series momentum strategies using the data provided 1. Direction of the estimated trend. For each instrument, estimate the direction of the trend as the sign of the sum of the past 12-months excess returns (+1 if the past . What is the average over time of these trend direction indicators for each instru- Interpret these numbers and discuss whether the strategy is market neutral at return is positive,-1 otherwise). ment any point in time iesubperiods) and on average 2. Time series momentum: constant notional. For each instrument, consider the strategy of going long yuan whenever the trend is estimated to be postive and otherwise go short 1 yuan What is the average Sharpe ratio (SR) of each of these strategies? Consider the equal-weighted portfolio of these strategies. What is the SR of this portfolio? What is the correlation bet ween each individual strategy and the equal-weighted average ? What are the maximum and minimum correlations? 3. Time series momentum: risk balanced. For each instrument, first est imate the the standard deviation annualized ex-ante volatility at each time. That is over the past 12 months and annualize by multiply by V12. Then consider the strategy of going long X yuan whenever the trend is estimated to be positive and otherwise go short X yuan where X is chosen such that the positions estimated annualized volatility is 40%, i Recall that, givon a random variable Z, lnultiply it by a constant a, will give a brw-m with volatility Vars ahle What is the average SR of each of these strategies? How does the answer compare . to that in the previous question? portfolio? How does the answer compare to that in the previous question? average? What are the maximum andminicorrelations? .Consider the equal-weighted portfolio of these strategies. What is the SR of this . What is the correlation between each individual strategy and the equal-weighted .Comment on the ideas of being risk balanced a) over time and b) across securities. Hedge Funds vs. Mutual Funds 1 Consider a passive mut ual fund, an active mutual fund, and a hedge fund. The mutual funds claim to deliver the following gross returns: rpasive fund before fee radive fund before 22% + ,tock index + e. The stock index has a volatility of vNarianTR-15% The active mutual fund has a tracking error with a mean of Ele1-0, a volatility of VWarlc.]-3.5%, and CovlEtock0 such that it's beta to the stock index is 1. The passive fund (such as an index ETF) charges an annual fee of 0.10% and the active mutual fund charges a foe of 1.20%. The hedge fund uses the same strategy as the active Inutnal fund to identify "goor and bad stocks, but implements the strategy as a long-short hedge fund, applying 4 times leverage. The risk-free interest rate is r/-1% and the financing spread is zero (meaning that borrowing and lending rates are equal). Therefore, the hedge fund's return before fees . What is the hedge fund's volatility? 2. What is the hedge fund's beta? 3. What is the hedge fund's alpha before fees (based on the mutual fund's alpha estimate)? . Suppose that an investor has 40 invested in the active fund and 60 in cash. What investments in the passive fund, the hedge fund, and cash ie, the risk-free asset) would yield the same market exposure, same alpha, same volatility, and same exposure to E? 5. As a result, what is the fair management fee for the hedge fund in the sense that it would make the investor indifferent between the two allocations (assume that the hedge fund charges a zero performance fee)? 6. If the hedge fund charges a managenont fee of 2%, what performance fee makes the expected fee the same as above? Ignore high water marks and ignore the fact that returns can be negative, but recall that performance fees are charged as a percentage of the (excess) return after management fees. Specifically, assume the performance fee is a fraction of the hedge funds outperformance (net of management fees) above the risk-free interest rate. 7. Comment on whether it is clear that bedge funds that charge 2-and-20 fees are "ex- pensive relative to typical mutual funds. More broadly, what should determine fees for hedge funds? anaged Futures: Trend-Following Investing 2 of 3 ercise, we backtest the time series momentum strategies using the data provided 1. Direction of the estimated trend. For each instrument, estimate the direction of the trend as the sign of the sum of the past 12-months excess returns (+1 if the past . What is the average over time of these trend direction indicators for each instru- Interpret these numbers and discuss whether the strategy is market neutral at return is positive,-1 otherwise). ment any point in time iesubperiods) and on average 2. Time series momentum: constant notional. For each instrument, consider the strategy of going long yuan whenever the trend is estimated to be postive and otherwise go short 1 yuan What is the average Sharpe ratio (SR) of each of these strategies? Consider the equal-weighted portfolio of these strategies. What is the SR of this portfolio? What is the correlation bet ween each individual strategy and the equal-weighted average ? What are the maximum and minimum correlations? 3. Time series momentum: risk balanced. For each instrument, first est imate the the standard deviation annualized ex-ante volatility at each time. That is over the past 12 months and annualize by multiply by V12. Then consider the strategy of going long X yuan whenever the trend is estimated to be positive and otherwise go short X yuan where X is chosen such that the positions estimated annualized volatility is 40%, i Recall that, givon a random variable Z, lnultiply it by a constant a, will give a brw-m with volatility Vars ahle What is the average SR of each of these strategies? How does the answer compare . to that in the previous question? portfolio? How does the answer compare to that in the previous question? average? What are the maximum andminicorrelations? .Consider the equal-weighted portfolio of these strategies. What is the SR of this . What is the correlation between each individual strategy and the equal-weighted .Comment on the ideas of being risk balanced a) over time and b) across securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts