Question: Hedging Currency Risks at AIFS The case provides an introduction to how currency mismatches create exposures, why companies hedge those exposures and how they hedge

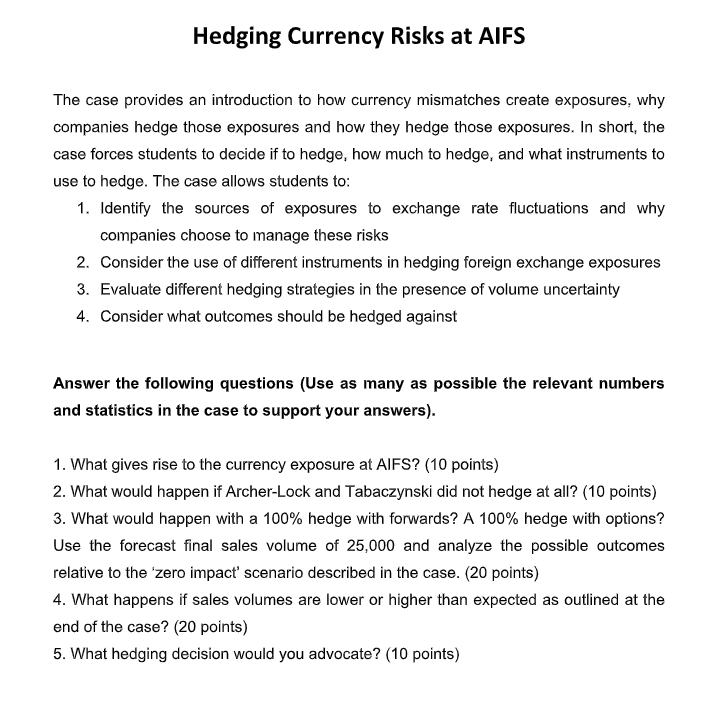

Hedging Currency Risks at AIFS The case provides an introduction to how currency mismatches create exposures, why companies hedge those exposures and how they hedge those exposures. In short, the case forces students to decide if to hedge, how much to hedge, and what instruments to use to hedge. The case allows students to: 1. Identify the sources of exposures to exchange rate fluctuations and why companies choose to manage these risks 2. Consider the use of different instruments in hedging foreign exchange exposures 3. Evaluate different hedging strategies in the presence of volume uncertainty 4. Consider what outcomes should be hedged against Answer the following questions (Use as many as possible the relevant numbers and statistics in the case to support your answers). 1. What gives rise to the currency exposure at AIFS? (10 points) 2. What would happen if Archer-Lock and Tabaczynski did not hedge at all? (10 points) 3. What would happen with a 100% hedge with forwards? A 100% hedge with options? Use the forecast final sales volume of 25,000 and analyze the possible outcomes relative to the 'zero impact' scenario described in the case. (20 points) 4. What happens if sales volumes are lower or higher than expected as outlined at the end of the case? (20 points) 5. What hedging decision would you advocate? (10 points) Hedging Currency Risks at AIFS The case provides an introduction to how currency mismatches create exposures, why companies hedge those exposures and how they hedge those exposures. In short, the case forces students to decide if to hedge, how much to hedge, and what instruments to use to hedge. The case allows students to: 1. Identify the sources of exposures to exchange rate fluctuations and why companies choose to manage these risks 2. Consider the use of different instruments in hedging foreign exchange exposures 3. Evaluate different hedging strategies in the presence of volume uncertainty 4. Consider what outcomes should be hedged against Answer the following questions (Use as many as possible the relevant numbers and statistics in the case to support your answers). 1. What gives rise to the currency exposure at AIFS? (10 points) 2. What would happen if Archer-Lock and Tabaczynski did not hedge at all? (10 points) 3. What would happen with a 100% hedge with forwards? A 100% hedge with options? Use the forecast final sales volume of 25,000 and analyze the possible outcomes relative to the 'zero impact' scenario described in the case. (20 points) 4. What happens if sales volumes are lower or higher than expected as outlined at the end of the case? (20 points) 5. What hedging decision would you advocate? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts