Question: Hedging refers to: A) B) C) D) The term loan is usually characterized by: Maturity of one to seven years. A variable interest rate. A)

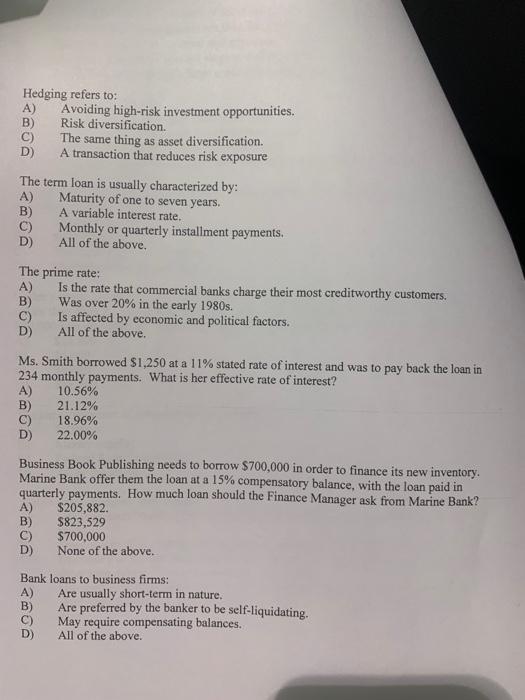

Hedging refers to: A) B) C) D) The term loan is usually characterized by: Maturity of one to seven years. A variable interest rate. A) B) C) D) Avoiding high-risk investment opportunities. Risk diversification. The same thing as asset diversification. A transaction that reduces risk exposure Monthly or quarterly installment payments. All of the above. The prime rate: A) B) C) D) B) C) D) Is the rate that commercial banks charge their most creditworthy customers. Was over 20% in the early 1980s. Is affected by economic and political factors. All of the above. Ms. Smith borrowed $1,250 at a 11% stated rate of interest and was to pay back the loan in 234 monthly payments. What is her effective rate of interest? A) B) C) D) 10.56% 21.12% 18.96% 22.00% Business Book Publishing needs to borrow $700,000 in order to finance its new inventory. Marine Bank offer them the loan at a 15% compensatory balance, with the loan paid in quarterly payments. How much loan should the Finance Manager ask from Marine Bank? A) $205,882. $823,529 $700,000 None of the above. Bank loans to business firms: A) B) C) D) Are usually short-term in nature. Are preferred by the banker to be self-liquidating. May require compensating balances. All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts