Question: Hedging You are a wealth manager. A client intends to sell 60,000 shares of Archer Daniels Midland (ADM) stock (an agribusiness firm) in order to

Hedging

Hedging

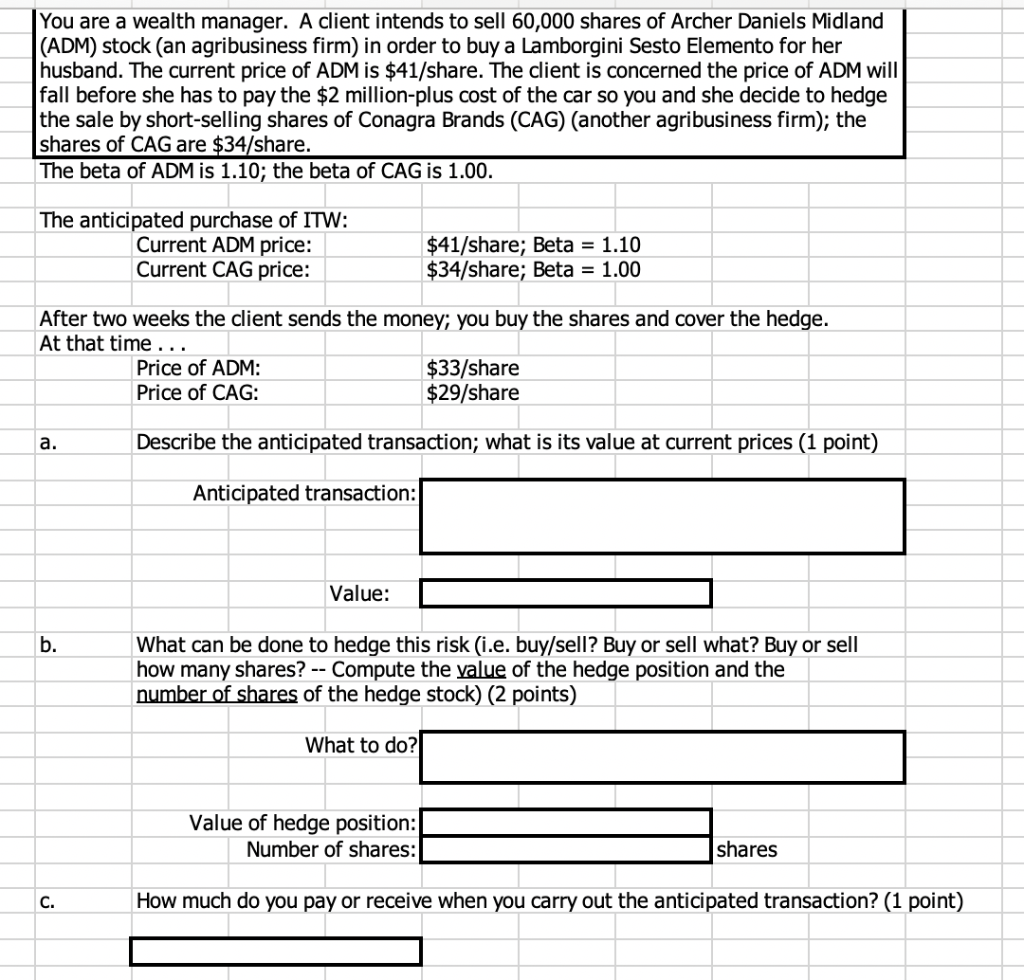

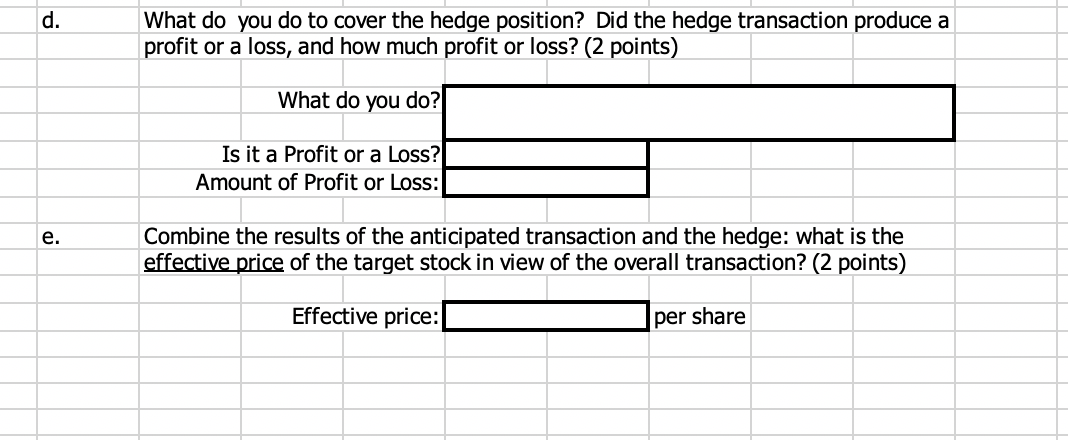

You are a wealth manager. A client intends to sell 60,000 shares of Archer Daniels Midland (ADM) stock (an agribusiness firm) in order to buy a Lamborgini Sesto Elemento for her husband. The current price of ADM is $41/share. The client is concerned the price of ADM will fall before she has to pay the $2 million-plus cost of the car so you and she decide to hedge the sale by short-selling shares of Conagra Brands (CAG) (another agribusiness firm); the shares of CAG are $34/share. The beta of ADM is 1.10; the beta of CAG is 1.00. The anticipated purchase of ITW: Current ADM price: Current CAG price: $41/share; Beta = 1.10 $34/share; Beta = 1.00 After two weeks the client sends the money; you buy the shares and cover the hedge. At that time... Price of ADM: $33/share Price of CAG: $29/share a. Describe the anticipated transaction; what is its value at current prices (1 point) Anticipated transaction: Value: b. What can be done to hedge this risk (i.e. buy/sell? Buy or sell what? Buy or sell how many shares? -- Compute the value of the hedge position and the number of shares of the hedge stock) (2 points) What to do? Value of hedge position: Number of shares: shares C. How much do you pay or receive when you carry out the anticipated transaction? (1 point) d. What do you do to cover the hedge position? Did the hedge transaction produce a profit or a loss, and how much profit or loss? (2 points) What do you do? Is it a Profit or a Loss? Amount of Profit or Loss: e. Combine the results of the anticipated transaction and the hedge: what is the effective price of the target stock in view of the overall transaction? (2 points) Effective price: per share You are a wealth manager. A client intends to sell 60,000 shares of Archer Daniels Midland (ADM) stock (an agribusiness firm) in order to buy a Lamborgini Sesto Elemento for her husband. The current price of ADM is $41/share. The client is concerned the price of ADM will fall before she has to pay the $2 million-plus cost of the car so you and she decide to hedge the sale by short-selling shares of Conagra Brands (CAG) (another agribusiness firm); the shares of CAG are $34/share. The beta of ADM is 1.10; the beta of CAG is 1.00. The anticipated purchase of ITW: Current ADM price: Current CAG price: $41/share; Beta = 1.10 $34/share; Beta = 1.00 After two weeks the client sends the money; you buy the shares and cover the hedge. At that time... Price of ADM: $33/share Price of CAG: $29/share a. Describe the anticipated transaction; what is its value at current prices (1 point) Anticipated transaction: Value: b. What can be done to hedge this risk (i.e. buy/sell? Buy or sell what? Buy or sell how many shares? -- Compute the value of the hedge position and the number of shares of the hedge stock) (2 points) What to do? Value of hedge position: Number of shares: shares C. How much do you pay or receive when you carry out the anticipated transaction? (1 point) d. What do you do to cover the hedge position? Did the hedge transaction produce a profit or a loss, and how much profit or loss? (2 points) What do you do? Is it a Profit or a Loss? Amount of Profit or Loss: e. Combine the results of the anticipated transaction and the hedge: what is the effective price of the target stock in view of the overall transaction? (2 points) Effective price: per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts