Question: heducation.com/hmitpx Problem 2-22 Calculating Cash Flows [LO4] Consider the following abbreviated financial statements for Parrothead Enterprises ARRO HEAD ENTERPRIS 2014 and 2015 Partial Balance Sheets

![heducation.com/hmitpx Problem 2-22 Calculating Cash Flows [LO4] Consider the following abbreviated](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe27f70cfd2_40666fe27f671000.jpg)

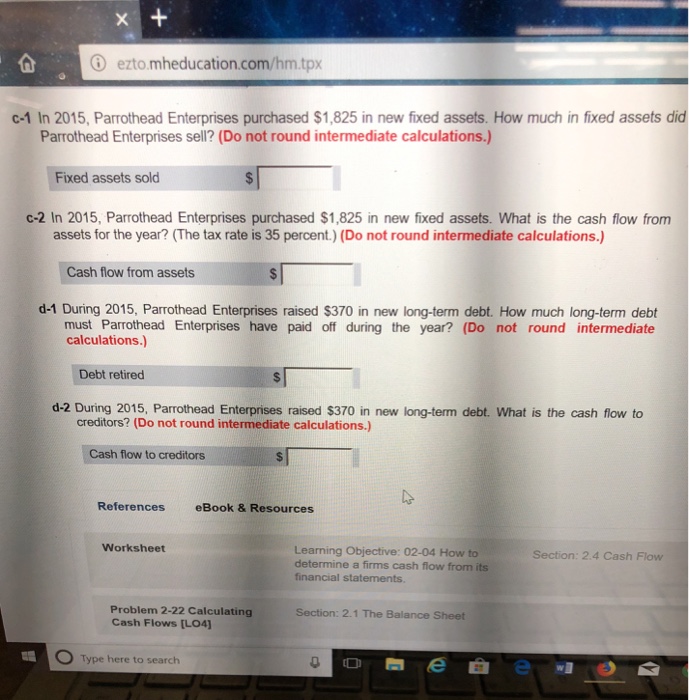

heducation.com/hmitpx Problem 2-22 Calculating Cash Flows [LO4] Consider the following abbreviated financial statements for Parrothead Enterprises ARRO HEAD ENTERPRIS 2014 and 2015 Partial Balance Sheets Assets Liabilities and Owners Equity 14 cl2014 2015 Current assets 926 $1,007 Current liabilities$ 370 $ 416 Net fixed assets 3,947 4,560 Long-term debt 2,009 2,147 ROTHEAD ENTERPRISES 2015 Income Statement Sales Costs Depreciation Interest paid S 11,390 5,570 1,050 150 a. What is owners' equity for 2014 and 2015? (Do not round intermediate calculations.) Owners equity 2014 Owners' equity 2015 b. What is the change in net working capital for 2015? (Do not round intermediate calculations.) Change in NWC c-1 In 2015, Parrothead Enterprises purchased $1,825 in new fixed assets. How much in fixed assets did Parrothead Enterprises sell? (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts