Question: please help for a good rating! Problem 2-20 Calculating Cash Flows (L04) Consider the following abbreviated financial statements for Parrothead Enterprises: PARROTHEAD ENTERPRISES 2020 and

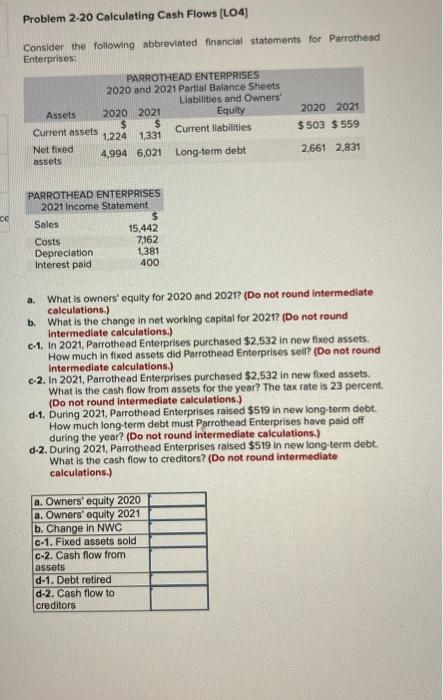

Problem 2-20 Calculating Cash Flows (L04) Consider the following abbreviated financial statements for Parrothead Enterprises: PARROTHEAD ENTERPRISES 2020 and 2021 Partial Balance Sheets Liabilities and Owners' Assets 2020 2021 Equity 2020 2021 $ $ Current assets Current liabilities $ 503 $559 1,224 1,331 Net fixed 4,994 6,021 Long-term debt 2,661 2,831 assets ce PARROTHEAD ENTERPRISES 2021 Income Statement $ Sales 15,442 Costs 7,162 Depreciation 1381 Interest paid 400 a. What is owners' equity for 2020 and 2021? (Do not round Intermediate calculations.) b. What is the change in net working capital for 2021? (Do not round Intermediate calculations.) c-1. In 2021, Parrothead Enterprises purchased $2,532 in new fixed assets How much in fixed assets did Parrothead Enterprises sell? (Do not round Intermediate calculations.) c-2. In 2021, Parrothead Enterprises purchased $2,532 in new fixed assets. What is the cash flow from assets for the year? The tax rate is 23 percent. (Do not round Intermediate calculations.) d-1. During 2021, Parrothead Enterprises raised $519 in new long-term debt. How much long-term debt must Parrothead Enterprises have paid off during the year? (Do not round Intermediate calculations.) d-2. During 2021, Parrothead Enterprises raised $519 in new long term debt. What is the cash flow to creditors? (Do not round intermediate calculations.) a. Owners' equity 2020 a. Owners' equity 2021 b. Change in NWC C-1. Fixed assets sold C-2. Cash flow from assets d-1. Debt retired d-2. Cash flow to creditors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts