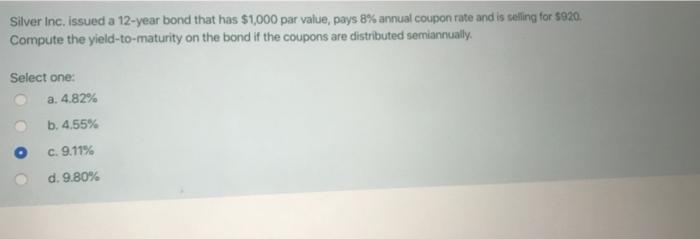

Question: hellllpppp plzzzz no timeeee Silver Inc. issued a 12-year bond that has $1,000 par value, pays 8% annual coupon rate and is seling for $920.

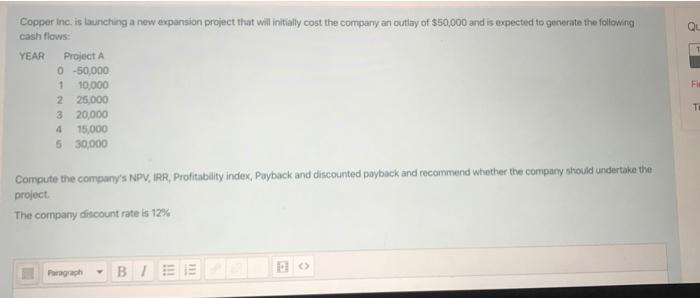

Silver Inc. issued a 12-year bond that has $1,000 par value, pays 8% annual coupon rate and is seling for $920. Compute the yield-to-maturity on the bond if the coupons are distributed semiannually. Select one: a. 4.82% b. 4.55% c. 9.11% d. 9.80% Copper Inc. is launching a new expansion project that will initially cost the company an outlay of $50,000 and is expected to generate the following cash flows YEAR Project A 0-50,000 1 10,000 2 25,000 320,000 4 15,000 5 30,000 TE Compute the company's NPV, IRR, Profitability index, Payback and discounted payback and recommend whether the company should undertake the project The company discount rate is 12% Paragraph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts