Question: Hello All, please help me solve this problem: Par, Premium, and Discount The discount or premium on bonds payable is recorded in a separate account

Hello All, please help me solve this problem:

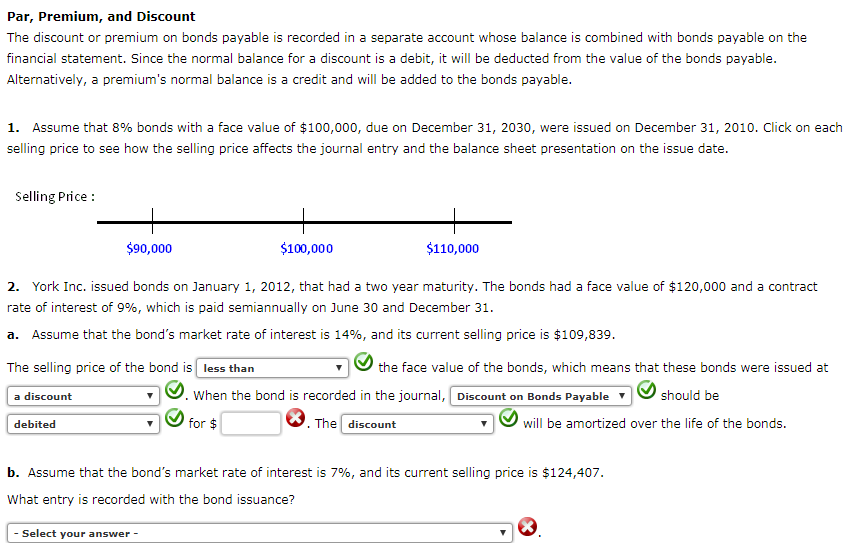

Par, Premium, and Discount The discount or premium on bonds payable is recorded in a separate account whose balance is combined with bonds payable on the financial statement. Since the normal balance for a discount is a debit, it will be deducted from the value of the bonds payable. Alternatively, a premium's normal balance is a credit and will be added to the bonds payable. I. Assume that 8% bonds with a face value of $100,000, due on December 31, 2030, were issued on December 31, 2010. Click on each selling price to see how the selling price affects the journal entry and the balance sheet presentation on the issue date. Selling Price: $90,000 $100,000 $110,000 2. York Inc. issued bonds on January 1, 2012, that had a two year maturity. The bonds had a face value of $120,000 and a contract rate of interest of 9%, which is paid semiannually on June 30 and December 31. a. Assume that the bond's market rate of interest is 14%, and its current selling price is $109,839. The selling price of the bond is less than the face value of the bonds, which means that these bonds were issued at ,0 when the bond is recorded in the journal, Discount on Bonds Payable , a discount should be debited for$ The discount will be amortized over the life of the bonds. b. Assume that the bond's market rate of interest is 7%, and its current selling price is $124,407. Select your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts