Question: please fill the blanks and i posts all the information needed. thank you Par, Premium, and Discount The discount or premium on bonds payable is

please fill the blanks and i posts all the information needed. thank you

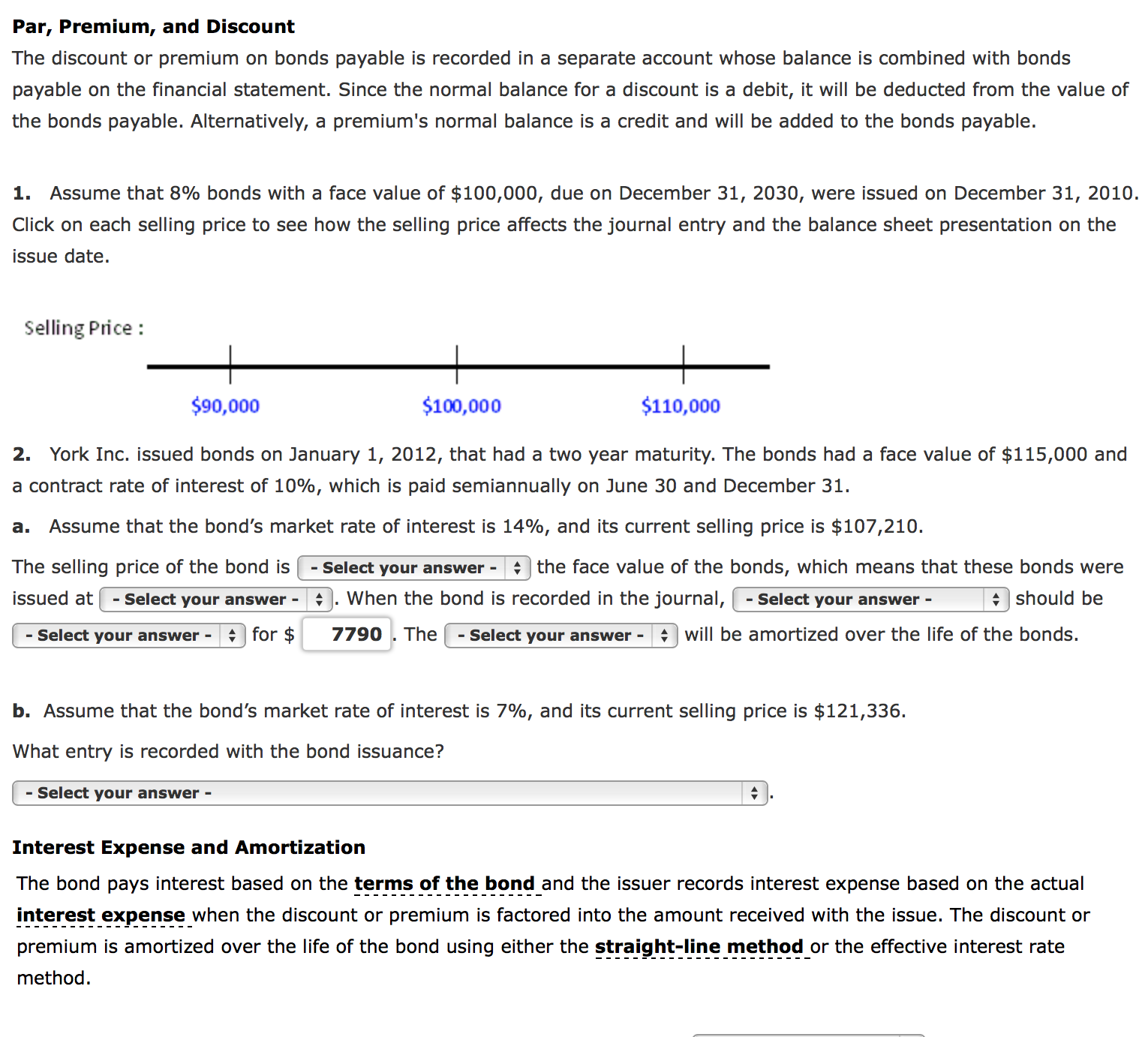

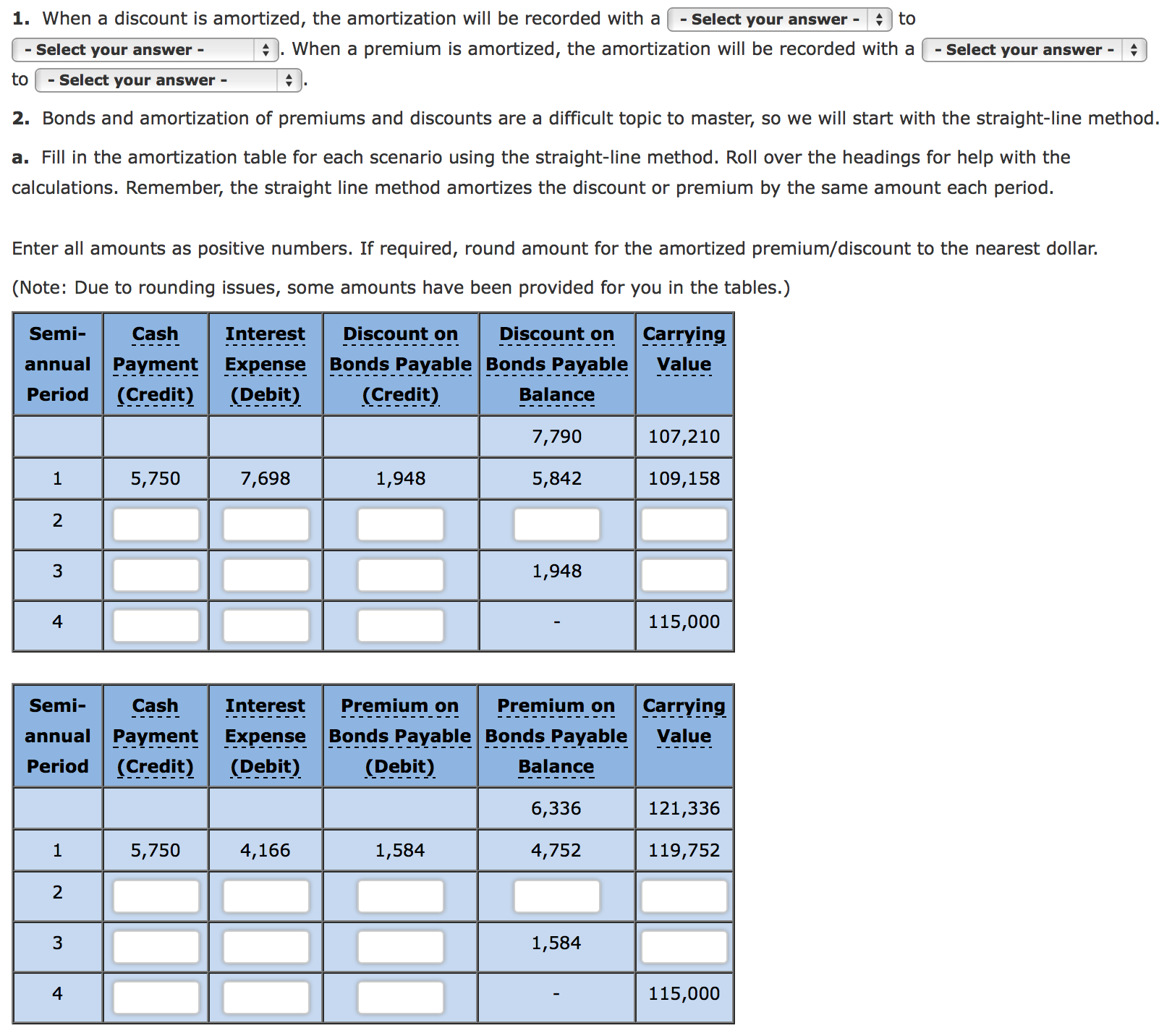

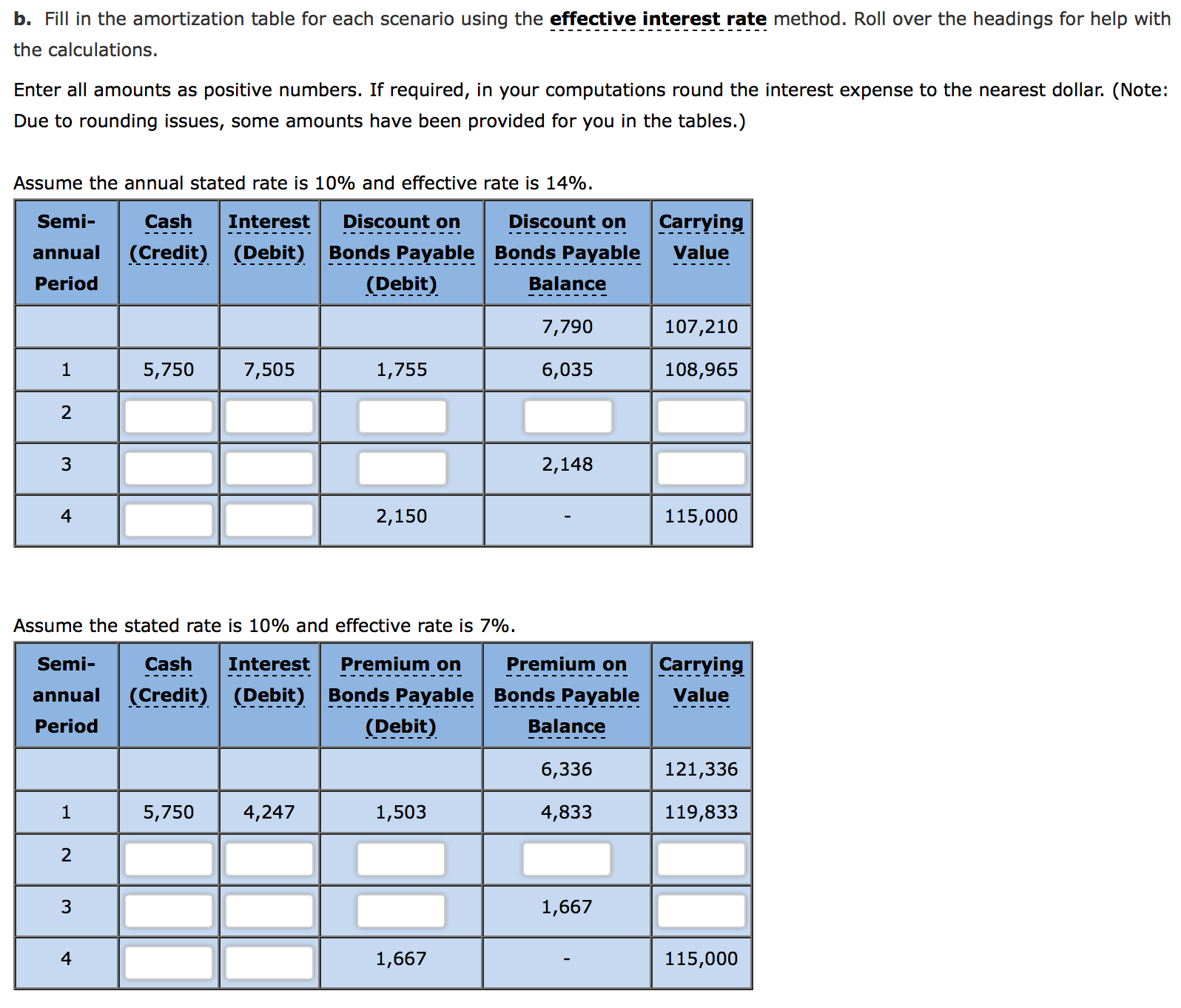

Par, Premium, and Discount The discount or premium on bonds payable is recorded in a separate account whose balance is combined with bonds payable on the financial statement. Since the normal balance for a discount is a debit, it will be deducted from the value of the bonds payable. Alternatively, a premium's normal balance is a credit and will be added to the bonds payable. I. Assume that 8% bonds with a face value of $100,000, due on December 31, 2030, were issued on December 31, 2010. Click on each selling price to see how the selling price affects the journal entry and the balance sheet presentation on the issue date, Selling Price: $90,000 100,000 $110,000 2. York Inc. issued bonds on January 1, 2012, that had a two year maturity. The bonds had a face value of $115,000 and a contract rate of interest of 10%, which is paid semiannually on June 30 and December 31. a. Assume that the bond's market rate of interest is 14%, and its current selling price is $107,210. The selling price of the bond is | -select your answer- I the face value of the bonds, which means that these bonds were issued at-select your answer- -when the bond is recorded in the journal, l -select your answer- 4 should be Select your answer- for $7790 The -Select your answer-will be amortized over the life of the bonds. b. Assume that the bond's market rate of interest is 7%, and its current selling price is $121,336. What entry is recorded with the bond issuance? Select your answer - Interest Expense and Amortization The bond pays interest based on the terms of the bond and the issuer records interest expense based on the actual interest expense when the discount or premium is factored into the amount received with the issue. The discount or premium is amortized over the life of the bond using either the straight-line method or the effective interest rate method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts