Question: Hello. Can I please get help with these 3 questions please? I am not understanding this and am in need of an explanation on how

Hello. Can I please get help with these 3 questions please? I am not understanding this and am in need of an explanation on how the answers are found please. Thank you for helping me!

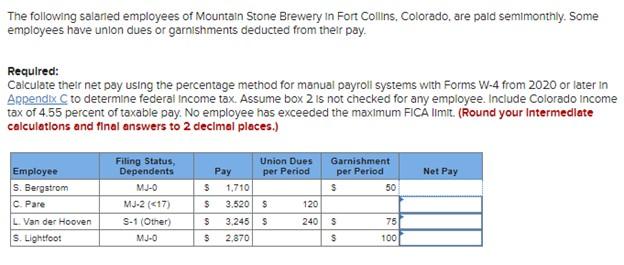

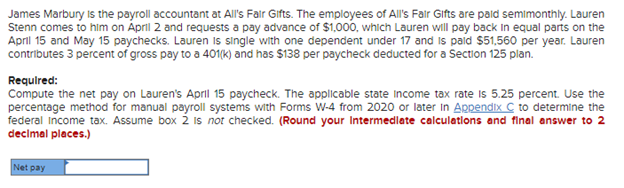

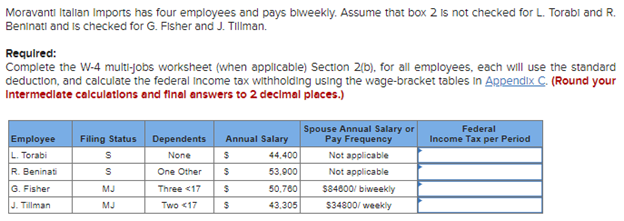

The following salaned employees of Mountain Stone Brewery in Fort Collins. Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from theif pay. Required: Calculate their net pay using the percentage method for manual payroll systems with Forms W-4 from 2020 or later in Appendx C to determine federal Income tax. Assume box 2 is not checked for any employee. Include Colorado income tax of 4.55 percent of taxable pay. No employee has exceeded the maximum FICA IImit. (Round your Intermedlate calculations and final answers to 2 decimal places.) James Marbury is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Lauren Stenn comes to him on April 2 and requests a pay advance of $1,000, which Lauren will pay back In equal parts on the April 15 and May 15 paychecks. Lauren Is single with one dependent under 17 and Is paid $51,560 per year. Lauren contributes 3 percent of gross pay to a 401(k) and has $138 per paycheck deducted for a Section 125 plan. Required: Compute the net pay on Lauren's April 15 paycheck. The applicable state income tax rate is 5.25 percent. Use the percentage method for manual payroll systems with Forms W-4 from 2020 or later In Appendix C to determine the federal Income tax. Assume box 2 is not checked. (Round your Intermedlate calculations and final answer to 2 decimal places.) Moravantl Itallan Imports has four employees and pays biweekly. Assume that box 2 is not checked for L. Torabl and R. Beninati and is checked for G. Fisher and J. Tillman. Required: Complete the W-4 multi-jobs worksheet (When applicable) Section 2(b), for all employees, each will use the standard deduction, and calculate the federal income tax withholding using the wage-bracket tables In Appendix^C. (Round your Intermedlate calculations and final answers to 2 decimal places.) The following salaned employees of Mountain Stone Brewery in Fort Collins. Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from theif pay. Required: Calculate their net pay using the percentage method for manual payroll systems with Forms W-4 from 2020 or later in Appendx C to determine federal Income tax. Assume box 2 is not checked for any employee. Include Colorado income tax of 4.55 percent of taxable pay. No employee has exceeded the maximum FICA IImit. (Round your Intermedlate calculations and final answers to 2 decimal places.) James Marbury is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Lauren Stenn comes to him on April 2 and requests a pay advance of $1,000, which Lauren will pay back In equal parts on the April 15 and May 15 paychecks. Lauren Is single with one dependent under 17 and Is paid $51,560 per year. Lauren contributes 3 percent of gross pay to a 401(k) and has $138 per paycheck deducted for a Section 125 plan. Required: Compute the net pay on Lauren's April 15 paycheck. The applicable state income tax rate is 5.25 percent. Use the percentage method for manual payroll systems with Forms W-4 from 2020 or later In Appendix C to determine the federal Income tax. Assume box 2 is not checked. (Round your Intermedlate calculations and final answer to 2 decimal places.) Moravantl Itallan Imports has four employees and pays biweekly. Assume that box 2 is not checked for L. Torabl and R. Beninati and is checked for G. Fisher and J. Tillman. Required: Complete the W-4 multi-jobs worksheet (When applicable) Section 2(b), for all employees, each will use the standard deduction, and calculate the federal income tax withholding using the wage-bracket tables In Appendix^C. (Round your Intermedlate calculations and final answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts