Question: Hello, can I please have your expertise on this assignment for my corporate finance course? Thank you very much. Sign Ir X SPC FINAN X

Hello, can I please have your expertise on this assignment for my corporate finance course? Thank you very much.

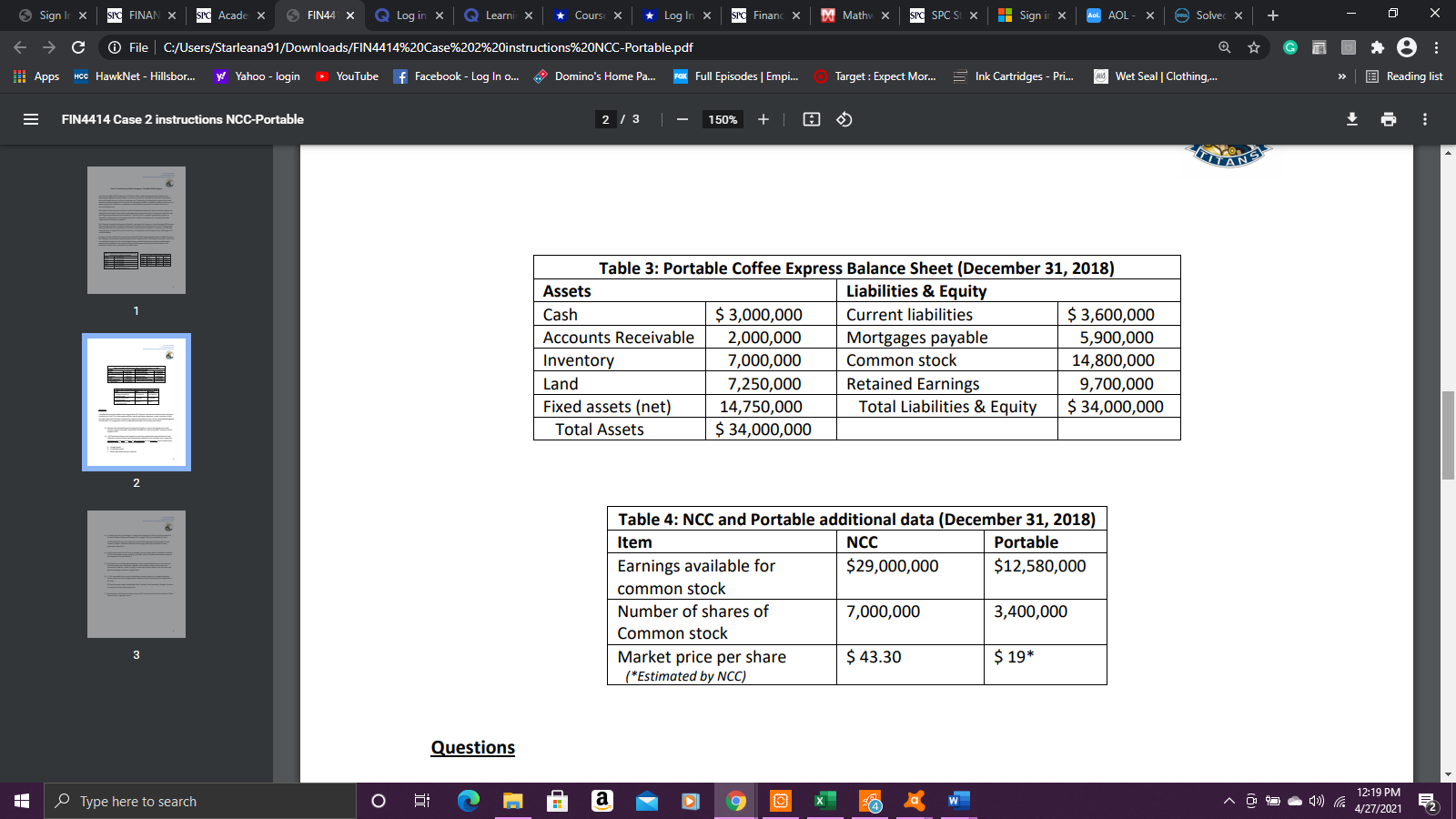

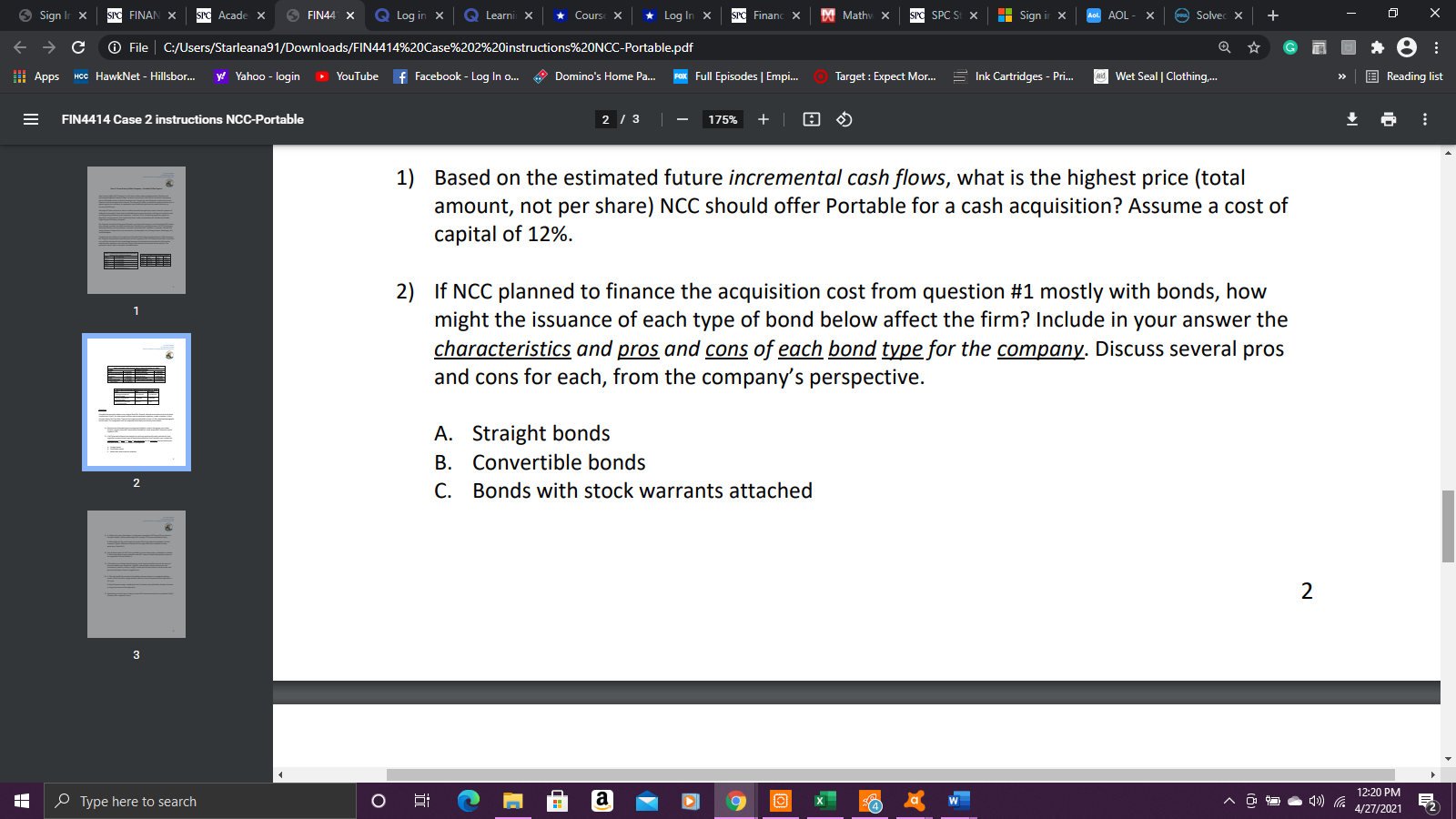

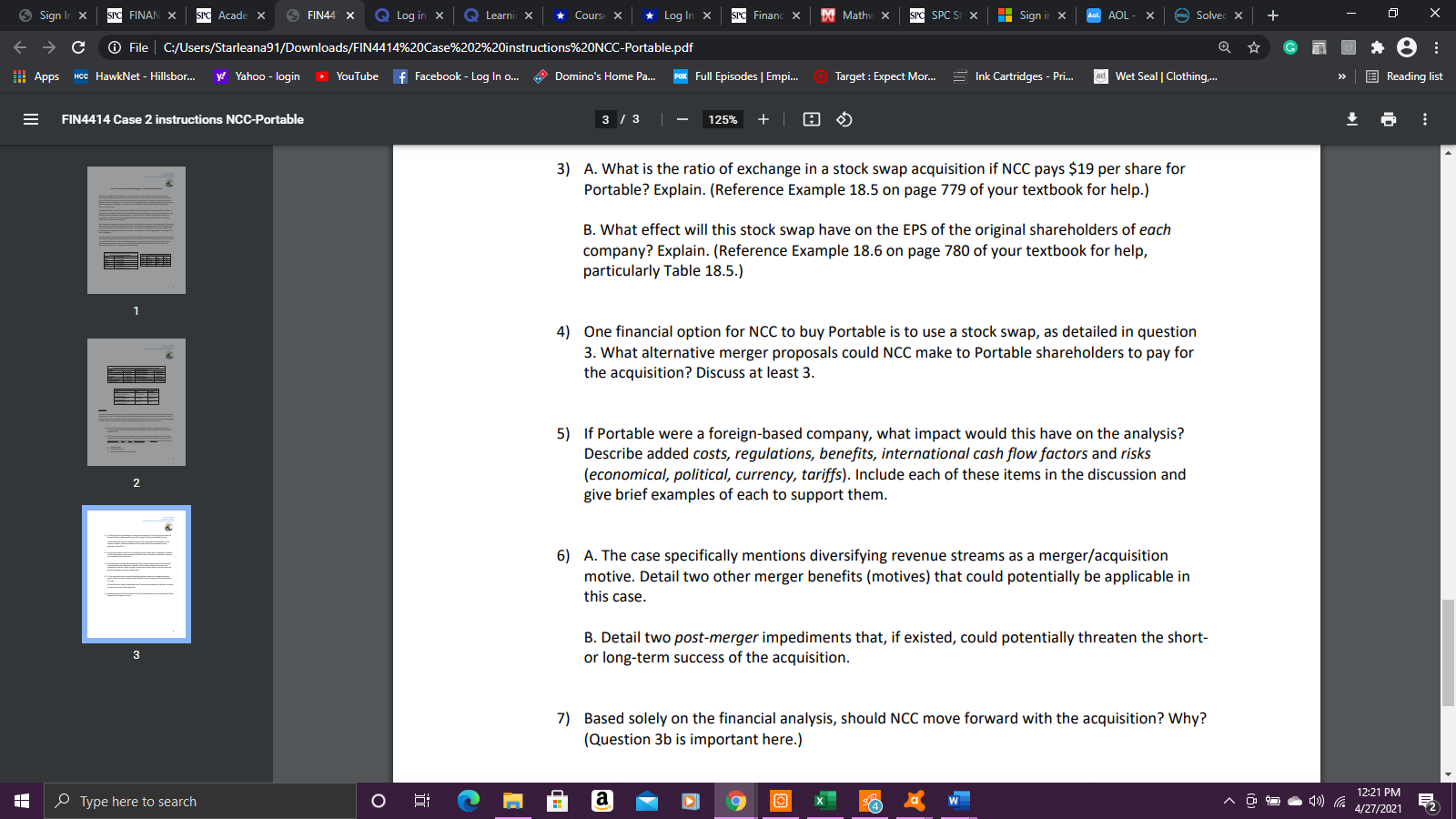

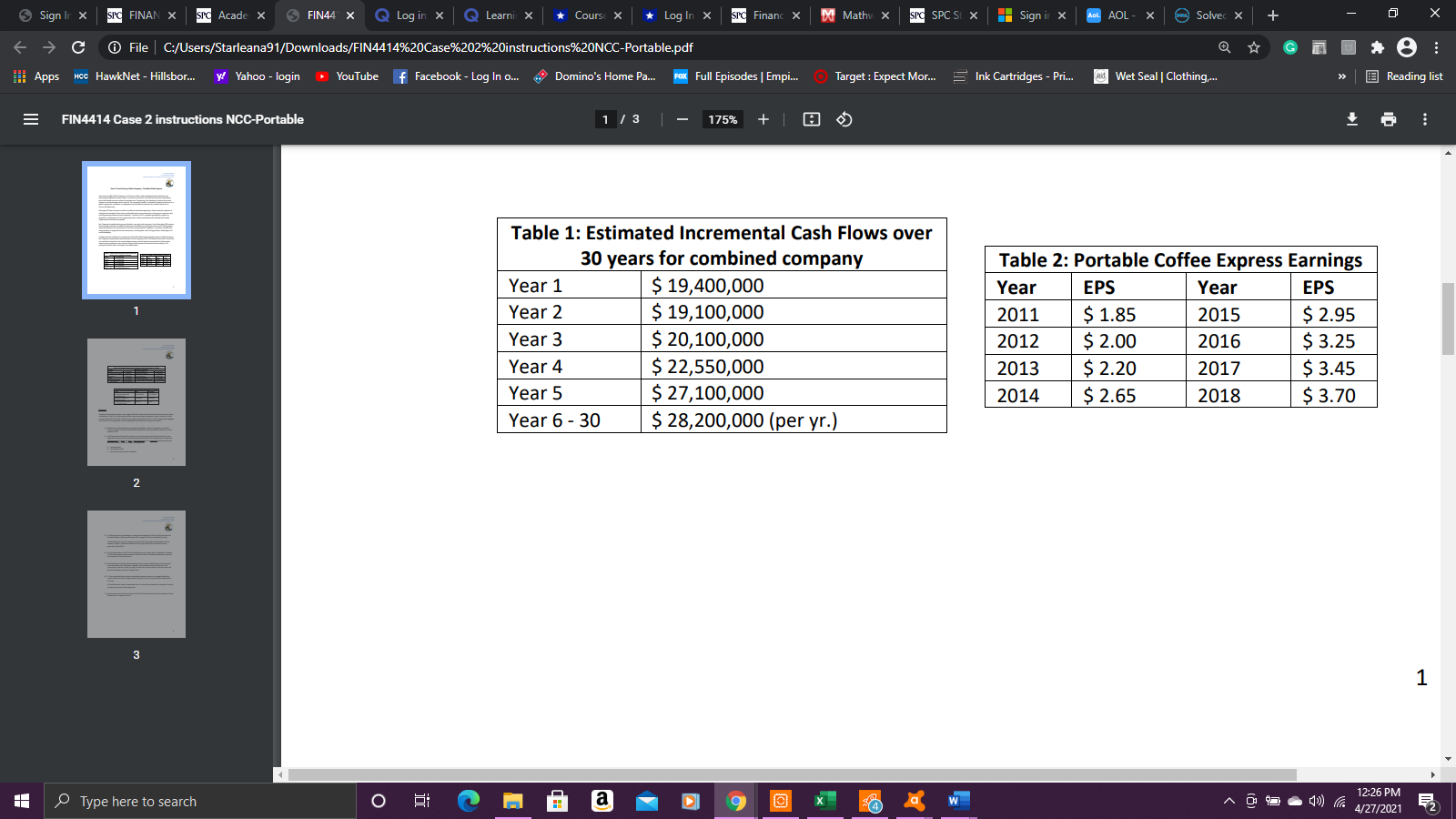

Sign Ir X SPC FINAN X sr Acade X 5 FIN44 X Q Log in X Q Learni X Course X * Log In X SPC Financ DO Mathv X sic SPC St x Sign ir X AOL AOL - X Solvec X + C O File | C:/Users/Starleana91/Downloads/FIN4414%20Case%202%20instructions%20NCC-Portable.pdf G ili Apps HCC HawkNet - Hillsbor. y! Yahoo - login YouTube f Facebook - Log In O.. Domino's Home Pa. Fox Full Episodes | Empi... O Target : Expect Mor.. Ink Cartridges - Pri. And Wet Seal | Clothing,. Reading list FIN4414 Case 2 instructions NCC-Portable 2 / 3 | - 150% + Table 3: Portable Coffee Express Balance Sheet (December 31, 2018) Assets Liabilities & Equity Cash $ 3,000,000 Current liabilities $ 3,600,000 Accounts Receivable 2,000,000 Mortgages payable 5,900,000 Inventory 7,000,000 Common stock 14,800,000 Land 7,250,000 Retained Earnings 9,700,000 Fixed assets (net) 14,750,000 Total Liabilities & Equity $ 34,000,000 Total Assets $ 34,000,000 2 Table 4: NCC and Portable additional data (December 31, 2018) Item NCC Portable Earnings available for $29,000,000 $12,580,000 common stock Number of shares of 7,000,000 3,400,000 Common stock 3 Market price per share $ 43.30 $ 19* (*Estimated by NCC) Questions Type here to search DI 9 X W 12:19 PM " 4/27/2021Sign Ir X SPC FINAN X sr Acade X 5 FIN44 X Q Log in X Q Learni X Course X * Log In X SPC Financ DO Mathv X sic SPC St x Sign ir X AOL AOL - X Solvec X + C O File | C:/Users/Starleana91/Downloads/FIN4414%20Case%202%20instructions%20NCC-Portable.pdf G ili Apps HCC HawkNet - Hillsbor. y! Yahoo - login YouTube f Facebook - Log In o.. 4 Domino's Home Pa. Fox Full Episodes | Empi... O Target : Expect Mor.. Ink Cartridges - Pri. Wet Seal | Clothing,.. Reading list FIN4414 Case 2 instructions NCC-Portable 2 / 3 175% + 1) Based on the estimated future incremental cash flows, what is the highest price (total amount, not per share) NCC should offer Portable for a cash acquisition? Assume a cost of capital of 12%. 2) If NCC planned to finance the acquisition cost from question #1 mostly with bonds, how might the issuance of each type of bond below affect the firm? Include in your answer the characteristics and pros and cons of each bond type for the company. Discuss several pros and cons for each, from the company's perspective. A. Straight bonds B. Convertible bonds 2 C. Bonds with stock warrants attached N 3 Type here to search 9 X W 12:20 PM 4/27/2021Sign Ir X SPC FINAN X sro Acade X 5 FIN44 X Q Log in X Q Learni X Course X * Log In X SPC Financ DO Mathv X sic SPC St x Sign ir X AOL AOL - X Solvec X + C O File | C:/Users/Starleana91/Downloads/FIN4414%20Case%202%20instructions%20NCC-Portable.pdf G ili Apps HCC HawkNet - Hillsbor. y Yahoo - login YouTube f Facebook - Log In o.. 4 Domino's Home Pa.. Fox Full Episodes | Empi... O Target: Expect Mor.. Ink Cartridges - Pri.. Wet Seal | Clothing,. Reading list FIN4414 Case 2 instructions NCC-Portable 3 / 3 125% + 3) A. What is the ratio of exchange in a stock swap acquisition if NCC pays $19 per share for Portable? Explain. (Reference Example 18.5 on page 779 of your textbook for help.) B. What effect will this stock swap have on the EPS of the original shareholders of each company? Explain. (Reference Example 18.6 on page 780 of your textbook for help, particularly Table 18.5.) 4) One financial option for NCC to buy Portable is to use a stock swap, as detailed in question 3. What alternative merger proposals could NCC make to Portable shareholders to pay for the acquisition? Discuss at least 3. 5) If Portable were a foreign-based company, what impact would this have on the analysis? Describe added costs, regulations, benefits, international cash flow factors and risks (economical, political, currency, tariffs). Include each of these items in the discussion and give brief examples of each to support them. 6) A. The case specifically mentions diversifying revenue streams as a merger/acquisition motive. Detail two other merger benefits (motives) that could potentially be applicable in this case. B. Detail two post-merger impediments that, if existed, could potentially threaten the short- 3 or long-term success of the acquisition. 7) Based solely on the financial analysis, should NCC move forward with the acquisition? Why? (Question 3b is important here.) Type here to search a DI 9 X w 12:21 PM " 4/27/2021Sign Ir X SPC FINAN X src Acade X 5 FIN44 X Q Log in X Q Learni X Course X * Log In X SPC Financ DO Mathv X spo SPC St x Sign ir X AOL AOL - X Solvec X + C O File | C:/Users/Starleana91/Downloads/FIN4414%20Case%202%20instructions%20NCC-Portable.pdf G ili Apps HCC HawkNet - Hillsbor. y! Yahoo - login YouTube f Facebook - Log In O... Domino's Home Pa.. Fox Full Episodes | Empi... O Target : Expect Mor.. Ink Cartridges - Pri. And Wet Seal | Clothing,.. Reading list FIN4414 Case 2 instructions NCC-Portable 1 /3 175% + Table 1: Estimated Incremental Cash Flows over 30 years for combined company Table 2: Portable Coffee Express Earnings Year 1 $ 19,400,000 Year EPS Year EPS Year 2 $ 19,100,000 2011 $ 1.85 2015 $ 2.95 Year 3 $ 20,100,000 2012 $ 2.00 2016 $ 3.25 Year 4 $ 22,550,000 2013 $ 2.20 2017 $ 3.45 Year 5 $ 27,100,000 2014 $ 2.65 2018 $ 3.70 Year 6 - 30 $ 28,200,000 (per yr.) 3 Type here to search 9 X W 12:26 PM 4/27/2021