Question: Hello can someone explain me how to do this questions in the financial calculator ? pls A 20-year U.S. Treasury bond with a face value

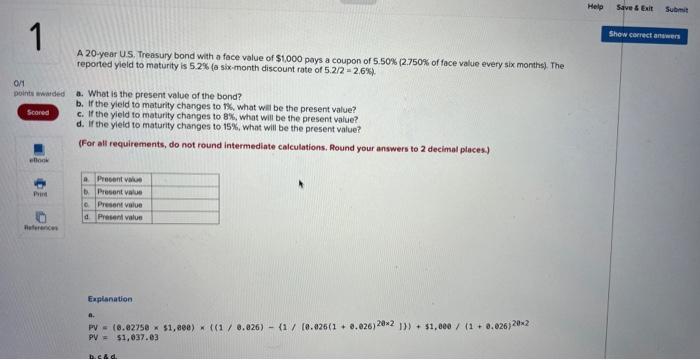

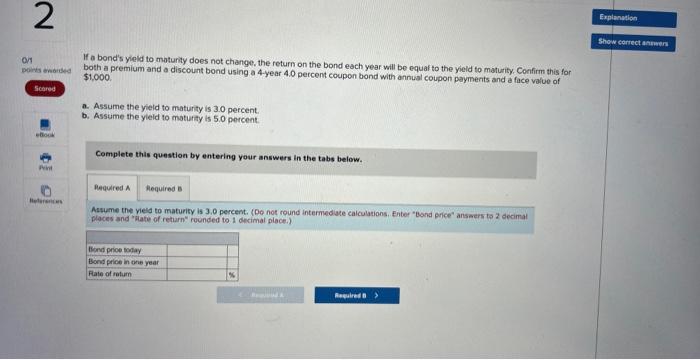

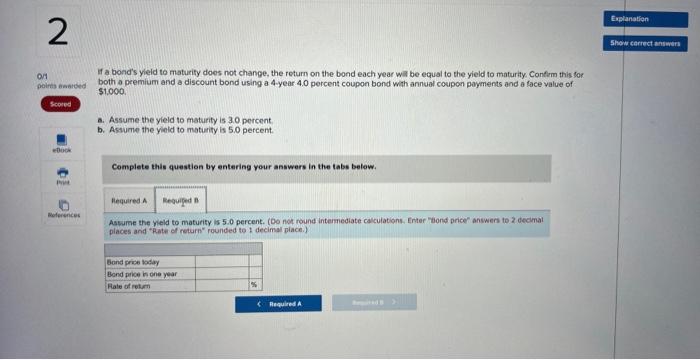

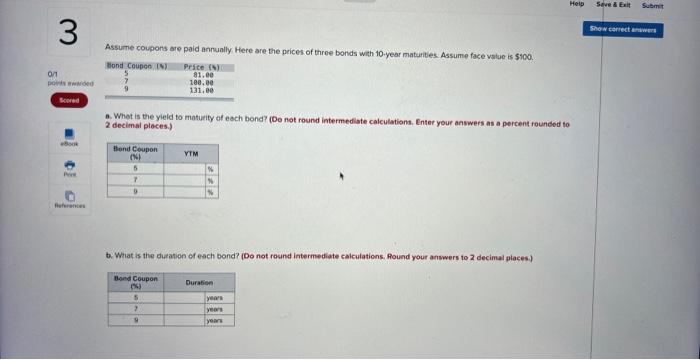

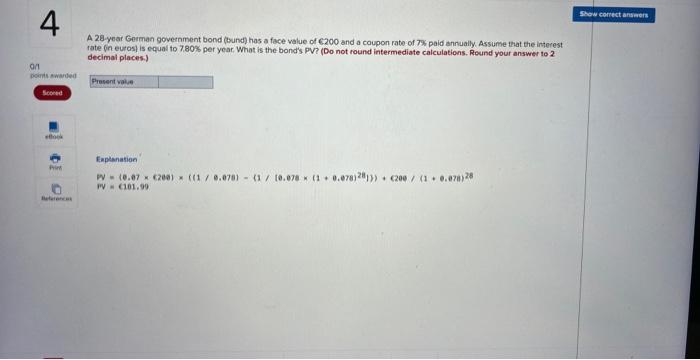

A 20-year U.S. Treasury bond with a face value of $1,000 pays a coupon of 5.50%(2.750% of face value every six months). The reported yleld to maturity is 5.2% a six-month discount rate of 5.2/2=2.6% a. What is the present value of the bond? b. If the yieid to maturity changes to th. what wil be the present value? c. If the yield to maturity changes to 8%, what will be the present value? d. If the yleid to maturity changes to 15%, what will be the present value? (For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places) Explanation a. PV=(0.0275051,30e)((1/0,026){1,(0.326(1+0.026)202})+$1,0e0/(1+0.026)202PV=51,037.03 If a bond's yield to maturity does not change, the return on the bond each year will be equaf to the yield to maturity, Confirm this for both a premium and a discount bond using a 4 -year 4.0 percent coupon bond with annual coupon payments and a face value of $1,000 a. Assume the yield to maturity is 3.0 percent. b. Assume the yield to moturity is 5.0 percent. Complete this question by entering your answers in the tabs below. Assume the vieid to maturity is 3.0 percent. (De not round intermediace calculations, Enter "Bond price' ansaers to 2 decimat. places and "Mate of retarn" rounded to I decimal place.) If a bond's yieid to maturity does not change, the return on the bond each year wil be equal to the yield to maturity Confem this for. both a premium and a discount bond using a 4 -year 4.0 percent coupon bond with annual coupon payments and a face value of 51,000. a. Assume the yield to maturity is 3.0 percent. b. Assume the yield to maturity is 5.0 percent. Complete this question by entering your answers in the tabs below. Aswume the yeld to maturity is 5.0 percent. (Do not round interniediate caiculations. Enter "bond price" answers to 2 decimai places and "Pate of return" rounded to 1 decimal piace.) Assume coupons are paid annually Here are the peices of three bonds with to-year maturities Assume face value is $100. a. What is the yleid to maturity of each bond? (Do not round intermediste calculations. Enter your answers as a percent rounded to 2 decimal pleces.) b. What is the duration of each bond? (Do not round intermediate calculations. Round your answers to 2 decimal places.) A 28 year German government bond (bund) has a face value of 6200 and a coupon rate of 7\%, paid annually. Assume that the interest rate (in euros) is equal to 7.80% per year. What is the bond's PV? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Eapeanation PV=(0.27(209)=((1,8,078)(1/(0.078(1+0.078)28/))+(200/(1+0.078)28P=(101.00 BAll Plus 4. Texas Instruments BUSINESS ANALYST

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts