Question: Hello can someone help me in this question . SHORT ANSWER QUESTION:S 3 questions worth 20 marks each [60 marks] Question 21 is worth 20

![QUESTION:S 3 questions worth 20 marks each [60 marks] Question 21 is](https://s3.amazonaws.com/si.experts.images/answers/2024/07/66a825113cecf_56866a8251099094.jpg) Hello can someone help me in this question .

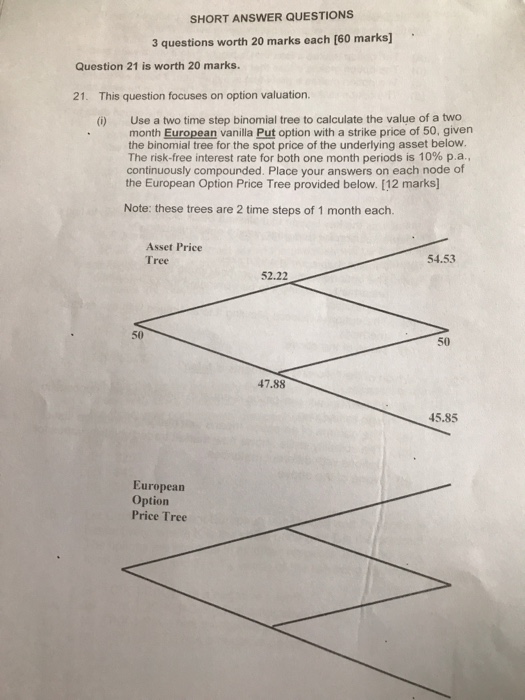

Hello can someone help me in this question . SHORT ANSWER QUESTION:S 3 questions worth 20 marks each [60 marks] Question 21 is worth 20 marks 21. This question focuses on option valuation Use a two time step binomial tree to calculate the value of a two month European vanilla Put option with a strike price of 50, given the binomial tree for the spot price of the underlying asset below The risk-free interest rate for both one month periods is 10% pa continuously compounded. Place your answers on each node of the European Option Price Tree provided below. [12 marks (0) Note: these trees are 2 time steps of 1 month each. Asset Price Tree 54.53 52.22 50 50 47.88 45.85 European Option Price Tree

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts