Question: Hello! Can someone please explain in detail question 2 Abcd and question 3 abc in detail. I'm not sure how they got these numbers Date

Hello! Can someone please explain in detail question 2 Abcd and question 3 abc in detail. I'm not sure how they got these numbers

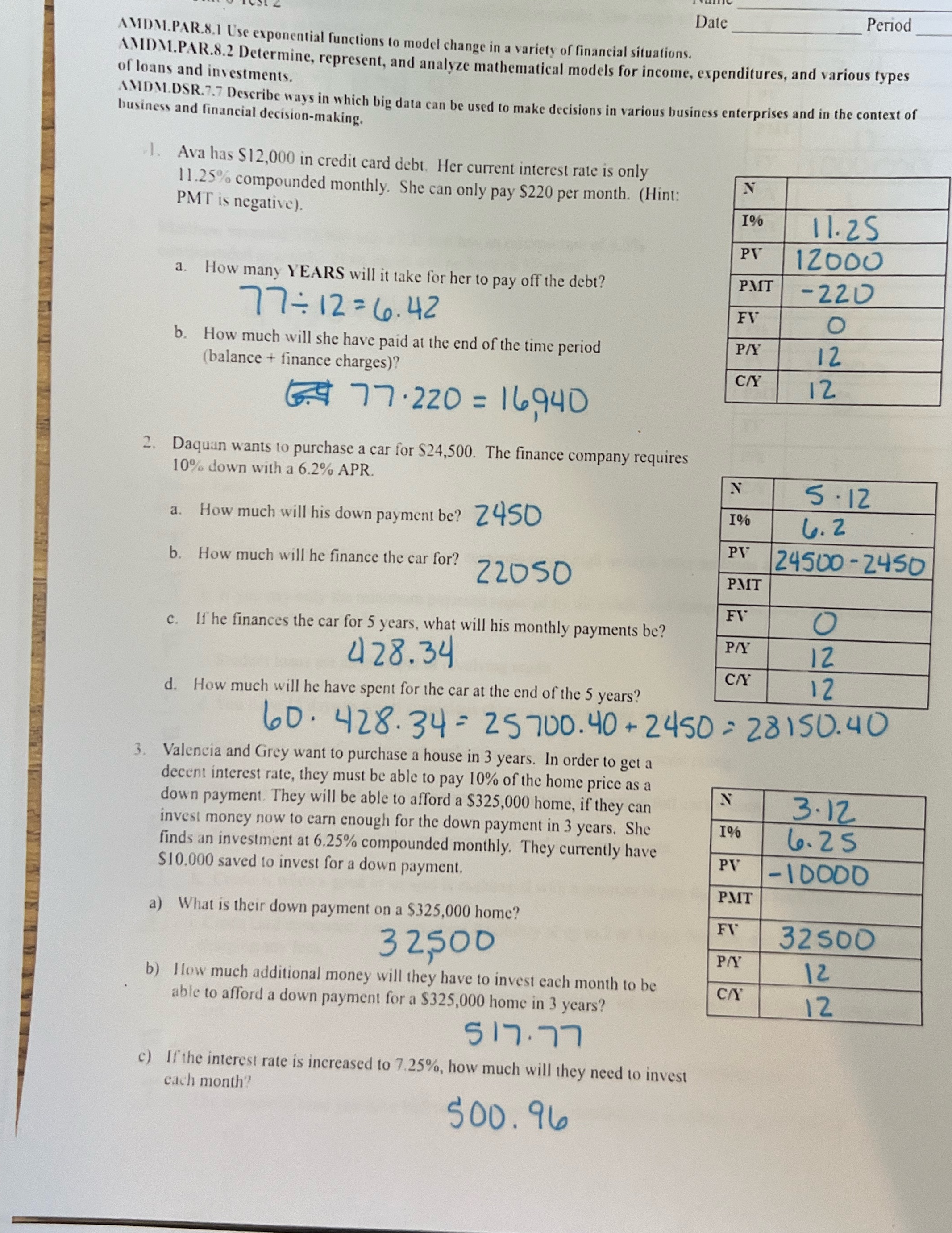

Date Period AMDM.PAR.8.1 Use exponential functions to model change in a variety of financial situations. AMDM.PAR.8.2 Determine, represent, and analyze mathematical models for income, expenditures, and various types of loans and investments. AMDM.DSR.7.7 Describe ways in which big data can be used to make decisions in various business enterprises and in the context of business and financial decision-making. 1. Ava has $12,000 in credit card debt. Her current interest rate is only 11.25% compounded monthly. She can only pay $220 per month. (Hint: N PMT is negative). 1% 11.25 PT 12000 a. How many YEARS will it take for her to pay off the debt? PMT - 220 77: 12 = 6.42 FV O b. How much will she have paid at the end of the time period PAY 12 (balance + finance charges)? 6. 77. 220 = 16940 12 2. Daquan wants to purchase a car for $24,500. The finance company requires 10% down with a 6.2% APR. N 5 . 12 a. How much will his down payment be? Z450 1% 6. 2 PV b. How much will he finance the car for? 22050 24500 - 2450 PMT FV c. If he finances the car for 5 years, what will his monthly payments be? O 428. 34 P/ 12 CA d. How much will he have spent for the car at the end of the 5 years? 12 60. 428. 34= 25700.40+ 2450= 28150.40 3. Valencia and Grey want to purchase a house in 3 years. In order to get a decent interest rate, they must be able to pay 10% of the home price as a down payment. They will be able to afford a $325,000 home, if they can N 3. 12 invest money now to earn enough for the down payment in 3 years. She 1% finds an investment at 6.25% compounded monthly. They currently have 6.25 $10.000 saved to invest for a down payment. PV - 1DODD PMT a) What is their down payment on a $325,000 home? FV 32500 32500 PA 12 b) How much additional money will they have to invest each month to be CAY able to afford a down payment for a $325,000 home in 3 years? 12 LL. LIS c) If the interest rate is increased to 7.25%, how much will they need to invest each month? 500. 96

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts