Question: 1)Based on data given in the Virgin Mobile case, on average how long did it take for the carriers to break even on the acquisition

1)Based on data given in the Virgin Mobile case, on average how long did it take for the carriers to break even on the acquisition cost? (6 pts.)

HINT: Break-even time = Acquisition cost / average monthly margin. Please also show how you get the average monthly margin.

2)An important aspect of the cell phone industry is the churn rate. Please answer the following questions in that regard:

a.What is the annual churn rate with contracts? (3 pts.)

b.What is the annual churn rate without contracts? (3 pts.)

c.Consider AT&T. How many additional customers would this firm lose to churn every year if it had no contracts (compared to if it did have contracts)? (5 pts.)

d.If AT&T then had to acquire the same number of customers, what would it cost the firm? (5 pts.)

3)Compare the Customer Life Time Values for with-contract customer and without-contract customer, then explain why most of the carriers require to sign contracts with customers?

e.CLV With-Contract (5 pts.)

f.CLV Without-Contract (5 pts.)

4)According to the results you get from question 1) to 3), please explain the reasons for signing contracts with customers from three different perspectives. (6 pts.)

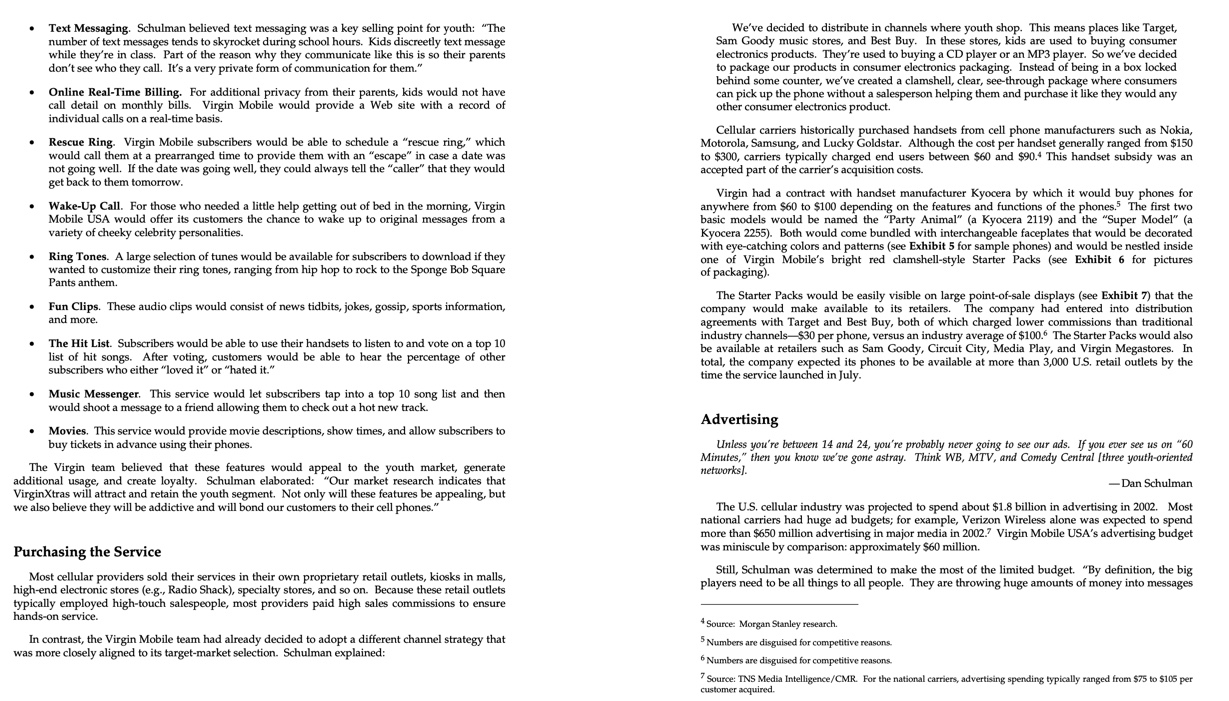

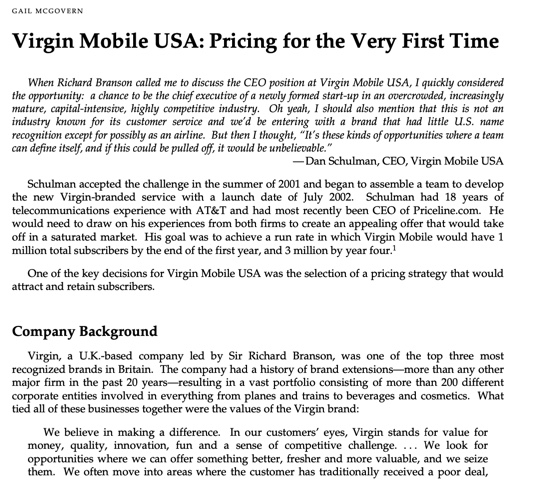

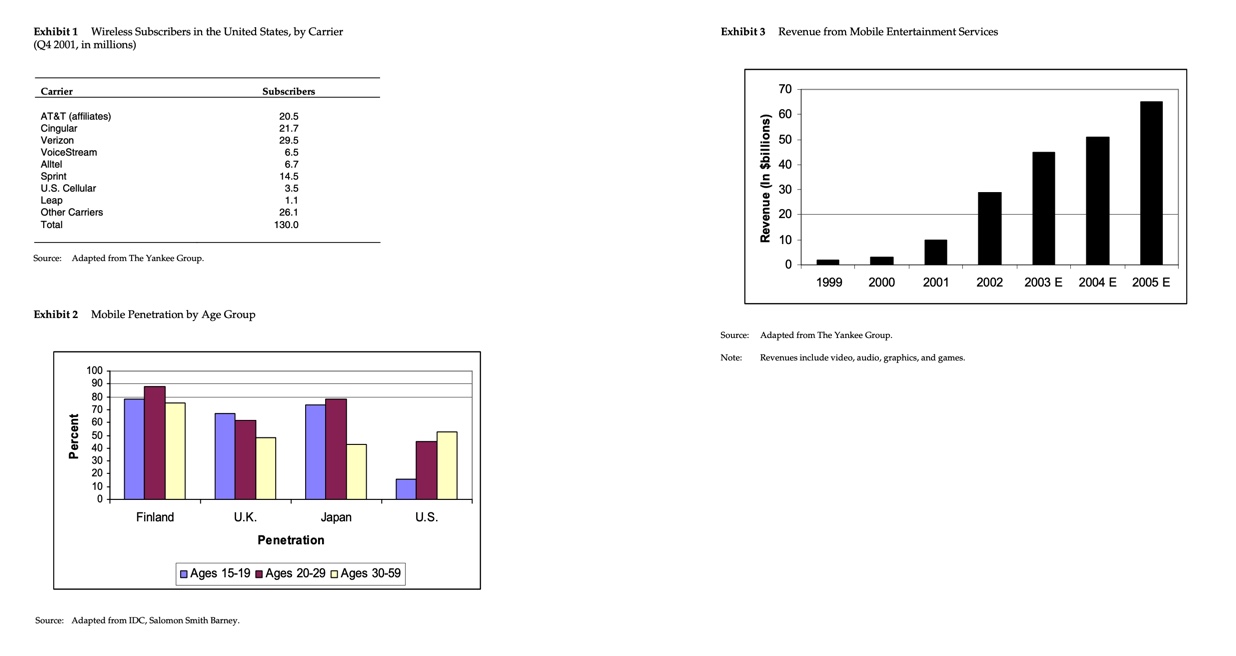

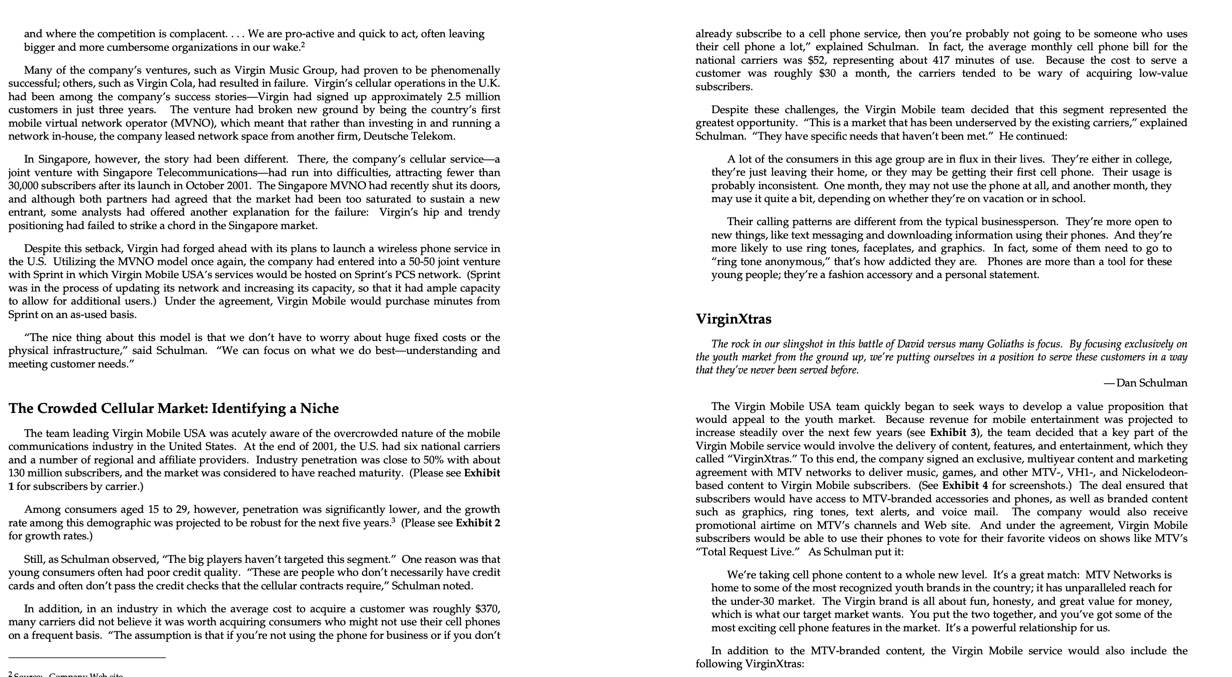

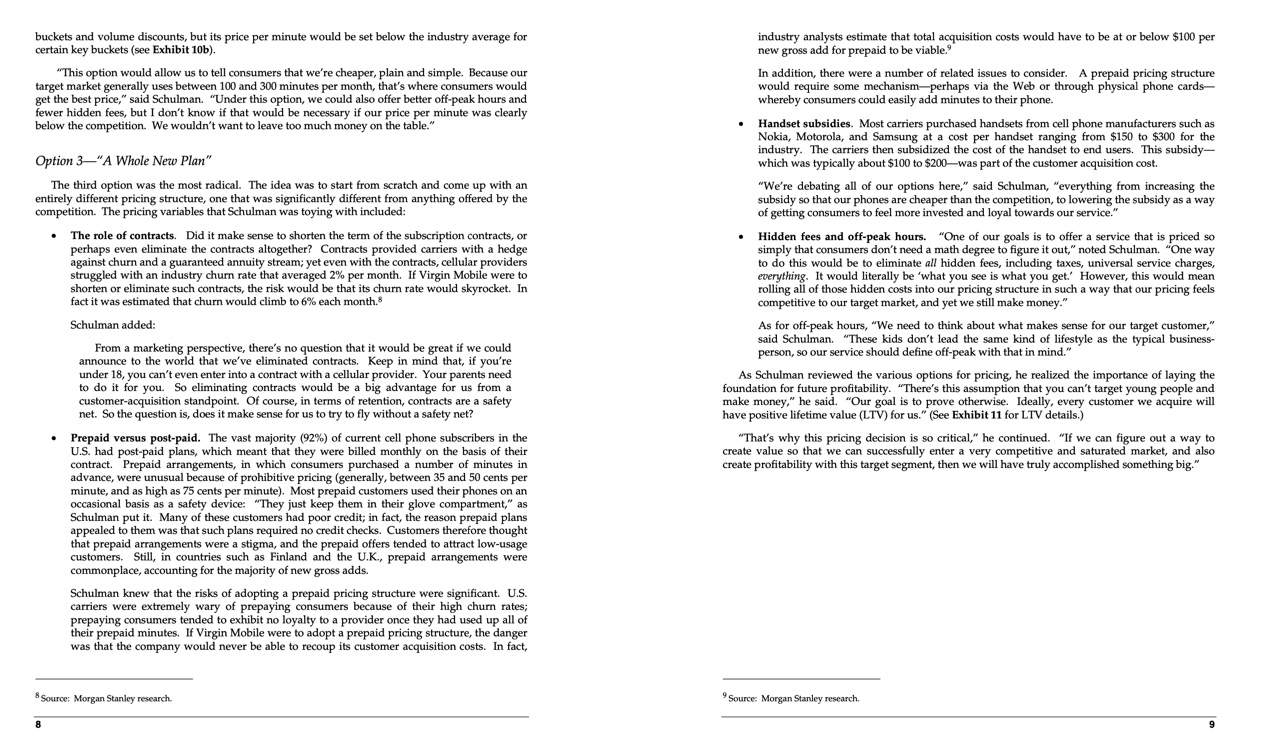

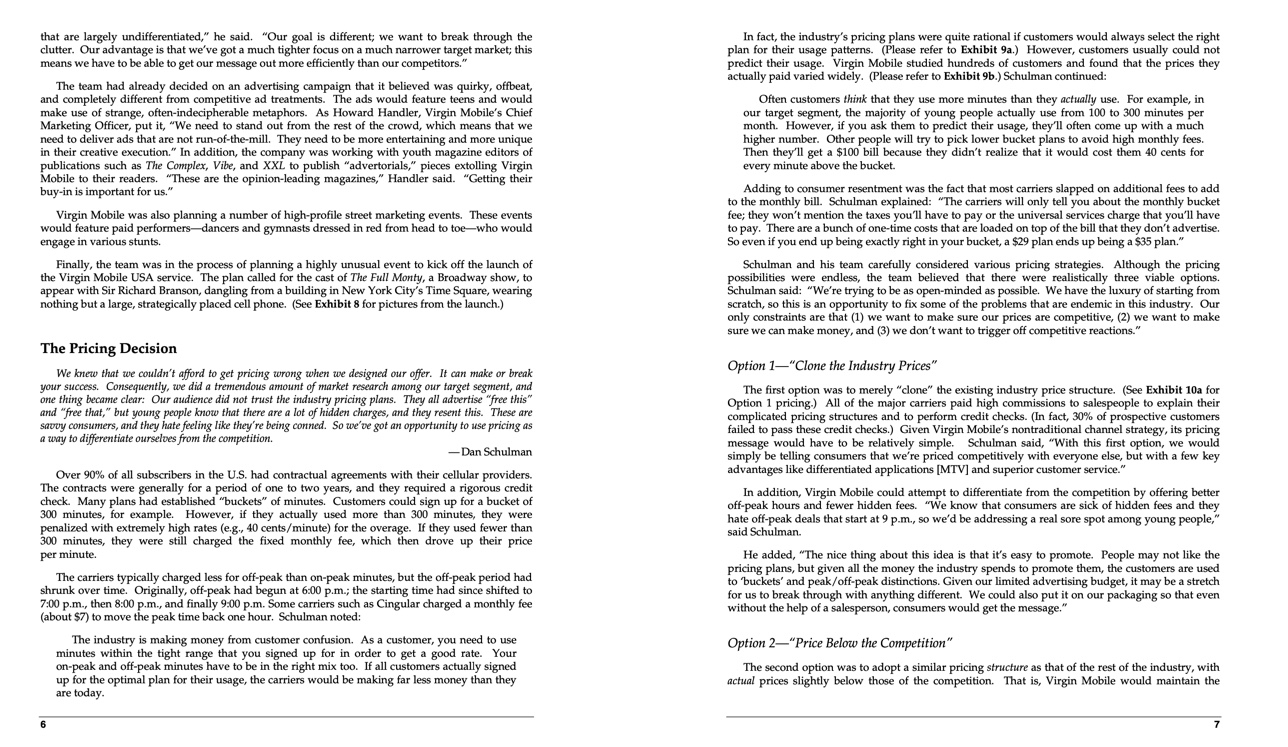

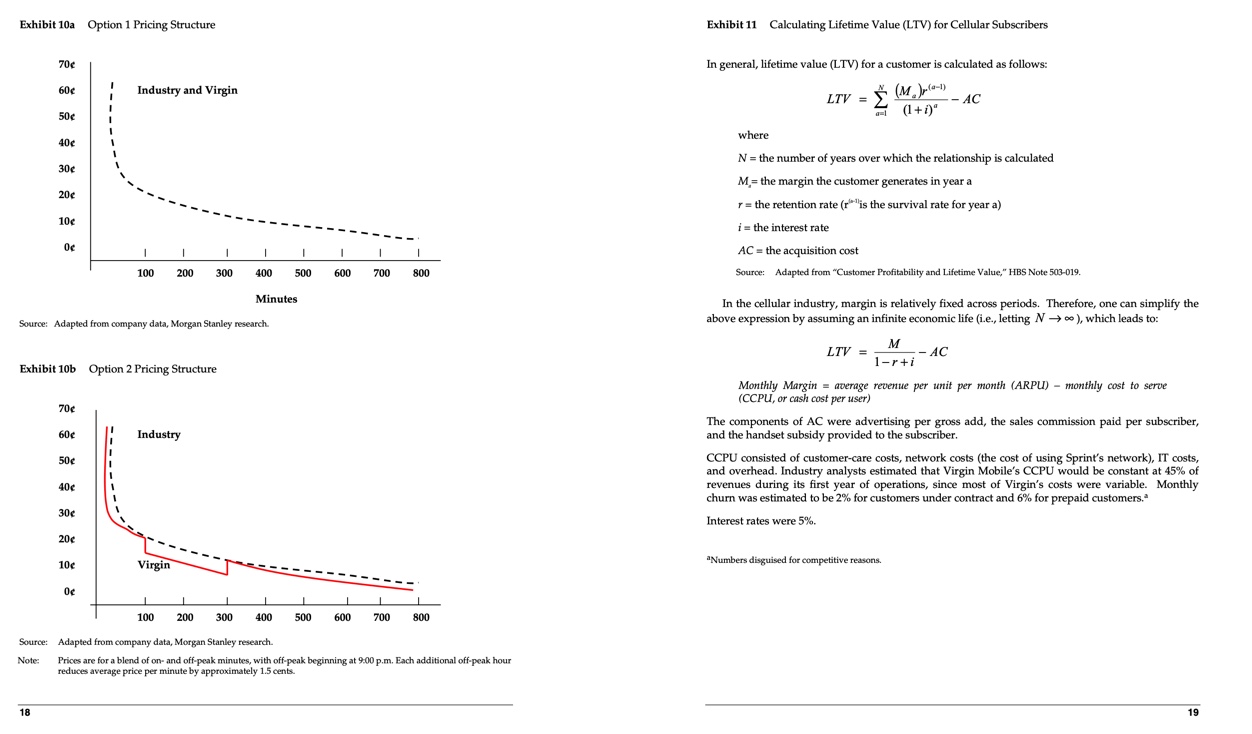

Text Messaging. Schulman believed text messaging was a key selling point for youth: "The We've decided to distribute in channels where youth shop. This means places like Target, number of text messages tends to skyrocket during school hours. Kids discreetly text message Sam Goody music stores, and Best Buy. In these stores, kids are used to buying consumer while they're in class. Part of the reason why they communicate like this is so their parents electronics products. They're used to buying a CD player or an MP3 player. So we've decided don't see who they call. It's a very private form of communication for them." to package our products in consumer electronics packaging. Instead of being in a box locked behind some counter, we've created a clamshell, clear, see-through package where consumers Online Real-Time Billing. For additional privacy from their parents, kids would not have can pick up the phone without a salesperson helping them and purchase it like they would any call detail on monthly bills. Virgin Mobile would provide a Web site with a record of other consumer electronics product. individual calls on a real-time basis. Cellular carriers historically purchased handsets from cell phone manufacturers such as Nokia, Rescue Ring. Virgin Mobile subscribers would be able to schedule a "rescue ring," which Motorola, Samsung, and Lucky Goldstar. Although the cost per handset generally ranged from $150 would call them at a prearranged time to provide them with an "escape" in case a date was to $300, carriers typically charged end users between $60 and $90.* This handset subsidy was an not going well. If the date was going well, they could always tell the "caller" that they would accepted part of the carrier's acquisition costs. get back to them tomorrow. Virgin had a contract with handset manufacturer Kyocera by which it would buy phones for Wake-Up Call. For those who needed a little help getting out of bed in the morning, Virgin anywhere from $60 to $100 depending on the features and functions of the phones. The first two Mobile USA would offer its customers the chance to wake up to original messages from a basic models would be named the "Party Animal" (a Kyocera 2119) and the "Super Model" (a variety of cheeky celebrity personalities. Kyocera 2255). Both would come bundled with interchangeable faceplates that would be decorated with eye-catching colors and patterns (see Exhibit 5 for sample phones) and would be nestled inside Ring Tones. A large selection of tunes would be available for subscribers to download if they one of Virgin Mobile's bright red clamshell-style Starter Packs (see Exhibit 6 for pictures wanted to customize their ring tones, ranging from hip hop to rock to the Sponge Bob Square of packaging). Pants anthem The Starter Packs would be easily visible on large point-of-sale displays (see Exhibit 7) that the Fun Clips. These audio clips would consist of news tidbits, jokes, gossip, sports information, company would make available to its retailers. The company had entered into distribution and more. agreements with Target and Best Buy, both of which charged lower commissions than traditional The Hit List. Subscribers would be able to use their handsets to listen to and vote on a top 10 industry channels-$30 per phone, versus an industry average of $100. The Starter Packs would also list of hit songs. After voting, customers would be able to hear the percentage of other be available at retailers such as Sam Goody, Circuit City, Media Play, and Virgin Megastores. In subscribers who either "loved it" or "hated it." total, the company expected its phones to be available at more than 3,000 U.S. retail outlets by the time the service launched in July. Music Messenger. This service would let subscribers tap into a top 10 song list and then would shoot a message to a friend allowing them to check out a hot new track. Advertising Movies. This service would provide movie descriptions, show times, and allow subscribers to buy tickets in advance using their phones. Unless you're between 14 and 24, you're probably never going to see our ads. If you ever see us on "60 Minutes," then you know we've gone astray. Think WB, MTV, and Comedy Central [three youth-oriented The Virgin team believed that these features would appeal to the youth market, generate networks]. additional usage, and create loyalty. Schulman elaborated: "Our market research indicates that -Dan Schulman VirginXtras will attract and retain the youth segment. Not only will these features be appealing, but we also believe they will be addictive and will bond our customers to their cell phones." The U.S. cellular industry was projected to spend about $1.8 billion in advertising in 2002. Most national carriers had huge ad budgets; for example, Verizon Wireless alone was expected to spend more than $650 million advertising in major media in 2002.7 Virgin Mobile USA's advertising budget Purchasing the Service was miniscule by comparison: approximately $60 million. Most cellular providers sold their services in their own proprietary retail outlets, kiosks in malls, Still, Schulman was determined to make the most of the limited budget. "By definition, the big high-end electronic stores (e.g., Radio Shack), specialty stores, and so on. Because these retail outlets players need to be all things to all people. They are throwing huge amounts of money into messages typically employed high-touch salespeople, most providers paid high sales commissions to ensure hands-on service. Source: Morgan Stanley research. In contrast, the Virgin Mobile team had already decided to adopt a different channel strategy that Numbers are disguised for competitive reasons. was more closely aligned to its target-market selection. Schulman explained: 6 Numbers are disguised for competitive reasons. Source: TNS Media Intelligence/CMR. For the national carriers, advertising spending typically ranged from $75 to $106 per customer acquired.GAIL MCGOVERN Virgin Mobile USA: Pricing for the Very First Time When Richard Branson called me to discuss the CEO position at Virgin Mobile USA, I quickly considered the opportunity: a chance to be the chief executive of a newly formed start-up in an overcrowded, increasingly mature, capital-intensive, highly competitive industry. Oh yeah, I should also mention that this is not an industry known for its customer service and we'd be entering with a brand that had little U.S. name recognition except for possibly as an airline. But then I thought, "It's these kinds of opportunities where a team can define itself, and if this could be pulled off, it would be unbelievable." -Dan Schulman, CEO, Virgin Mobile USA Schulman accepted the challenge in the summer of 2001 and began to assemble a team to develop the new Virgin-branded service with a launch date of July 2002. Schulman had 18 years of telecommunications experience with AT&T and had most recently been CEO of Priceline.com. He would need to draw on his experiences from both firms to create an appealing offer that would take off in a saturated market. His goal was to achieve a run rate in which Virgin Mobile would have 1 million total subscribers by the end of the first year, and 3 million by year four. One of the key decisions for Virgin Mobile USA was the selection of a pricing strategy that would attract and retain subscribers. Company Background Virgin, a U.K.-based company led by Sir Richard Branson, was one of the top three most recognized brands in Britain. The company had a history of brand extensions-more than any other major firm in the past 20 years-resulting in a vast portfolio consisting of more than 200 different corporate entities involved in everything from planes and trains to beverages and cosmetics. What tied all of these businesses together were the values of the Virgin brand: We believe in making a difference. In our customers' eyes, Virgin stands for value for money, quality, innovation, fun and a sense of competitive challenge. ... We look for opportunities where we can offer something better, fresher and more valuable, and we seize them. We often move into areas where the customer has traditionally received a poor deal,Exhibit 3 Revenue from Mobile Entertainment Services Exhibit 1 Wireless Subscribers in the United States, by Carrier (Q4 2001, in millions) Carrier Subscribers AT&T (affiliates) 20.5 Cingular 21.7 Verizon 29.5 VoiceStream 6.5 Alltel 6.7 6 8 8 8 8 8 8 8 Revenue (In $billions) Sprint 14.5 U.S. Cellular 3.5 Leap 1.1 Other Carriers 26.1 Total 130.0 Source: Adapted from The Yankee Group 1999 2000 2001 2002 2003 E 2004 E 2005 E Exhibit 2 Mobile Penetration by Age Group Source: Adapted from The Yankee Group. Note: Revenues include video, audio, graphics, and games. 100 Percent 0688688388 Finland U.K. Japan U.S. Penetration Ages 15-19 Ages 20-29 0 Ages 30-59 Source: Adapted from IDC, Salomon Smith Barney.and where the competition is complacent. .. . We are pro-active and quick to act, often leaving already subscribe to a cell phone service, then you're probably not going to be someone who uses bigger and more cumbersome organizations in our wake.' their cell phone a lot," explained Schulman. In fact, the average monthly cell phone bill for the national carriers was $52, representing about 417 minutes of use. Because the cost to serve a Many of the company's ventures, such as Virgin Music Group, had proven to be phenomenally customer was roughly $30 a month, the carriers tended to be wary of acquiring low-value successful; others, such as Virgin Cola, had resulted in failure. Virgin's cellular operations in the U.K. subscribers. had been among the company's success stories-Virgin had signed up approximately 2.5 million customers in just three years. The venture had broken new ground by being the country's first Despite these challenges, the Virgin Mobile team decided that this segment represented the mobile virtual network operator (MVNO), which meant that rather than investing in and running a greatest opportunity. "This is a market that has been underserved by the existing carriers," explained network in-house, the company leased network space from another firm, Deutsche Telekom. Schulman. "They have specific needs that haven't been met." He continued: In Singapore, however, the story had been different. There, the company's cellular service-a A lot of the consumers in this age group are in flux in their lives. They're either in college, joint venture with Singapore Telecommunications-had run into difficulties, attracting fewer than they're just leaving their home, or they may be getting their first cell phone. Their usage is 30,000 subscribers after its launch in October 2001. The Singapore MVNO had recently shut its doors, probably inconsistent. One month, they may not use the phone at all, and another month, they and although both partners had agreed that the market had been too saturated to sustain a new may use it quite a bit, depending on whether they're on vacation or in school. entrant, some analysts had offered another explanation for the failure: Virgin's hip and trendy positioning had failed to strike a chord in the Singapore market. Their calling patterns are different from the typical businessperson. They're more open to new things, like text messaging and downloading information using their phones. And they're Despite this setback, Virgin had forged ahead with its plans to launch a wireless phone service in more likely to use ring tones, faceplates, and graphics. In fact, some of them need to go to the U.S. Utilizing the MVNO model once again, the company had entered into a 50-50 joint venture "ring tone anonymous," that's how addicted they are. Phones are more than a tool for these with Sprint in which Virgin Mobile USA's services would be hosted on Sprint's PCS network. (Sprint young people; they're a fashion accessory and a personal statement. was in the process of updating its network and increasing its capacity, so that it had ample capacity to allow for additional users.) Under the agreement, Virgin Mobile would purchase minutes from Sprint on an as-used basis. VirginXtras The nice thing about this model is that we don't have to worry about huge fixed costs or the physical infrastructure," said Schulman. "We can focus on what we do best-understanding and The rock in our slingshot in this battle of David versus many Goliaths is focus. By focusing exclusively on meeting customer needs." the youth market from the ground up, we're putting ourselves in a position to serve these customers in a way that they've never been served before. -Dan Schulman The Crowded Cellular Market: Identifying a Niche The Virgin Mobile USA team quickly began to seek ways to develop a value proposition that would appeal to the youth market. Because revenue for mobile entertainment was projected to The team leading Virgin Mobile USA was acutely aware of the overcrowded nature of the mobile increase steadily over the next few years (see Exhibit 3), the team decided that a key part of the communications industry in the United States. At the end of 2001, the U.S. had six national carriers Virgin Mobile service would involve the delivery of content, features, and entertainment, which they and a number of regional and affiliate providers. Industry penetration was close to 50% with about called "VirginXtras." To this end, the company signed an exclusive, multiyear content and marketing 130 million subscribers, and the market was considered to have reached maturity. (Please see Exhibit agreement with MTV networks to deliver music, games, and other MTV-, VH1-, and Nickelodeon- 1 for subscribers by carrier.) based content to Virgin Mobile subscribers. (See Exhibit 4 for screenshots.) The deal ensured that subscribers would have access to MTV-branded accessories and phones, as well as branded content Among consumers aged 15 to 29, however, penetration was significantly lower, and the growth such as graphics, ring tones, text alerts, and voice mail. The company would also receive rate among this demographic was projected to be robust for the next five years. (Please see Exhibit 2 promotional airtime on MTV's channels and Web site. And under the agreement, Virgin Mobile for growth rates.) subscribers would be able to use their phones to vote for their favorite videos on shows like MTV's Still, as Schulman observed, "The big players haven't targeted this segment." One reason was that "Total Request Live." As Schulman put it: young consumers often had poor credit quality. "These are people who don't necessarily have credit We're taking cell phone content to a whole new level. It's a great match: MTV Networks is cards and often don't pass the credit checks that the cellular contracts require," Schulman noted. home to some of the most recognized youth brands in the country; it has unparalleled reach for In addition, in an industry in which the average cost to acquire a customer was roughly $370, the under-30 market. The Virgin brand is all about fun, honesty, and great value for money, many carriers did not believe it was worth acquiring consumers who might not use their cell phones which is what our target market wants. You put the two together, and you've got some of the on a frequent basis. "The assumption is that if you're not using the phone for business or if you don't most exciting cell phone features in the market. It's a powerful relationship for us. In addition to the MTV-branded content, the Virgin Mobile service would also include the following VirginXtras:buckets and volume discounts, but its price per minute would be set below the industry average for industry analysts estimate that total acquisition costs would have to be at or below $100 per certain key buckets (see Exhibit 10b). new gross add for prepaid to be viable." "This option would allow us to tell consumers that we're cheaper, plain and simple. Because our In addition, there were a number of related issues to consider. A prepaid pricing structure target market generally uses between 100 and 300 minutes per month, that's where consumers would would require some mechanism-perhaps via the Web or through physical phone cards- get the best price," said Schulman. "Under this option, we could also offer better off-peak hours and whereby consumers could easily add minutes to their phone. fewer hidden fees, but I don't know if that would be necessary if our price per minute was clearly below the competition. We wouldn't want to leave too much money on the table." Handset subsidies. Most carriers purchased handsets from cell phone manufacturers such as Nokia, Motorola, and Samsung at a cost per handset ranging from $150 to $300 for the industry. The carriers then subsidized the cost of the handset to end users. This subsidy- Option 3-"A Whole New Plan" which was typically about $100 to $200-was part of the customer acquisition cost. The third option was the most radical. The idea was to start from scratch and come up with an "We're debating all of our options here," said Schulman, "everything from increasing the entirely different pricing structure, one that was significantly different from anything offered by the subsidy so that our phones are cheaper than the competition, to lowering the subsidy as a way competition. The pricing variables that Schulman was toying with included: of getting consumers to feel more invested and loyal towards our service." The role of contracts. Did it make sense to shorten the term of the subscription contracts, or Hidden fees and off-peak hours. "One of our goals is to offer a service that is priced so perhaps even eliminate the contracts altogether? Contracts provided carriers with a hedge simply that consumers don't need a math degree to figure it out," noted Schulman. "One way against churn and a guaranteed annuity stream; yet even with the contracts, cellular providers to do this would be to eliminate all hidden fees, including taxes, universal service charges, struggled with an industry churn rate that averaged 2% per month. If Virgin Mobile were to everything. It would literally be "what you see is what you get.' However, this would mean shorten or eliminate such contracts, the risk would be that its churn rate would skyrocket. In rolling all of those hidden costs into our pricing structure in such a way that our pricing feels fact it was estimated that churn would climb to 6% each month. competitive to our target market, and yet we still make money." Schulman added: As for off-peak hours, "We need to think about what makes sense for our target customer," said Schulman. "These kids don't lead the same kind of lifestyle as the typical business- From a marketing perspective, there's no question that it would be great if we could person, so our service should define off-peak with that in mind." announce to the world that we've eliminated contracts. Keep in mind that, if you're under 18, you can't even enter into a contract with a cellular provider. Your parents need As Schulman reviewed the various options for pricing, he realized the importance of laying the to do it for you. So eliminating contracts would be a big advantage for us from a foundation for future profitability. "There's this assumption that you can't target young people and customer-acquisition standpoint. Of course, in terms of retention, contracts are a safety make money," he said. "Our goal is to prove otherwise. Ideally, every customer we acquire will net. So the question is, does it make sense for us to try to fly without a safety net? have positive lifetime value (LTV) for us." (See Exhibit 11 for LTV details.) Prepaid versus post-paid. The vast majority (92%) of current cell phone subscribers in the "That's why this pricing decision is so critical," he continued. "If we can figure out a way to U.S. had post-paid plans, which meant that they were billed monthly on the basis of their create value so that we can successfully enter a very competitive and saturated market, and also contract. Prepaid arrangements, in which consumers purchased a number of minutes in create profitability with this target segment, then we will have truly accomplished something big." advance, were unusual because of prohibitive pricing (generally, between 35 and 50 cents per minute, and as high as 75 cents per minute). Most prepaid customers used their phones on an occasional basis as a safety device: "They just keep them in their glove compartment," as Schulman put it. Many of these customers had poor credit; in fact, the reason prepaid plans appealed to them was that such plans required no credit checks. Customers therefore thought that prepaid arrangements were a stigma, and the prepaid offers tended to attract low-usage customers. Still, in countries such as Finland and the U.K., prepaid arrangements were commonplace, accounting for the majority of new gross adds. Schulman knew that the risks of adopting a prepaid pricing structure were significant. U.S. carriers were extremely wary of prepaying consumers because of their high churn rates; prepaying consumers tended to exhibit no loyalty to a provider once they had used up all of their prepaid minutes. If Virgin Mobile were to adopt a prepaid pricing structure, the danger was that the company would never be able to recoup its customer acquisition costs. In fact, Source: Morgan Stanley research. " Source: Morgan Stanley research.that are largely undifferentiated," he said. "Our goal is different; we want to break through the In fact, the industry's pricing plans were quite rational if customers would always select the right clutter. Our advantage is that we've got a much tighter focus on a much narrower target market; this plan for their usage patterns. (Please refer to Exhibit 9a.) However, customers usually could not means we have to be able to get our message out more efficiently than our competitors." predict their usage. Virgin Mobile studied hundreds of customers and found that the prices they actually paid varied widely. (Please refer to Exhibit 9b.) Schulman continued: The team had already decided on an advertising campaign that it believed was quirky, offbeat, and completely different from competitive ad treatments. The ads would feature teens and would Often customers think that they use more minutes than they actually use. For example, in make use of strange, often-indecipherable metaphors. As Howard Handler, Virgin Mobile's Chief our target segment, the majority of young people actually use from 100 to 300 minutes per Marketing Officer, put it, "We need to stand out from the rest of the crowd, which means that we month. However, if you ask them to predict their usage, they'll often come up with a much need to deliver ads that are not run-of-the-mill. They need to be more entertaining and more unique higher number. Other people will try to pick lower bucket plans to avoid high monthly fees. in their creative execution." In addition, the company was working with youth magazine editors of Then they'll get a $100 bill because they didn't realize that it would cost them 40 cents for publications such as The Complex, Vibe, and XXL to publish "advertorials," pieces extolling Virgin every minute above the bucket. Mobile to their readers. "These are the opinion-leading magazines," Handler said. "Getting their buy-in is important for us." Adding to consumer resentment was the fact that most carriers slapped on additional fees to add to the monthly bill. Schulman explained: "The carriers will only tell you about the monthly bucket Virgin Mobile was also planning a number of high-profile street marketing events. These events fee; they won't mention the taxes you'll have to pay or the universal services charge that you'll have would feature paid performers-dancers and gymnasts dressed in red from head to toe-who would to pay. There are a bunch of one-time costs that are loaded on top of the bill that they don't advertise. engage in various stunts. So even if you end up being exactly right in your bucket, a $29 plan ends up being a $35 plan." Finally, the team was in the process of planning a highly unusual event to kick off the launch of Schulman and his team carefully considered various pricing strategies. Although the pricing the Virgin Mobile USA service. The plan called for the cast of The Full Monty, a Broadway show, to possibilities were endless, the team believed that there were realistically three viable options. appear with Sir Richard Branson, dangling from a building in New York City's Time Square, wearing Schulman said: "We're trying to be as open-minded as possible. We have the luxury of starting from nothing but a large, strategically placed cell phone. (See Exhibit 8 for pictures from the launch.) scratch, so this is an opportunity to fix some of the problems that are endemic in this industry. Our only constraints are that (1) we want to make sure our prices are competitive, (2) we want to make sure we can make money, and (3) we don't want to trigger off competitive reactions." The Pricing Decision We knew that we couldn't afford to get pricing wrong when we designed our offer. It can make or break Option 1-"Clone the Industry Prices" your success. Consequently, we did a tremendous amount of market research among our target segment, and The first option was to merely "clone" the existing industry price structure. (See Exhibit 10a for one thing became clear: Our audience did not trust the industry pricing plans. They all advertise "free this" Option 1 pricing.) All of the major carriers paid high commissions to salespeople to explain their and "free that," but young people know that there are a lot of hidden charges, and they resent this. These are savvy consumers, and they hate feeling like they're being conned. So we've got an opportunity to use pricing as complicated pricing structures and to perform credit checks. (In fact, 30% of prospective customers a way to differentiate ourselves from the competition. failed to pass these credit checks.) Given Virgin Mobile's nontraditional channel strategy, its pricing - Dan Schulman message would have to be relatively simple. Schulman said, "With this first option, we would simply be telling consumers that we're priced competitively with everyone else, but with a few key Over 90% of all subscribers in the U.S. had contractual agreements with their cellular providers. advantages like differentiated applications [MTV] and superior customer service." The contracts were generally for a period of one to two years, and they required a rigorous credit check. Many plans had established "buckets" of minutes. Customers could sign up for a bucket of In addition, Virgin Mobile could attempt to differentiate from the competition by offering better 300 minutes, for example. However, if they actually used more than 300 minutes, they were off-peak hours and fewer hidden fees. "We know that consumers are sick of hidden fees and they penalized with extremely high rates (e.g., 40 cents/minute) for the overage. If they used fewer than hate off-peak deals that start at 9 p.m., so we'd be addressing a real sore spot among young people," said Schulman. 300 minutes, they were still charged the fixed monthly fee, which then drove up their price per minute. He added, "The nice thing about this idea is that it's easy to promote. People may not like the The carriers typically charged less for off-peak than on-peak minutes, but the off-peak period had pricing plans, but given all the money the industry spends to promote them, the customers are used to 'buckets' and peak/ off-peak distinctions. Given our limited advertising budget, it may be a stretch shrunk over time. Originally, off-peak had begun at 6:00 p.m.; the starting time had since shifted to for us to break through with anything different. We could also put it on our packaging so that even 7:00 p.m., then 8:00 p.m., and finally 9:00 p.m. Some carriers such as Cingular charged a monthly fee (about $7) to move the peak time back one hour. Schulman noted: without the help of a salesperson, consumers would get the message." The industry is making money from customer confusion. As a customer, you need to use Option 2-"Price Below the Competition" minutes within the tight range that you signed up for in order to get a good rate. Your on-peak and off-peak minutes have to be in the right mix too. If all customers actually signed The second option was to adopt a similar pricing structure as that of the rest of the industry, with up for the optimal plan for their usage, the carriers would be making far less money than they actual prices slightly below those of the competition. That is, Virgin Mobile would maintain the are today.Exhibit 10a Option 1 Pricing Structure Exhibit 11 Calculating Lifetime Value (LTV) for Cellular Subscribers 70e In general, lifetime value (LTV) for a customer is calculated as follows: 60 Industry and Virgin LTV = (1+1)' - AC 50c where 40 N = the number of years over which the relationship is calculated 30 M,= the margin the customer generates in year a 20c r = the retention rate (r is the survival rate for year a) 10c i = the interest rate AC = the acquisition cost 100 200 300 400 500 600 700 800 Source: Adapted from "Customer Profitability and Lifetime Value," HBS Note 503-019. Minutes In the cellular industry, margin is relatively fixed across periods. Therefore, one can simplify the above expression by assuming an infinite economic life (i.e., letting N -> co ), which leads to: Source: Adapted from company data, Morgan Stanley research. M LTV = - AC 1-r+i Exhibit 10b Option 2 Pricing Structure Monthly Margin = average revenue per unit per month (ARPU) - monthly cost to serve (CCPU, or cash cost per user) 70e The components of AC were advertising per gross add, the sales commission paid per subscriber, 60e Industry and the handset subsidy provided to the subscriber. 50c CCPU consisted of customer-care costs, network costs (the cost of using Sprint's network), IT costs, and overhead. Industry analysts estimated that Virgin Mobile's CCPU would be constant at 45% of 40e revenues during its first year of operations, since most of Virgin's costs were variable. Monthly churn was estimated to be 2% for customers under contract and 6% for prepaid customers.* 30c Interest rates were 5%. 20e Numbers disguised for competitive reasons. 10 Virgin 100 200 300 400 500 600 700 800 Source: Adapted from company data, Morgan Stanley research. Note: Prices are for a blend of on- and off-peak minutes, with off-peak beginning at 9:00 p.m. Each additional off-peak hour reduces average price per minute by approximately 1.5 cents. 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts