Question: Hello can someone show me 2.10 with steps please l OW S trea delayed by three years. Calculate the value of the delayed stream. c.

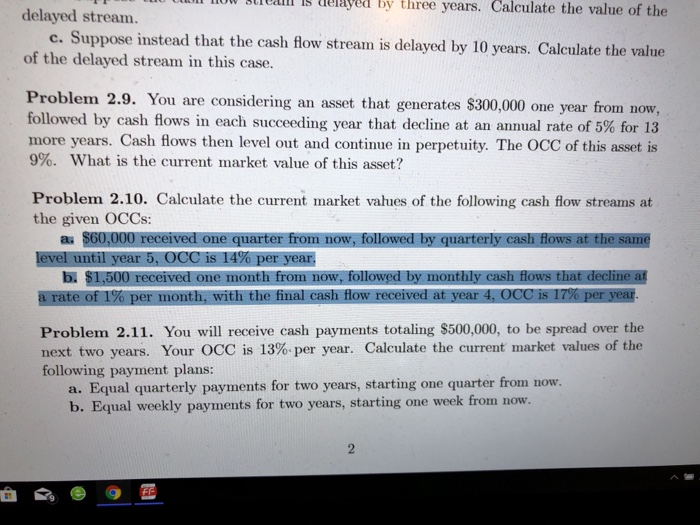

l OW S trea delayed by three years. Calculate the value of the delayed stream. c. Suppose instead that the cash flow stream is delayed by 10 years. Calculate the value of the delayed stream in this case. Problem followed by cash flows in each succeeding year that decline at an annual rate of 5% for 13 more years. Cash flows then level out and continue in perpetuity. The OCC of this asset is 9%, what is the current market value of this asset? 2.9. You are considering an asset that generates $300,000 one year from now, Problem 2.10. Calculate the current market vahues of the following cash flow streams at the given OCCs: a. $60 in nn Problem 2.11. You will receive cash payments totaling $500,000, to be spread over the next two years. Your OCC is 13%, per year. Calculate the current market values of the following payment plans: a. Equal quarterly payments for two years, starting one quarter from now. b. Equal weekly payments for two years, starting one week from now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts