Question: hello can you help me answer this question? some of these are incorrect / missing answers. thanks!! The following are the information of Chun Equipment

hello can you help me answer this question? some of these are incorrect / missing answers. thanks!!

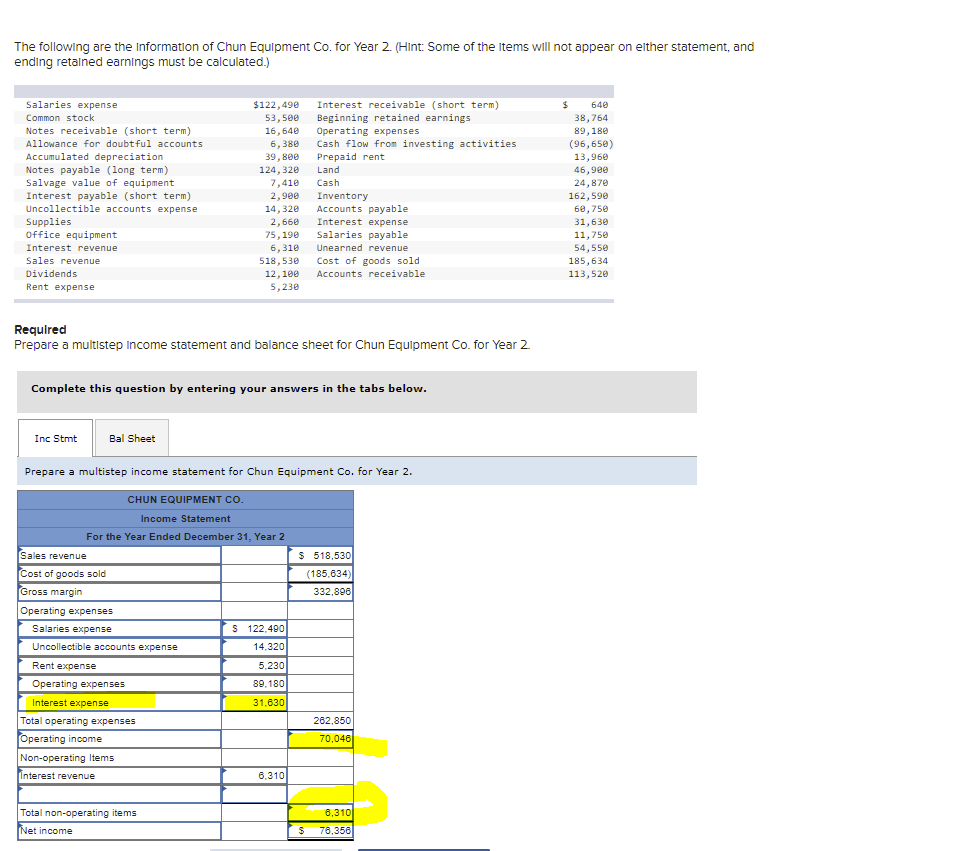

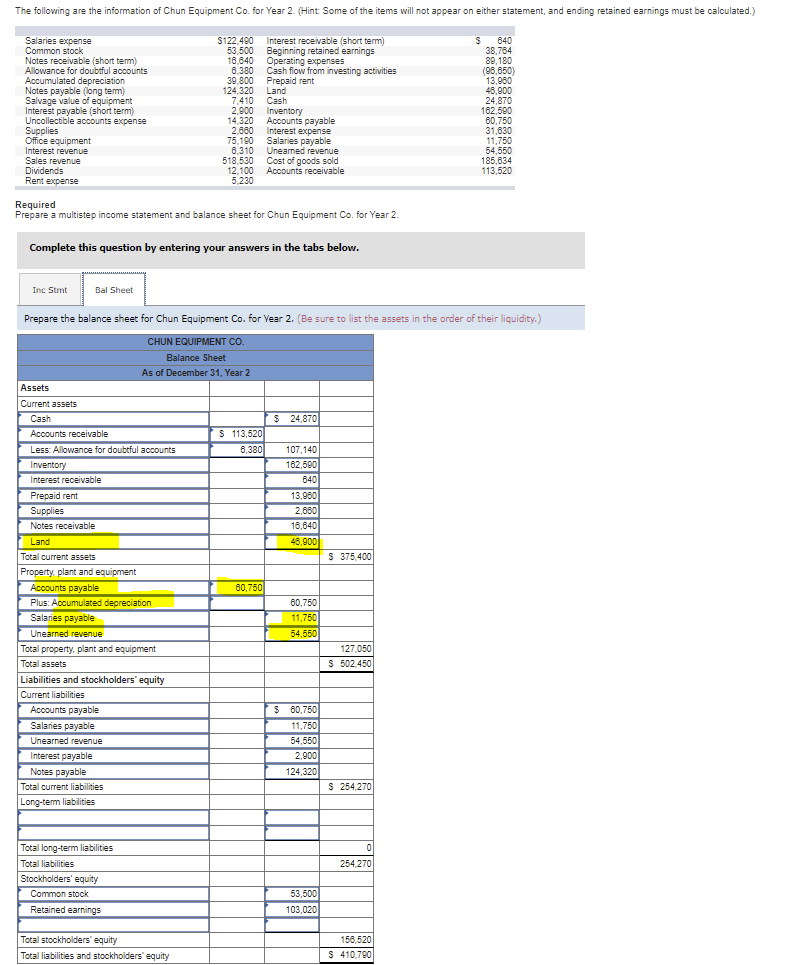

The following are the information of Chun Equipment Co. for Year 2. (Hint: Some of the items will not appear on either statement, and ending retained earnings must be calculated.) Salaries expense $122,490 Interest receivable (short term) 640 Common stock Beginning retained earnings 38,764 53,500 16,640 Notes receivable (short term) Operating expenses 89,180 Allowance for doubtful accounts 6,380 (96,650) Cash flow from investing activities Prepaid rent Accumulated depreciation 39,800 13,960 124, 320 Land 46,900 7,410 Cash 24,870 Notes payable (long term) Salvage value of equipment Interest payable (short term) Uncollectible accounts expense Supplies 2,900 Inventory 162,590 14,320 Accounts payable 60,750 2,660 Interest expense 31,630 office equipment Salaries payable 11,750 Interest revenue 75,190 6,310 518,530 Unearned revenue 54,550 Sales revenue Cost of goods sold. 185,634 Dividends 113,520 12, 100 Accounts receivable 5,230 Rent expense Required Prepare a multistep Income statement and balance sheet for Chun Equipment Co. for Year 2. Complete this question by entering your answers in the tabs below. Inc Stmt Bal Sheet Prepare a multistep income statement for Chun Equipment Co. for Year 2. CHUN EQUIPMENT CO. Income Statement For the Year Ended December 31, Year 2 Sales revenue Cost of goods sold $518,530 (185,634) 332,896 Gross margin Operating expenses Salaries expense $ 122,490 Uncollectible accounts expense 14,320 Rent expense 5,230 Operating expenses 89,180 Interest expense 31,630 Total operating expenses 262,850 70,046 Operating income Non-operating Items Interest revenue 6.310 Total non-operating items 6,310 Net income 76,356 $ The following are the information of Chun Equipment Co. for Year 2. (Hint: Some of the items will not appear on either statement, and ending retained earnings must be calculated.) $ 640 Salaries expense Common stock $122,490 53,500 16,640 Interest receivable (short term) Beginning retained earnings Operating expenses 38,764 89,180 Notes receivable (short term) Allowance for doubtful accounts 6.380 (96,650) Cash flow from investing activities Prepaid rent 39,800 13,950 124,320 Land 46,900 7,410 Cash 24.870 Accumulated depreciation Notes payable (long term) Salvage value of equipment Interest payable (short term) Uncollectible accounts expense Supplies 2,900 Inventory 162,590 14,320 Accounts payable 60,750 2,660 Interest expense 31.630 Office equipment 75.190 Salaries payable 11,750 Interest revenue 6.310 Unearned revenue 518,530 Cost of goods sold Sales revenue Dividends 54,550 185,634 113.520 12,100 Accounts receivable 5,230 Rent expense Required Prepare a multistep income statement and balance sheet for Chun Equipment Co. for Year 2. Complete this question by entering your answers in the tabs below. Inc Stmt Bal Sheet Prepare the balance sheet for Chun Equipment Co. for Year 2. (Be sure to list the assets in the order of their liquidity.) CHUN EQUIPMENT CO. Balance Sheet As of December 31, Year 2 Assets Current assets Cash $ 24,870 Accounts receivable Less: Allowance for doubtful accounts 107,140 162.590 Inventory Interest receivable 840 13,960 Prepaid rent Supplies 2,680 K Notes receivable 16,640 Land 45,900 Total current assets Property, plant and equipment Accounts payable Plus: Accumulated depreciation Salaries payable 60,750 11,750 54,550 Unearned revenue Total property, plant and equipment Total assets Liabilities and stockholders' equity Current liabilities Accou Accounts payable $ 60,750 Salaries payable 11,750 Unearned revenue 54,550 2,900 Interest payable Notes payable 124,320 Total current liabilities Long-term liabilities Total long-term liabilities Total liabilities Stockholders' equity Common stock 53,500 103,020 Retained earnings Total stockholders' equity Total liabilities and stockholders' equity S 113,520 6,380 60,750 $ 375,400 127,050 $ 502,450 $ 254,270 0 254,270 156,520 $ 410,790

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts