Question: Please solve this cost accounting problem with actual calculations, previous answers only contained theory and how to do it, however I find it difficult to

Please solve this cost accounting problem with actual calculations, previous answers only contained theory and how to do it, however I find it difficult to check if my answers are correct or not, please provide a detailed solution with actual calculations. it would be very valuable for me and for my exam preparation.

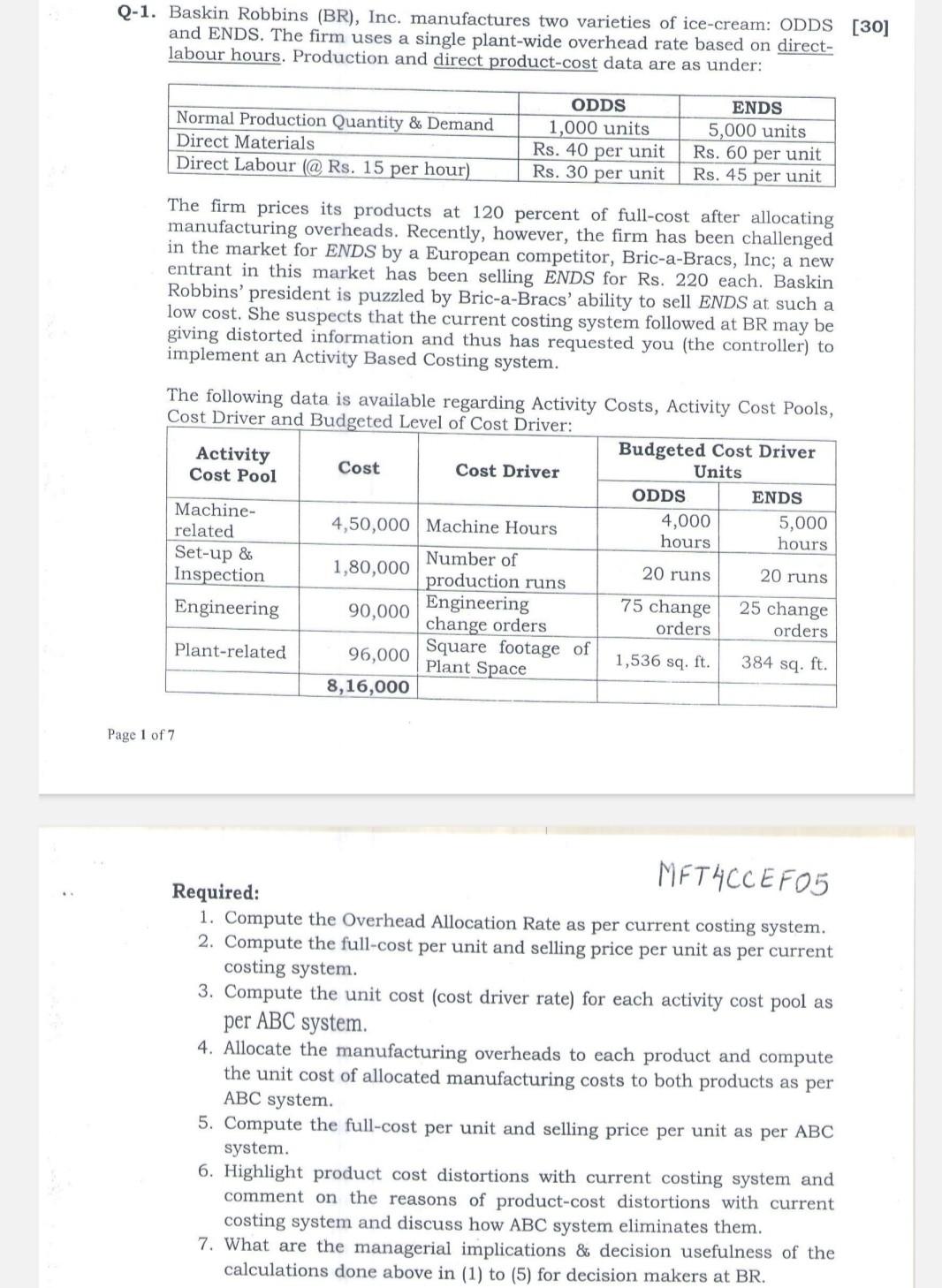

Q-1. Baskin Robbins (BR), Inc. manufactures two varieties of ice-crearn: ODDS [30] and ENDS. The firm uses a single plant-wide overhead rate based on directlabour hours. Production and direct product-cost data are as under: The firm prices its products at 120 percent of full-cost after allocating manufacturing overheads. Recently, however, the firm has been challenged in the market for ENDS by a European competitor, Bric-a-Bracs, Inc; a new entrant in this market has been selling ENDS for Rs. 220 each. Baskin Robbins' president is puzzled by Bric-a-Bracs' ability to sell ENDS at such a low cost. She suspects that the current costing system followed at BR may be giving distorted information and thus has requested you (the controller) to implement an Activity Based Costing system. The following data is available regarding Activity Costs, Activity Cost Pools, Cost Driver and Budgeted Level of Cost Driver. Page 1 of 7 Required: MFT4CCEFO5 1. Compute the Overhead Allocation Rate as per current costing system. 2. Compute the full-cost per unit and selling price per unit as per current costing system. 3. Compute the unit cost (cost driver rate) for each activity cost pool as per ABC system. 4. Allocate the manufacturing overheads to each product and compute the unit cost of allocated manufacturing costs to both products as per ABC system. 5. Compute the full-cost per unit and selling price per unit as per ABC system. 6. Highlight product cost distortions with current costing system and comment on the reasons of product-cost distortions with current costing system and discuss how ABC system eliminates them. 7. What are the managerial implications \& decision usefulness of the calculations done above in (1) to (5) for decision makers at BR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts