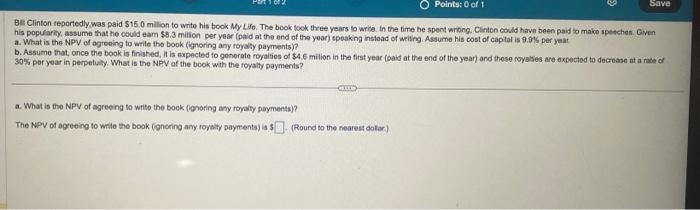

Question: hello! can you help me solve part a and b please? his popularioy, assume that he could eam $8.3 milion per year (paid at the

his popularioy, assume that he could eam $8.3 milion per year (paid at the end of the year) spoaking instoad of weling. Assume his cost of captal is 9.9% per yeat a. What is the NPV of ogreoing to write the book (gnoring any royalicy payments)? b. Assume that, once the book is finished, it is expected to gonerate royalios of $4.6 milion in the first year (oaid at the end of the yean and these royalses are expected to decroase at a race of 30% por yoar in perpetuiny. What is the NPV of the book with the royalty payments? a. What is the NPV of agreeing to writo the book (fonoring any royaly payments)? The NPV of agreing to write the book (fonoring ary royalty payments) is : (Round to the neares dolar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts