Question: Save Homework: HW 4a - NPV and Inv. decision rules Score: 0 of 4 pts 4 of 9 (6 complete) HW Score: 48.26%, 11.1 of

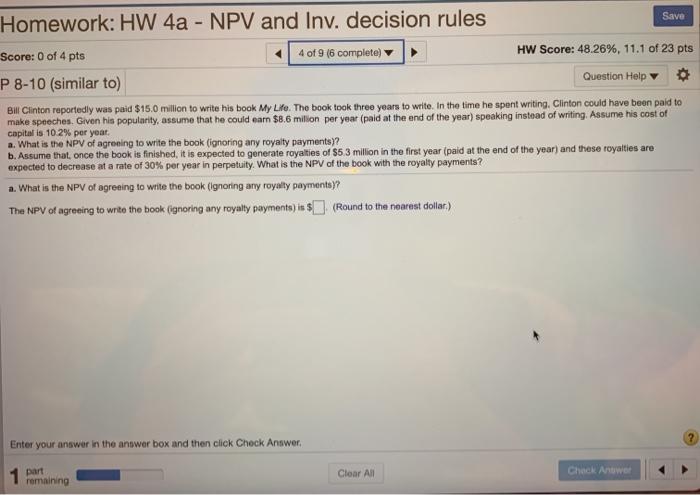

Save Homework: HW 4a - NPV and Inv. decision rules Score: 0 of 4 pts 4 of 9 (6 complete) HW Score: 48.26%, 11.1 of 23 pts P 8-10 (similar to) Question Help Bill Clinton reportedly was paid $15.0 million to write his book My Life. The book took three years to write in the time he spent writing, Clinton could have been paid to make speeches. Given his popularity, assume that he could earn $8.6 milion per year (paid at the end of the year) speaking instead of writing. Assume his cost of capital is 102% per year. a. What is the NPV of agreeing to write the book (ignoring any royalty payments)? b. Assume that once the book is finished, it is expected to generate royalties of $5.3 million in the first year (paid at the end of the year, and these royalties are expected to decrease at a rate of 30% per year in perpetuity. What is the NPV of the book with the royalty payments? a. What is the NPV of agreeing to write the book (Ignoring any royalty payments? The NPV of agreeing to write the book (ignoring any royalty payments) in $(Round to the nearest dollar) Enter your answer in the answer box and then click Check Answer 1 Part Clear All Check Antwer remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts