Question: hello can you please help me with part f? also nice if you could help me with g, h, i. A emia: admium Evaluating Risk

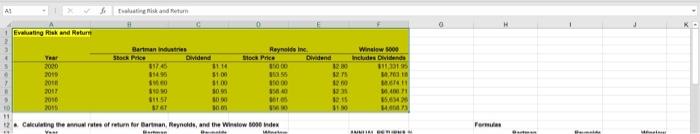

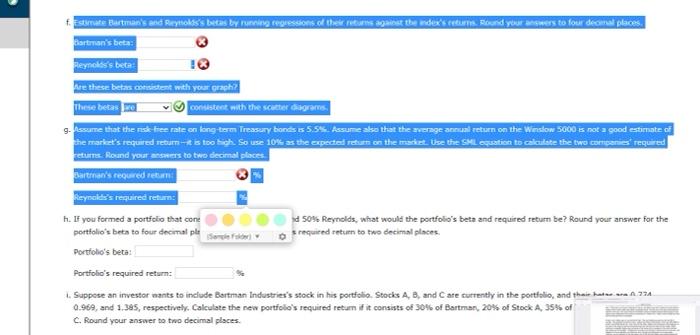

A emia: admium Evaluating Risk and Nature Bartmanin Reynaldin Mock Price Dividend 100 Window Includes Die Shock 2000 Dividend 1114 3100 1100 10 W 120 1 100 20 2017 2010 2011 000H OS 100 3117 000 001 12 BE 15.6 H. Ost 11 Calculating the rule of return to Bartman Reynolds, and the Winslow 6000 miles Form HE curate Bartman's Bod Reynoks beras by rurolig regressions de returns against the descrisBound your answers to four des places Barton's beta Reyno's bet Are these belastisistent with your graph These betas RO consistent with the scatter Gorans Julescure that the risk tree rate on long-teren Treasury bonds s5.SS. Assume ako that the average annual return on the Winslow 5000 s not a good estimate si the market's required returns to tigh So use 10% as the expected returns on the market. Use the Skecuation to calculate the two comparis required returns. Round your answers to two decimal places Batman's required return Reynald's required return h. If you formed a porticia that come 50% Reynolds, what would the portfolio's bets and required returm be? Round your answer for the portfolio's beta to four decimal ple Sonderako s required return to two decimal places Portfolio's beta: Portfolio's required return; Suppose an investor wants to include Bartman Industries's stock in his portfolio Stocks A, B, and are currently in the portfolio, and their heat.Az 0.969, and 1.385, respectively. Calculate the new portfolio's required return if it consists of 30% of Bartman, 20% of Stock A, 35% of C. Round your answer to two decimal places. A emia: admium Evaluating Risk and Nature Bartmanin Reynaldin Mock Price Dividend 100 Window Includes Die Shock 2000 Dividend 1114 3100 1100 10 W 120 1 100 20 2017 2010 2011 000H OS 100 3117 000 001 12 BE 15.6 H. Ost 11 Calculating the rule of return to Bartman Reynolds, and the Winslow 6000 miles Form HE curate Bartman's Bod Reynoks beras by rurolig regressions de returns against the descrisBound your answers to four des places Barton's beta Reyno's bet Are these belastisistent with your graph These betas RO consistent with the scatter Gorans Julescure that the risk tree rate on long-teren Treasury bonds s5.SS. Assume ako that the average annual return on the Winslow 5000 s not a good estimate si the market's required returns to tigh So use 10% as the expected returns on the market. Use the Skecuation to calculate the two comparis required returns. Round your answers to two decimal places Batman's required return Reynald's required return h. If you formed a porticia that come 50% Reynolds, what would the portfolio's bets and required returm be? Round your answer for the portfolio's beta to four decimal ple Sonderako s required return to two decimal places Portfolio's beta: Portfolio's required return; Suppose an investor wants to include Bartman Industries's stock in his portfolio Stocks A, B, and are currently in the portfolio, and their heat.Az 0.969, and 1.385, respectively. Calculate the new portfolio's required return if it consists of 30% of Bartman, 20% of Stock A, 35% of C. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts