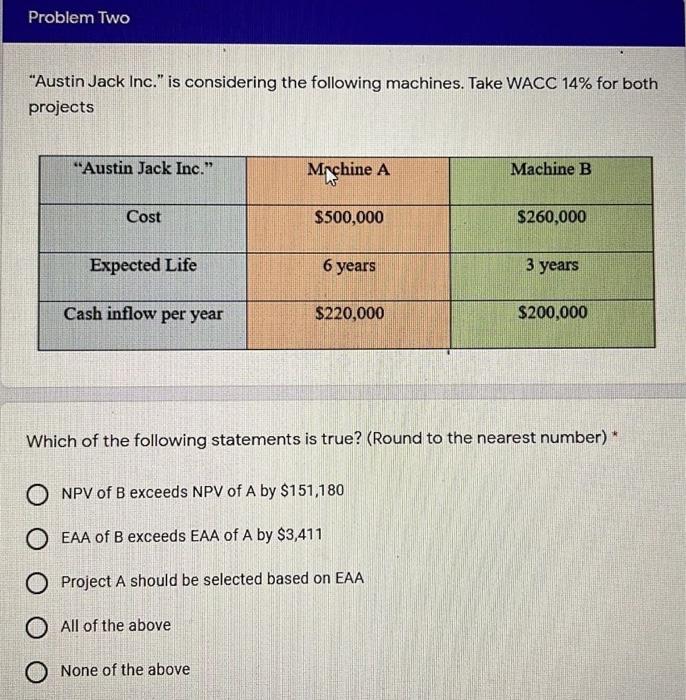

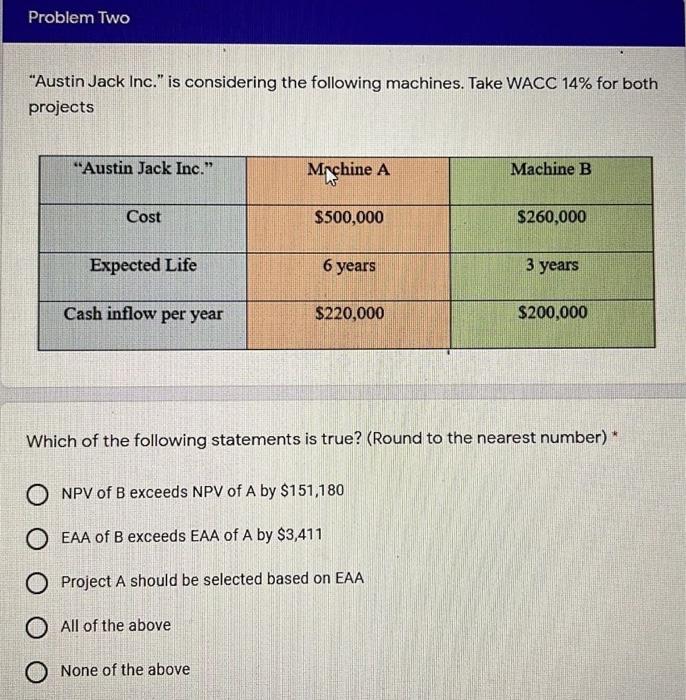

Question: problem 2 Problem Two Austin Jack Inc. is considering the following machines. Take WACC 14% for both projects Austin Jack Inc. Mrchine A Machine B

problem 2

Problem Two "Austin Jack Inc." is considering the following machines. Take WACC 14% for both projects "Austin Jack Inc." Mrchine A Machine B Cost $500,000 $260,000 Expected Life 6 years 3 years Cash inflow per year $220,000 $200,000 Which of the following statements is true? (Round to the nearest number) O NPV of B exceeds NPV of A by $151,180 O EAA of B exceeds EAA of A by $3,411 O Project A should be selected based on EAA O All of the above O None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock