Question: Hello , can you please help me with this assignment. I have highlighted the table I am struggling with red. I am not sure how

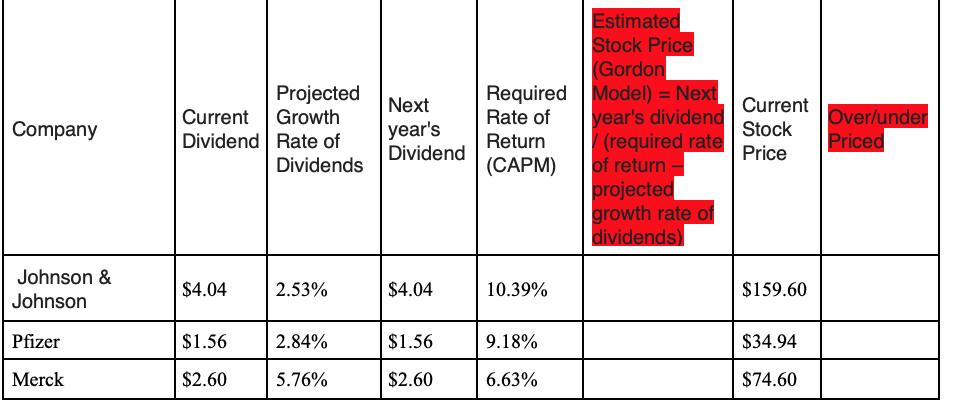

Hello , can you please help me with this assignment. I have highlighted the table I am struggling with red. I am not sure how to calculate Estimated Sock Price in Table 2 according to ( Gordon Model also need explain this and also verify my number. Thank you so much!

In this step, you have been asked to visit a credible Web site that provides detailed information on publicly traded stocks and select 1 that has at least a 5-year history of paying dividends and 2 of its closest competitors.

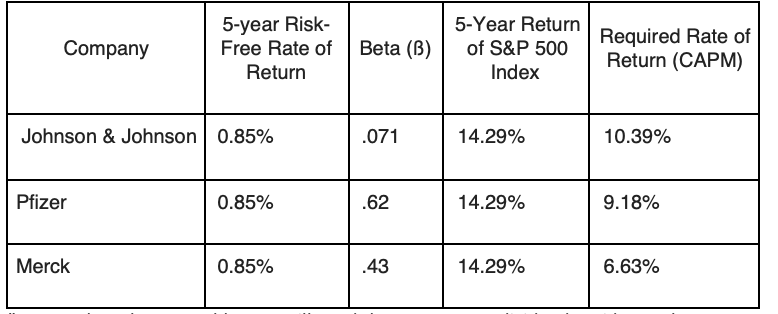

"To fill up the first table, you will need to gather information needed to calculate the required rate of return for each of the 3 stocks (use the Capital Asset Pricing model). You will need to find the risk-free rate online. It is the 5-year Treasury rate.You will need the market return which is just the return on the S&P 500 Index, and it is available online. You should use an average over 5 years (find the historical yearly returns for the S&P 500 Index and average them). You must research your stocks to find the betas. You should be able to find them atfinance.yahoo.com."

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts