Question: Project 1 Probability Return Standard Deviation Beta 50% Chance 22% 12% 1.2 50% Chance -4% Project 2 Probability Return Standard Deviation Beta 30 % Chance

Project 1

Probability Return Standard Deviation Beta

50% Chance 22% 12% 1.2

50% Chance -4%

Project 2

Probability Return Standard Deviation Beta

30 % Chance 28% 19.5% .08

40% Chance 10.5%

30% Chance -20%

Project 3

Probability Return Standard Deviation Beta

10% Chance 28% 12% 2.0

70% Chance 18%

20% Chance -8%

Assume the risk free rate of return is 2% and the market risk premium is 8$. If you are a risk averse investor, which project should you choose?

Please be specific and explain why -

A. Either Project 2 or Project 3 because the higher expected return on Project 3 offsets its higher risk

B. Project 2

C. Project 1

D. Project

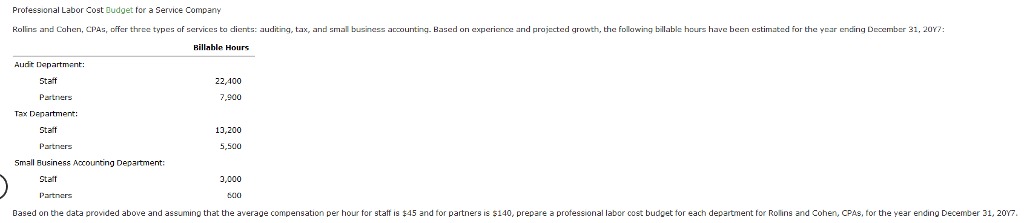

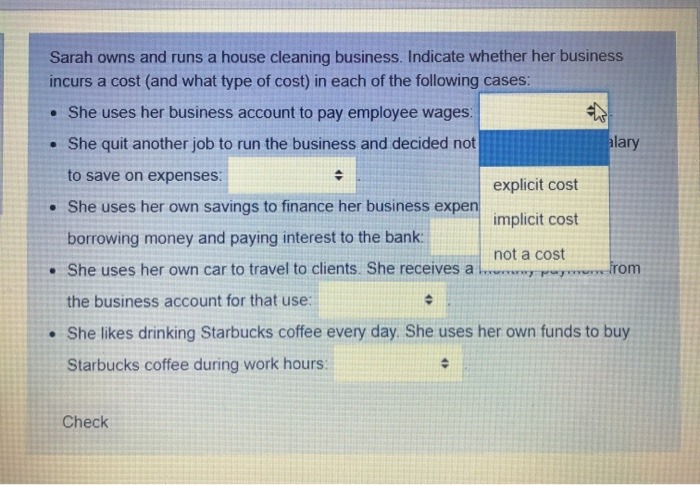

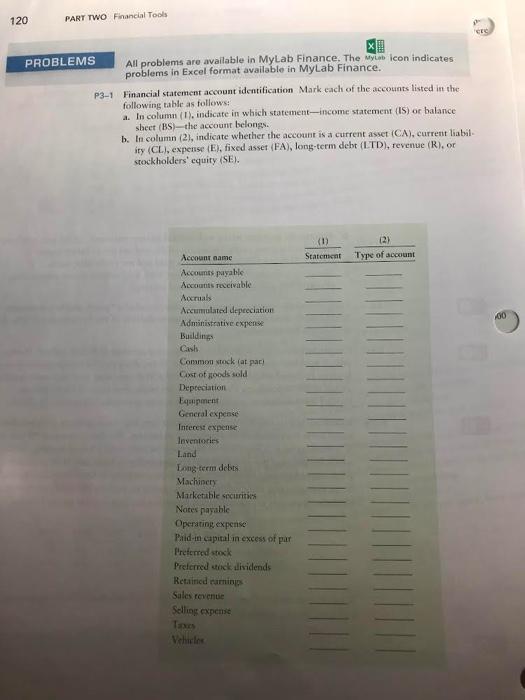

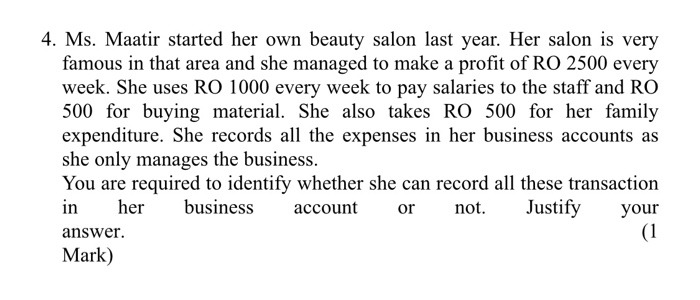

Professional Labor Cost Budget for a Service Company Rollins and Cohen, CPAs, offer three types of services to dients: auditing, tax, and small business accounting. Based on experience and projected growth, the following billable hours have been estimated for the year ending December 31, 2017: Billable Hours Audit Department: Staff 22/400 Partners 7,900 Tax Department: Staft 13,200 Partners 5,500 Small Business Accounting Department: Staff 3,000 Partners Bad Based on the data provided above and assuming that the average compensation per hour for staff is $45 and for partners is $140, prepare a professional labor cost budget for each department for Rollins and Cohen, CPAS, for the year ending December 31, 2017.Sarah owns and runs a house cleaning business. Indicate whether her business incurs a cost (and what type of cost) in each of the following cases: . She uses her business account to pay employee wages: . She quit another job to run the business and decided not alary to save on expenses: explicit cost . She uses her own savings to finance her business expen implicit cost borrowing money and paying interest to the bank: not a cost . She uses her own car to travel to clients. She receives a lema payroll the business account for that use: . She likes drinking Starbucks coffee every day. She uses her own funds to buy Starbucks coffee during work hours: Check120 PART TWO Financial Tools PROBLEMS All problems are available in MyLab Finance, The Myweb Icon indicates problems in Excel format available in MyLab Finance. P3-1 Financial statement account identification Mark each of the accounts listed in the following table as follows: a. In column ( 1), indicate in which statement-income statement (IS) or balance sheet (BS)-the account belongs. b. In column (21, indicate whether the account is a current asset (CA), current liable iry (CL), expense (El, fixed asset (FA), long-term debt (LTD), revenue (RI, or stockholders equity (SEI. 121 Account name Type of account Accounts payable Accounts receivable Acemak Accumulated depreciation Administrative copenst 100 Buildings Cash Common stock fat pact Cost of goods sold Depreciation Equipment General expense Interest expense Inventories Land Long term debts Machinery Marketable securities Notes parable Operating expense Fold-in capital an excess of par Preferred stock Preferred erick dividends Sales revenue Selling expense Taxcy 114. Ms. Maatir started her own beauty salon last year. Her salon is very famous in that area and she managed to make a prot of R0 2500 every week. She uses R0 1000 every week to pay salaries to the staff and R0 500 fer buying material. She also takes R0 500 for her family expenditure. She records all the expenses in her business accounts as she only manages the business. You are required to identify whether she can record all these transaction in her business account or not. Justify your answer. (1 Mark)