Question: hello! could somebody please help me understand these questions for my finance class? thank you! (i will like to see the reasoning for the answer,

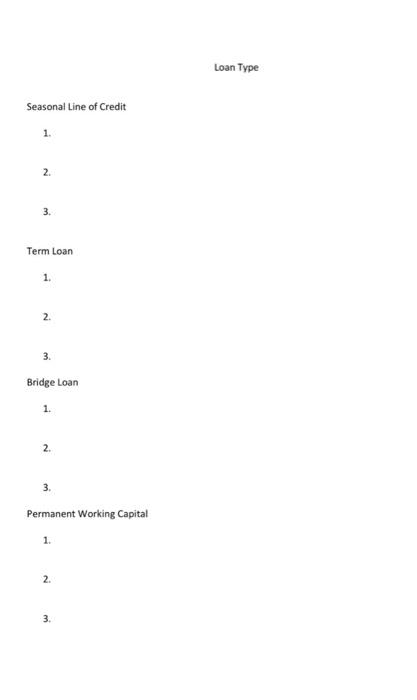

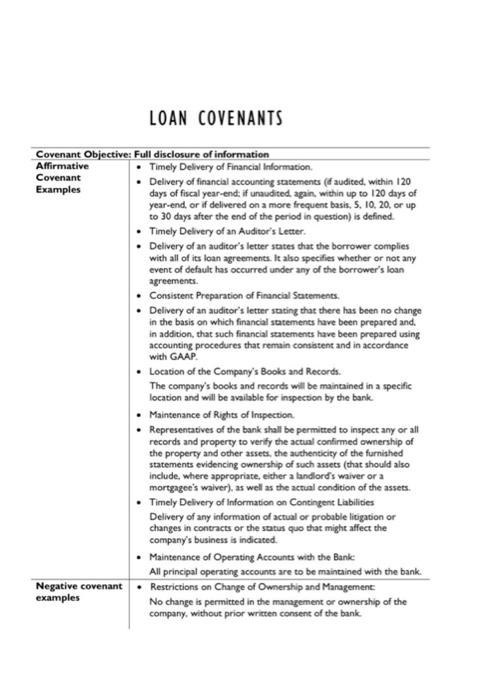

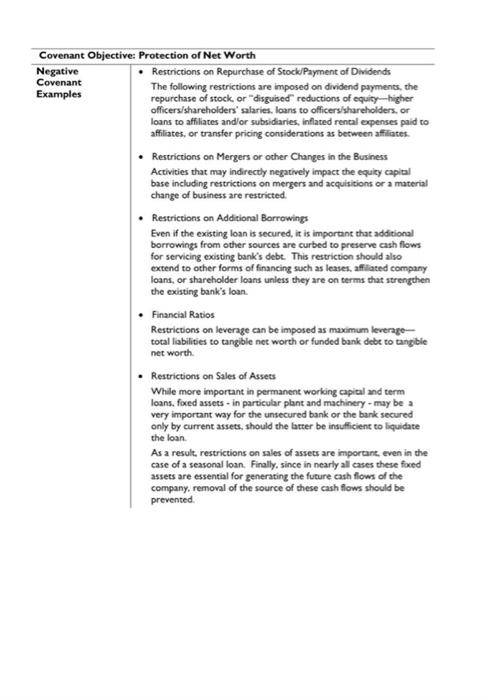

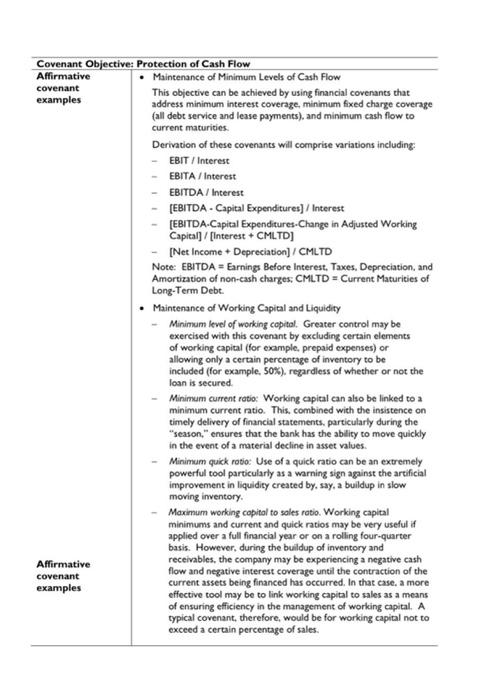

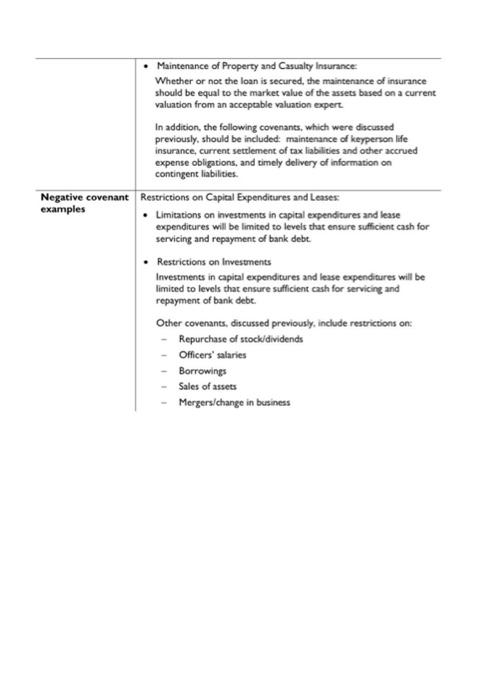

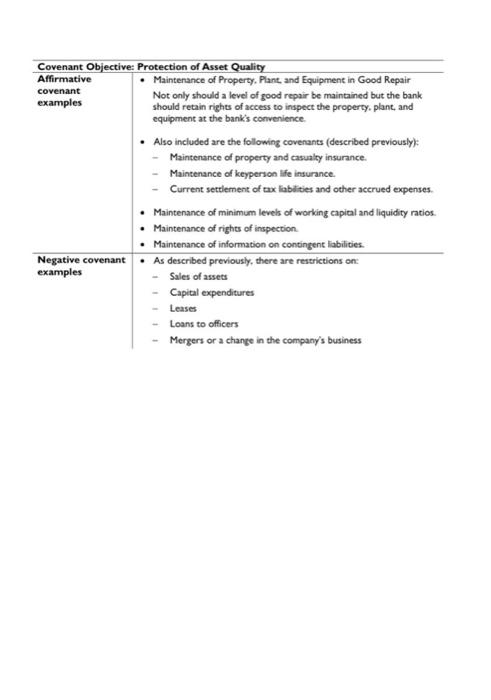

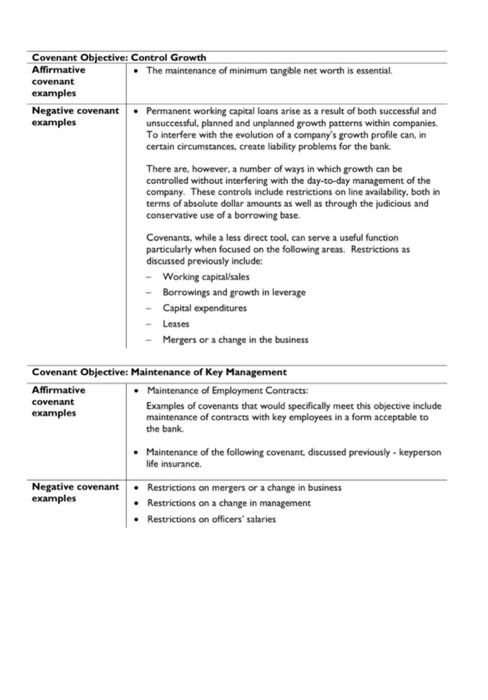

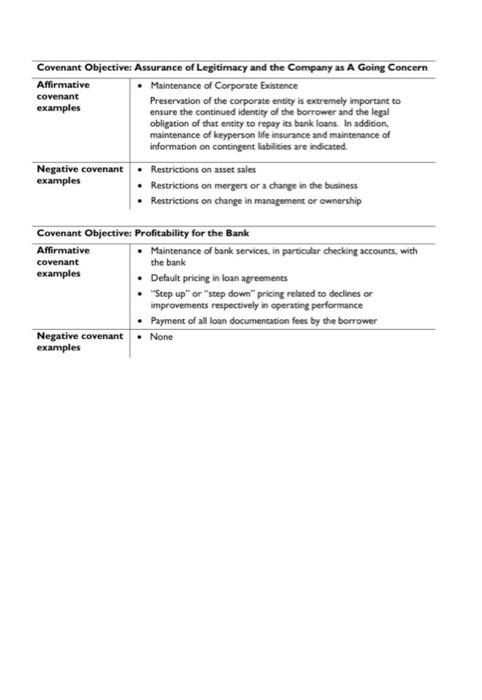

DETERMINING WHICH COVENANTS TO USE The purpose of is to practice identifying key financial covenants that would be most effective in preserving cash flow for debt repayment based on the specific type of loan being considered. I. For each of the basic loan types (seasonal loan, permanent working capital loan, bridge loan and term loan) identify two or three key financial covenants that would best preserve and protect the bank's source of repayment based on the type of loan. 2. Use the Loan Covenants Guide to help make your determination. Loan Type Seasonal Line of Credit 1. 2. 3. Term Loan 1. 2. 3. Bridge Loan 1. 2. 3. Permanent Working Capital 1. 2. 3. LOAN COVENANTS ive: Full disclosure of information - Timely Delivery of Financial Information. - Delivery of financial accounting statements (f audited, within 120 days of fiscal year-end: if unaudited, again, within up to 120 days of year-end, or if delivered on a more frequent basis, 5, 10,20, or up to 30 days after the end of the period in question) is defined. - Timely Delivery of an Auditor's Letter. - Delivery of an auditor's letter states that the borrower complies with all of its loan agreements. It also specifies whecher or not any event of default has occurred under any of the borrower's loan agreements. - Consistent Preparation of Financial Satements. - Delivery of an auditor's letter stating that there has been no change in the basis on which financial satements have been prepared and. in addition, that such firancial statements have been prepared using accounting procedures that remain consiatent and in accordance with GAAP. - Location of the Company's Books and Reconds. The company's books and records will be maintained in a specific location and will be available for inspection by the bank. - Maintenance of Rights of Inupection. - Representatives of the bank shall be permitted to inspect any or all records and property to verify the actual confirmed ownership of the property and other assets, the auchenticity of the furnished statements evidencing ownership of such assets (that should also include. where appropriate, either a landlord's waiver or a mortgagee's waiver), as well as the actual condition of the assets. - Timely Delivery of Information on Contingent Llabilities Delivery of any information of actual or probable litigation or changes in contracts or the satus quo that might affect the company's business is indicated. - Maintenance of Operating Accounts with the Bankc All principal operating accounts are to be maintained with the bank. - Restrictions on Change of Ownership and Management: No change is permitted in the management or ownership of the company, without prior written consent of the bank. ctive: Protection of Net Worth - Maintenance of Minimum Tangible Net Worth The maintenance of a minimum tangible net worth ratio will ensure an adequate cushion for the senior debt provider, particularly when combined with carefully crafted maximum leverage ratios. Note: Such covenants also should include the formula for the calculation of minimum tangible net worth, and, most important. this formul or basis for calculation always should be communicated and explained to the customer. With a seasonal loan, this covenant can still be reinforced, provided the bank has retained the right to receive regular and timely financial statements. - Other Financial Ratios For seasonal and other permanent working capial loans, other ratios-ratios as sales to net worth, net profit to net worth, and debt to depreciated capital assets-are maintained. - Maintenance of Keyperson Life Insurance If the continued success of the borrower depends on one or two key individuals, keyperson lfe insurance. equal to the amount of the bank's exposure. should be maintained with the benefits assigned to the bank. - Current Settlement of Tax Liabilities and Other Accrued Expense Obligations Tax payments should be made as they fall due, insurance premiums should be kept up to date, and restrictions on the cash payment of accrued officers' salaries may also be appropriate. - Timely Delivery of Information on Contingent Labilities Delivery of any information of actual or probable litgation or changes in existing contracts that might affect the company's business should be specified. - Restrictions on Repurchase of Stock Payment of Dividends The following restrictions are imposed on dividend payments, the repurchase of stock, or "disguised" reductions of equity- higher officers/shareholders' salaries. loans to officers/shareholders, or loans to affliates andlor subsidiaries, inflated rencal expenses paid to affiliates, or tansfer pricing considerations as between affiliates. - Restrictions on Mergers or other Changes in the Business Activities that may indirectly negatively impact the equity capial base including restrictions on mergers and acquisitions or a material change of business are restricted. - Restrictions on Additional Borrowings Even if the existing loan is secured, it is important that additional borrowings from other sources are curbed to preserve cash flows for servicing existing bank's debt. This restriction should also extend to other forms of financing such as leases, afflated company loans, or shareholder loans unless they are on terms that strengthen the existing bank's loan. - Financial Ratios Restrictions on leverage can be imposed as maximum leveragetotal labilities to tangible net worth or funded bank debe to tangble net worth. - Restrictions on Sales of Assets While more important in permanent working capial and term loans. fixed assets - in parbicular plant and machinery - may be a very imporant way for the unsecured bank or the bank secured only by current assets, should the latter be insuficient to liquidate the loan. As a result, restrictions on sales of assets are important, even in the case of a seasonal loan. Finally, since in nearly all cases these foced assets are essential for generating the future cash flows of the company, remonal of the source of these cash flows should be prevented. Protection of Cash Flow - Maintenance of Minimum Levels of Cash Flow This objective can be achieved by using financial covenants that address minimum interest coverage, minimum fixed charge coverage (all debt service and lease payments), and minimum cash flow to current maturities. Derivation of these covenants will comprise variations including: - EBIT / Interest - EBITA / interest - EBITDA/ Interest - [EBITDA - Capital Expenditures]/Interest - [EBITDA.Capital Expenditures. Change in Adjusted Working Capital] / [nterest + CML.TD] - [Net Income + Depreciabion]/ CMLTD Note: EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization of non-eash charges; CMLTD = Current Maturities of Long-Term Debt. - Maintenance of Working Capital and Liquidity - Minimum level of working copital, Greater control may be exercised with this covenant by excluding certain elements of working capital (for example, prepaid expenses) or allowing only a certain percentage of inventory to be included (for example, 50\%). regardless of whether or not the loan is secured. - Minimum current rotio: Working capital can also be linked to a minimum current ratio. This, combined with the insistence on timely delivery of financial statements. particularly during the "season," ensures that the bank has the ablity to move quickly in the event of a material decline in asset values. - Minimum quick rotio: Use of a quick ratio can be an extremely powerful tool particularly as a warning sign against the artificial improvement in liquidity created by, say, a buildup in slow moving inventory. - Maximum working copitol to sales ratio. Working capital minimums and current and quick ratios may be very useful if applied over a full firancial year or on a rolling four-quarter basis. However, during the buildup of inventory and receivables, the company may be experiencing a negative cash flow and negative interest coverage until the contraction of the current assets being financed has occurred, In that case, a more effective tool may be to link working capital to sales as a means of ensuring efficiency in the management of working capital. A typical covenant, therefore, would be for working capital not to exceed a cerain percentage of sales. - Maintenance of Property and Casualy Insurance: Whether or not the loan is secured, the maintenance of insurance should be equal to the market value of the assets based on a current valuation from an acceptable valuation expert. In addition, the following covenants, which were discussed previously, should be included: maintenance of keyperson life insurance, current settlement of tax labilities and other accrued expense obligtions, and timely delivery of information on contingent liabilities. \begin{tabular}{l|l} \hline Negativecovenantexamples & RestrictionsonCapitalExpendituresandLeases-Limitationsoninvestmentsincapitalexpendituresandleaseexpenditureswillbelimitedtolevelsthatensuresufficientcashforservicingandrepaymentofbankdebt. \\ -RestrictionsonlnvestmentsInvestmentsincapitalexpendituresandleaseexpenditureswillbelimitedtolevelsthatensuresufficientcashforservicingandrepaymentofbankdebc.Othercovenants,discussedpreviously,includerestrictionson:RepurchaseofstockidividendsOfficers"salariesBorrowingsSalesofassetsMergers/changeinbusiness \end{tabular} Covenant Objective: Maintenance of Key Management life insurance. \begin{tabular}{l|l} \hline Negative covenant & - Restrictions on mergers or a change in business \\ examples & - Restrictions on a change in management \\ - Restrictions on officers' salaries \end{tabular} Covenant Objective: Assurance of Legitimacy and the Company as A Going Concern \begin{tabular}{l|l} \hline Affirmativecovenantexamples & -MaintenanceofCorporateExistencePreservationofthecorporateenticyisextremelyimpoensurethecontinuedidentityoftheborrowerandtheobligationofthatentitytorepayitsbankloans.Inadditiomaintenanceofkeypersonifeinsuranceandmaintenanceinformationoncontingentlabilitiesareindicated. \\ \hline Negativecovenantexamples & -Restrictionsonassetsales-Restrictionsonmergersorachangeinthebusiness-Restrictionsonchangeinmanagementorownership \end{tabular} Covenant Objective: Profitability for the Bank DETERMINING WHICH COVENANTS TO USE The purpose of is to practice identifying key financial covenants that would be most effective in preserving cash flow for debt repayment based on the specific type of loan being considered. I. For each of the basic loan types (seasonal loan, permanent working capital loan, bridge loan and term loan) identify two or three key financial covenants that would best preserve and protect the bank's source of repayment based on the type of loan. 2. Use the Loan Covenants Guide to help make your determination. Loan Type Seasonal Line of Credit 1. 2. 3. Term Loan 1. 2. 3. Bridge Loan 1. 2. 3. Permanent Working Capital 1. 2. 3. LOAN COVENANTS ive: Full disclosure of information - Timely Delivery of Financial Information. - Delivery of financial accounting statements (f audited, within 120 days of fiscal year-end: if unaudited, again, within up to 120 days of year-end, or if delivered on a more frequent basis, 5, 10,20, or up to 30 days after the end of the period in question) is defined. - Timely Delivery of an Auditor's Letter. - Delivery of an auditor's letter states that the borrower complies with all of its loan agreements. It also specifies whecher or not any event of default has occurred under any of the borrower's loan agreements. - Consistent Preparation of Financial Satements. - Delivery of an auditor's letter stating that there has been no change in the basis on which financial satements have been prepared and. in addition, that such firancial statements have been prepared using accounting procedures that remain consiatent and in accordance with GAAP. - Location of the Company's Books and Reconds. The company's books and records will be maintained in a specific location and will be available for inspection by the bank. - Maintenance of Rights of Inupection. - Representatives of the bank shall be permitted to inspect any or all records and property to verify the actual confirmed ownership of the property and other assets, the auchenticity of the furnished statements evidencing ownership of such assets (that should also include. where appropriate, either a landlord's waiver or a mortgagee's waiver), as well as the actual condition of the assets. - Timely Delivery of Information on Contingent Llabilities Delivery of any information of actual or probable litigation or changes in contracts or the satus quo that might affect the company's business is indicated. - Maintenance of Operating Accounts with the Bankc All principal operating accounts are to be maintained with the bank. - Restrictions on Change of Ownership and Management: No change is permitted in the management or ownership of the company, without prior written consent of the bank. ctive: Protection of Net Worth - Maintenance of Minimum Tangible Net Worth The maintenance of a minimum tangible net worth ratio will ensure an adequate cushion for the senior debt provider, particularly when combined with carefully crafted maximum leverage ratios. Note: Such covenants also should include the formula for the calculation of minimum tangible net worth, and, most important. this formul or basis for calculation always should be communicated and explained to the customer. With a seasonal loan, this covenant can still be reinforced, provided the bank has retained the right to receive regular and timely financial statements. - Other Financial Ratios For seasonal and other permanent working capial loans, other ratios-ratios as sales to net worth, net profit to net worth, and debt to depreciated capital assets-are maintained. - Maintenance of Keyperson Life Insurance If the continued success of the borrower depends on one or two key individuals, keyperson lfe insurance. equal to the amount of the bank's exposure. should be maintained with the benefits assigned to the bank. - Current Settlement of Tax Liabilities and Other Accrued Expense Obligations Tax payments should be made as they fall due, insurance premiums should be kept up to date, and restrictions on the cash payment of accrued officers' salaries may also be appropriate. - Timely Delivery of Information on Contingent Labilities Delivery of any information of actual or probable litgation or changes in existing contracts that might affect the company's business should be specified. - Restrictions on Repurchase of Stock Payment of Dividends The following restrictions are imposed on dividend payments, the repurchase of stock, or "disguised" reductions of equity- higher officers/shareholders' salaries. loans to officers/shareholders, or loans to affliates andlor subsidiaries, inflated rencal expenses paid to affiliates, or tansfer pricing considerations as between affiliates. - Restrictions on Mergers or other Changes in the Business Activities that may indirectly negatively impact the equity capial base including restrictions on mergers and acquisitions or a material change of business are restricted. - Restrictions on Additional Borrowings Even if the existing loan is secured, it is important that additional borrowings from other sources are curbed to preserve cash flows for servicing existing bank's debt. This restriction should also extend to other forms of financing such as leases, afflated company loans, or shareholder loans unless they are on terms that strengthen the existing bank's loan. - Financial Ratios Restrictions on leverage can be imposed as maximum leveragetotal labilities to tangible net worth or funded bank debe to tangble net worth. - Restrictions on Sales of Assets While more important in permanent working capial and term loans. fixed assets - in parbicular plant and machinery - may be a very imporant way for the unsecured bank or the bank secured only by current assets, should the latter be insuficient to liquidate the loan. As a result, restrictions on sales of assets are important, even in the case of a seasonal loan. Finally, since in nearly all cases these foced assets are essential for generating the future cash flows of the company, remonal of the source of these cash flows should be prevented. Protection of Cash Flow - Maintenance of Minimum Levels of Cash Flow This objective can be achieved by using financial covenants that address minimum interest coverage, minimum fixed charge coverage (all debt service and lease payments), and minimum cash flow to current maturities. Derivation of these covenants will comprise variations including: - EBIT / Interest - EBITA / interest - EBITDA/ Interest - [EBITDA - Capital Expenditures]/Interest - [EBITDA.Capital Expenditures. Change in Adjusted Working Capital] / [nterest + CML.TD] - [Net Income + Depreciabion]/ CMLTD Note: EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization of non-eash charges; CMLTD = Current Maturities of Long-Term Debt. - Maintenance of Working Capital and Liquidity - Minimum level of working copital, Greater control may be exercised with this covenant by excluding certain elements of working capital (for example, prepaid expenses) or allowing only a certain percentage of inventory to be included (for example, 50\%). regardless of whether or not the loan is secured. - Minimum current rotio: Working capital can also be linked to a minimum current ratio. This, combined with the insistence on timely delivery of financial statements. particularly during the "season," ensures that the bank has the ablity to move quickly in the event of a material decline in asset values. - Minimum quick rotio: Use of a quick ratio can be an extremely powerful tool particularly as a warning sign against the artificial improvement in liquidity created by, say, a buildup in slow moving inventory. - Maximum working copitol to sales ratio. Working capital minimums and current and quick ratios may be very useful if applied over a full firancial year or on a rolling four-quarter basis. However, during the buildup of inventory and receivables, the company may be experiencing a negative cash flow and negative interest coverage until the contraction of the current assets being financed has occurred, In that case, a more effective tool may be to link working capital to sales as a means of ensuring efficiency in the management of working capital. A typical covenant, therefore, would be for working capital not to exceed a cerain percentage of sales. - Maintenance of Property and Casualy Insurance: Whether or not the loan is secured, the maintenance of insurance should be equal to the market value of the assets based on a current valuation from an acceptable valuation expert. In addition, the following covenants, which were discussed previously, should be included: maintenance of keyperson life insurance, current settlement of tax labilities and other accrued expense obligtions, and timely delivery of information on contingent liabilities. \begin{tabular}{l|l} \hline Negativecovenantexamples & RestrictionsonCapitalExpendituresandLeases-Limitationsoninvestmentsincapitalexpendituresandleaseexpenditureswillbelimitedtolevelsthatensuresufficientcashforservicingandrepaymentofbankdebt. \\ -RestrictionsonlnvestmentsInvestmentsincapitalexpendituresandleaseexpenditureswillbelimitedtolevelsthatensuresufficientcashforservicingandrepaymentofbankdebc.Othercovenants,discussedpreviously,includerestrictionson:RepurchaseofstockidividendsOfficers"salariesBorrowingsSalesofassetsMergers/changeinbusiness \end{tabular} Covenant Objective: Maintenance of Key Management life insurance. \begin{tabular}{l|l} \hline Negative covenant & - Restrictions on mergers or a change in business \\ examples & - Restrictions on a change in management \\ - Restrictions on officers' salaries \end{tabular} Covenant Objective: Assurance of Legitimacy and the Company as A Going Concern \begin{tabular}{l|l} \hline Affirmativecovenantexamples & -MaintenanceofCorporateExistencePreservationofthecorporateenticyisextremelyimpoensurethecontinuedidentityoftheborrowerandtheobligationofthatentitytorepayitsbankloans.Inadditiomaintenanceofkeypersonifeinsuranceandmaintenanceinformationoncontingentlabilitiesareindicated. \\ \hline Negativecovenantexamples & -Restrictionsonassetsales-Restrictionsonmergersorachangeinthebusiness-Restrictionsonchangeinmanagementorownership \end{tabular} Covenant Objective: Profitability for the Bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts