Question: Hello, could u help me tackle Q 3 and give a description? I choose Aristocrat Leisure as my evaluation target and it can only apply

Hello, could u help me tackle Q 3 and give a description? I choose Aristocrat Leisure as my evaluation target and it can only apply data from 2016-2020 with 2 stage evaluation. And long term growth (Assume 2%)

Hello, could u help me tackle Q 3 and give a description? I choose Aristocrat Leisure as my evaluation target and it can only apply data from 2016-2020 with 2 stage evaluation. And long term growth (Assume 2%)

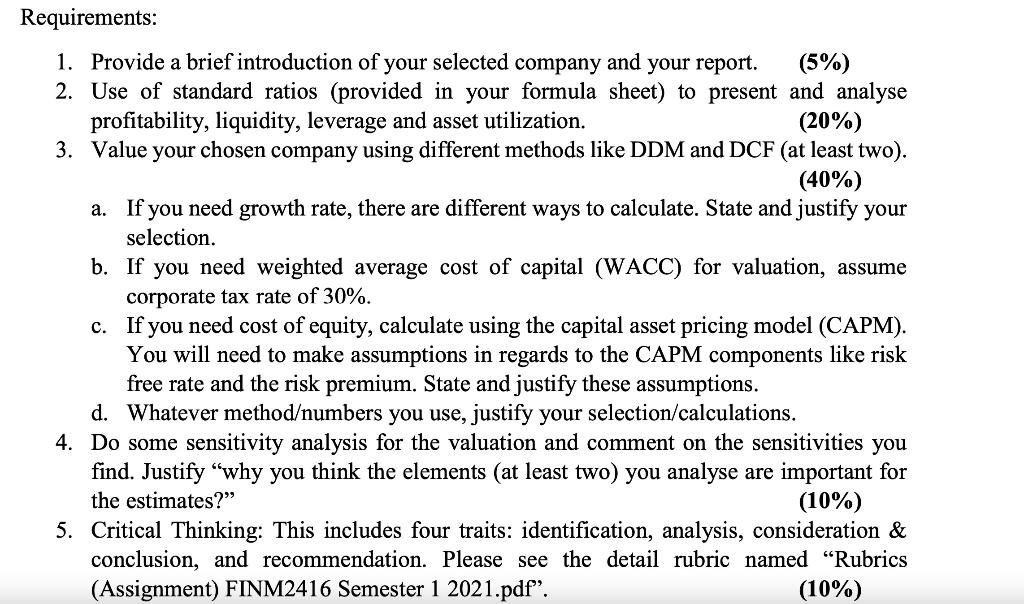

Requirements: 1. Provide a brief introduction of your selected company and your report. (5%) 2. Use of standard ratios (provided in your formula sheet) to present and analyse profitability, liquidity, leverage and asset utilization. (20%) 3. Value your chosen company using different methods like DDM and DCF (at least two). (40%) a. If you need growth rate, there are different ways to calculate. State and justify your selection. b. If you need weighted average cost of capital (WACC) for valuation, assume corporate tax rate of 30%. c. If you need cost of equity, calculate using the capital asset pricing model (CAPM). You will need to make assumptions in regards to the CAPM components like risk free rate and the risk premium. State and justify these assumptions. d. Whatever methodumbers you use, justify your selection calculations. 4. Do some sensitivity analysis for the valuation and comment on the sensitivities you find. Justify "why you think the elements (at least two) you analyse are important for the estimates?" (10%) 5. Critical Thinking: This includes four traits: identification, analysis, consideration & conclusion, and recommendation. Please see the detail rubric named "Rubrics (Assignment) FINM2416 Semester 1 2021.pdf". (10%) Requirements: 1. Provide a brief introduction of your selected company and your report. (5%) 2. Use of standard ratios (provided in your formula sheet) to present and analyse profitability, liquidity, leverage and asset utilization. (20%) 3. Value your chosen company using different methods like DDM and DCF (at least two). (40%) a. If you need growth rate, there are different ways to calculate. State and justify your selection. b. If you need weighted average cost of capital (WACC) for valuation, assume corporate tax rate of 30%. c. If you need cost of equity, calculate using the capital asset pricing model (CAPM). You will need to make assumptions in regards to the CAPM components like risk free rate and the risk premium. State and justify these assumptions. d. Whatever methodumbers you use, justify your selection calculations. 4. Do some sensitivity analysis for the valuation and comment on the sensitivities you find. Justify "why you think the elements (at least two) you analyse are important for the estimates?" (10%) 5. Critical Thinking: This includes four traits: identification, analysis, consideration & conclusion, and recommendation. Please see the detail rubric named "Rubrics (Assignment) FINM2416 Semester 1 2021.pdf". (10%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts