Question: hello could you please help me solve this with excel sheets? thsnk you the page that starts with in this assigment is the first page

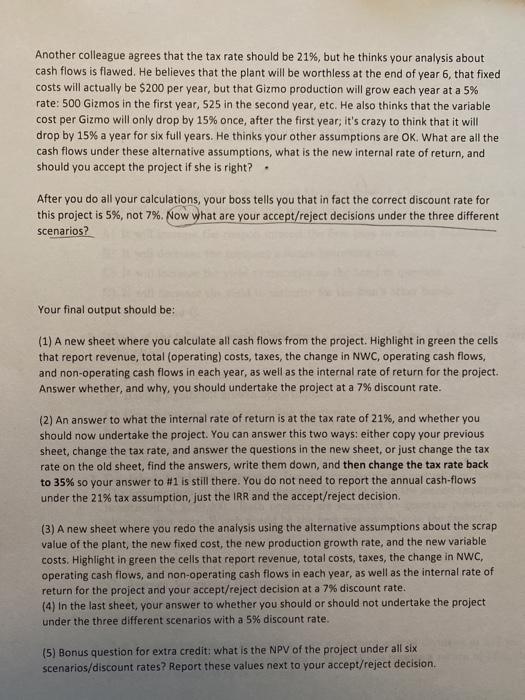

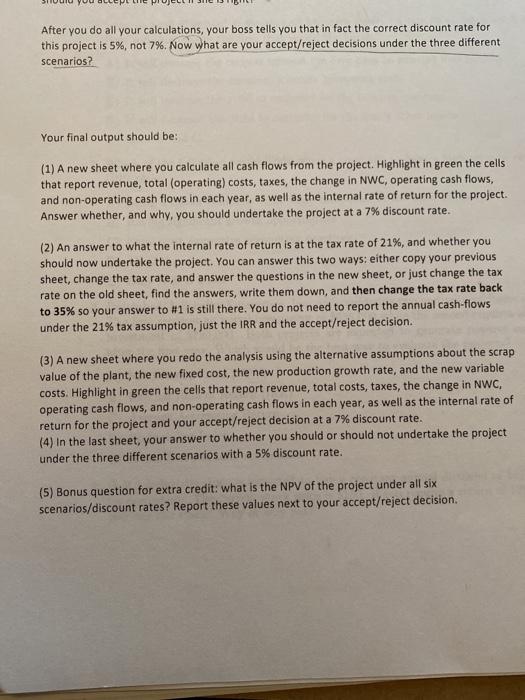

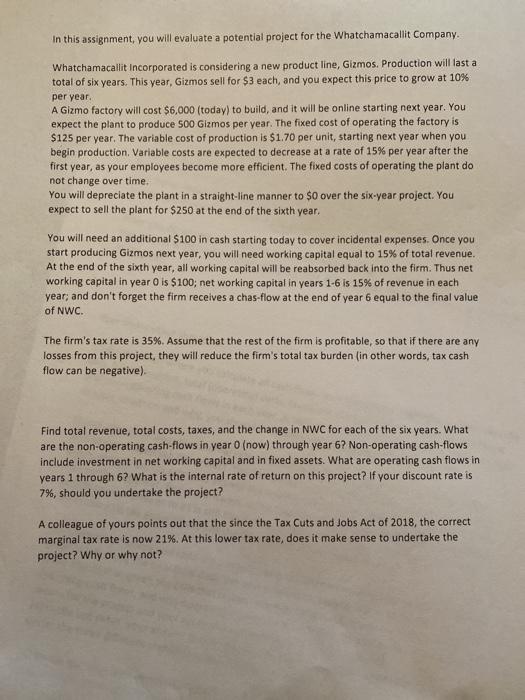

Another colleague agrees that the tax rate should be 21%, but he thinks your analysis about cash flows is flawed. He believes that the plant will be worthless at the end of year 6, that fixed costs will actually be $200 per year, but that Gizmo production will grow each year at a 5% rate: 500 Gizmos in the first year, 525 in the second year, etc. He also thinks that the variable cost per Gizmo will only drop by 15% once, after the first year, it's crazy to think that it will drop by 15% a year for six full years. He thinks your other assumptions are OK. What are all the cash flows under these alternative assumptions, what is the new internal rate of return, and should you accept the project if she is right? After you do all your calculations, your boss tells you that in fact the correct discount rate for this project is 5%, not 7%. Now what are your accept/reject decisions under the three different scenarios? Your final output should be: (1) A new sheet where you calculate all cash flows from the project. Highlight in green the cells that report revenue, total (operating costs, taxes, the change in NWC, operating cash flows, and non-operating cash flows in each year, as well as the internal rate of return for the project. Answer whether, and why you should undertake the project at a 7% discount rate. (2) An answer to what the internal rate of return is at the tax rate of 21%, and whether you should now undertake the project. You can answer this two ways: either copy your previous sheet, change the tax rate, and answer the questions in the new sheet, or just change the tax rate on the old sheet, find the answers, write them down, and then change the tax rate back to 35% so your answer to #1 is still there. You do not need to report the annual cash-flows under the 21% tax assumption, just the IRR and the accept/reject decision. (3) A new sheet where you redo the analysis using the alternative assumptions about the scrap value of the plant, the new fixed cost, the new production growth rate, and the new variable costs. Highlight in green the cells that report revenue, total costs, taxes, the change in NWC, operating cash flows, and non-operating cash flows in each year, as well as the internal rate of return for the project and your accept/reject decision at a 7% discount rate. (4) In the last sheet, your answer to whether you should or should not undertake the project under the three different scenarios with a 5% discount rate. (5) Bonus question for extra credit: what is the NPV of the project under all six scenarios/discount rates? Report these values next to your accept/reject decision After you do all your calculations, your boss tells you that in fact the correct discount rate for this project is 5%, not 7%. Now what are your accept/reject decisions under the three different scenarios? Your final output should be: (1) A new sheet where you calculate all cash flows from the project. Highlight in green the cells that report revenue, total (operating) costs, taxes, the change in NWC, operating cash flows, and non-operating cash flows in each year, as well as the internal rate of return for the project. Answer whether, and why you should undertake the project at a 7% discount rate. (2) An answer to what the internal rate of return is at the tax rate of 21%, and whether you should now undertake the project. You can answer this two ways: either copy your previous sheet, change the tax rate, and answer the questions in the new sheet, or just change the tax rate on the old sheet, find the answers, write them down, and then change the tax rate back to 35% so your answer to #1 is still there. You do not need to report the annual cash-flows under the 21% tax assumption, just the IRR and the accept/reject decision (3) A new sheet where you redo the analysis using the alternative assumptions about the scrap value of the plant, the new fixed cost, the new production growth rate, and the new variable costs. Highlight in green the cells that report revenue, total costs, taxes, the change in NWC, operating cash flows, and non-operating cash flows in each year, as well as the internal rate of return for the project and your accept/reject decision at a 7% discount rate. (4) In the last sheet, your answer to whether you should or should not undertake the project under the three different scenarios with a 5% discount rate. (5) Bonus question for extra credit: what is the NPV of the project under all six scenarios/discount rates? Report these values next to your accept/reject decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts