Question: Hello! Could you please help to solve this task? I need to prepare the statement of changes in equity for P Ltd for 31 December

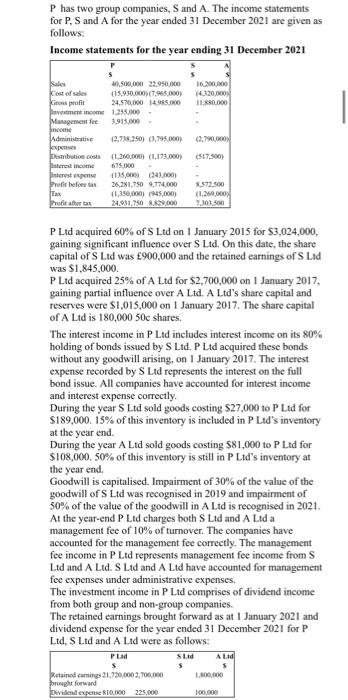

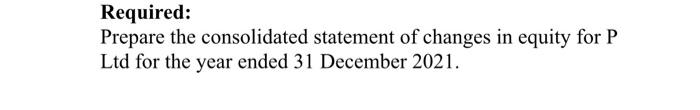

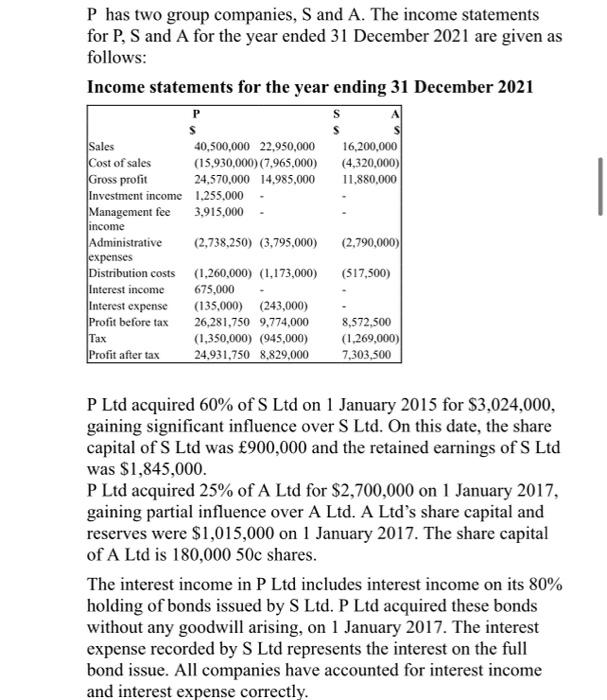

P has two group companies, S and A. The income statements for P, S and A for the year ended 31 December 2021 are given as follows: Income statements for the year ending 31 December 2021 Sales 40,500,000 22.950.000 16.300,00 Cost of sales (15.930,000) (7.265.000) (4.320,000 Kinonprofit 24.570,000 1495.000 11.880.000 Hvement income 1.295.000 Management fee 3.915,000 Income Administrative 2.73%250) 0.795.000 0.70 express Destion costs (1,260,000) (1,173,000) (517.500) sredine 675.000 interese pense (135.000 (241.00 Profile for 26,281.750 9.774,000 .572.500 Tax (1.350,000) 945,000 (1.260.000 hurithru 24.931.10.29.000 7.101.500 P Ltd acquired 60% of S Ltd on 1 January 2015 for $3,024,000, gaining significant influence over S Ltd. On this date, the share capital of Ltd was 900,000 and the retained earnings of S Lad was $1,845,000. P Ltd acquired 25% of A Ltd for $2,700,000 on 1 January 2017, gaining partial influence over A Ltd. A Ltd's share capital and reserves were $1,015,000 on 1 January 2017. The share capital of A Ltd is 180,000 50c shares. The interest income in P Ltd includes interest income on its 80% holding of bonds issued by S Ltd. P Ltd acquired these bonds without any goodwill arising, on 1 January 2017. The interest expense recorded by S Lid represents the interest on the full bond issue. All companies have accounted for interest income and interest expense correctly. During the year S Ltd sold goods costing $27,000 to P Ltd for S189,000. 15% of this inventory is included in P Ltd's inventory at the year end. During the year A Lid sold goods costing $81,000 to P Ltd for $108,000, 50% of this inventory is still in P Ltd's inventory at the year end Goodwill is capitalised. Impairment of 30% of the value of the goodwill of Ltd was recognised in 2019 and impairment of 50% of the value of the goodwill in A Ltd is recognised in 2021. At the year-end P Ltd charges both S Ltd and A Ltda management fee of 10% of turnover. The companies have accounted for the management fee correctly. The management fee income in P Ltd represents management fee income from S Ltd and A Ltd. S Lid and A Ltd have accounted for management fee expenses under administrative expenses. The investment income in P Lid comprises of dividend income from both group and non-group companies. The retained earnings brought forward as at 1 January 2021 and dividend expense for the year ended 31 December 2021 for P Ltd, S Ltd and A Lid were as follows: P Lid SLA ALA s 10,000 Retained coming 21.720,000 2,700,000 rought forward Dividend expertise 10.000 225,000 10.000 Required: Prepare the consolidated statement of changes in equity for P Ltd for the year ended 31 December 2021. P has two group companies, S and A. The income statements for P, S and A for the year ended 31 December 2021 are given as follows: Income statements for the year ending 31 December 2021 $ Sales 40,500,000 22,950,000 16,200,000 Cost of sales (15,930,000) (7,965,000) (4,320,000) Gross profit 24,570,000 14.985,000 11,880,000 Investment income 1.255.000 Management fee 3,915,000 income Administrative (2,738,250) (3,795,000) (2.790,000) Jexpenses Distribution costs (1,260,000) (1,173,000) (517,500) Interest income 675,000 Interest expense (135,000) (243,000) Profit before tax 26,281,750 9,774,000 8,572,500 (1,350,000) (945,000) (1,269,000) Profit after tax 24,931,750 8.829,000 7,303,500 Tax P Ltd acquired 60% of S Ltd on 1 January 2015 for $3,024,000, gaining significant influence over S Ltd. On this date, the share capital of S Ltd was 900,000 and the retained earnings of S Ltd was $1,845,000. P Ltd acquired 25% of A Ltd for $2,700,000 on 1 January 2017, gaining partial influence over A Ltd. A Ltd's share capital and reserves were $1,015,000 on 1 January 2017. The share capital of A Ltd is 180,000 50c shares. The interest income in P Ltd includes interest income on its 80% holding of bonds issued by S Ltd. P Ltd acquired these bonds without any goodwill arising, on 1 January 2017. The interest expense recorded by S Ltd represents the interest on the full bond issue. All companies have accounted for interest income and interest expense correctly. During the year S Ltd sold goods costing $27,000 to P Ltd for $189,000. 15% of this inventory is included in P Ltd's inventory at the year end. During the year A Ltd sold goods costing $81,000 to P Ltd for $108,000. 50% of this inventory is still in P Ltd's inventory at the year end. Goodwill is capitalised. Impairment of 30% of the value of the goodwill of S Ltd was recognised in 2019 and impairment of 50% of the value of the goodwill in A Ltd is recognised in 2021. At the year-end P Ltd charges both S Ltd and A Ltd a management fee of 10% of turnover. The companies have accounted for the management fee correctly. The management fee income in P Ltd represents management fee income from S Ltd and A Ltd. S Ltd and A Ltd have accounted for management fee expenses under administrative expenses. The investment income in P Ltd comprises of dividend income from both group and non-group companies. The retained earnings brought forward as at 1 January 2021 and dividend expense for the year ended 31 December 2021 for P Ltd, S Ltd and A Ltd were as follows: P Ltd S Ltd A Ltd $ $ Retained earnings 21,720,000 2,700,000 1,800,000 brought forward Dividend expense 810,000 225,000 100,000 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts